We know how badly the coronavirus is hurting the global economy. A chart of the S&P 500 in the last five weeks pretty well sums it up. And yet, as we all stay inside and “socially distance,” there are companies that are benefitting from this global pandemic. Not all of their share prices have reflected it yet. But when the market finally rebounds (it will!), these four stocks are likely to lead the charge.

4 Stocks Benefitting from Coronavirus

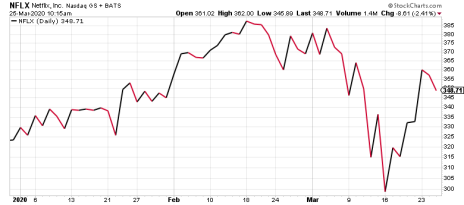

Netflix (NFLX)

This one’s obvious. We’re all home, we’re all watching TV, and 160 million of us are watching Netflix—or at least that was the number of global subscribers the streaming-video behemoth had at the end of last year. My guess is that number is much higher now, which means Netflix is on track for a monster quarter, the results of which are due out in less than a month.

[text_ad]

Netflix stock has already held up quite well in the last month, down a mere 6% since its February 18 peak (the S&P is down more than 30% during that time). In fact, NFLX appears to have already bottomed more than a week ago, rising in six of the last eight trading sessions as other stocks have been in a downward spiral.

There are other streaming services that will benefit from worldwide forced coach-potato-ism—Amazon Prime, Hulu, Disney Plus, Apple TV+, etc.—but Netflix is the only pure play of the bunch. Buy it now before the stock rises any further.

Amazon (AMZN)

Another obvious blue-chip stock choice. Retailers everywhere are hurting like never before now, with most brick-and-mortar stores either shuttered or doing appointment-only curbside pickup service. And with the entire country now doing its non-grocery shopping online, Amazon is gobbling up virtually all of that business.

Suddenly, it’s Black Friday every day for Jeff Bezos’ company. To keep up with demand, the company has hired 100,000 new workers, and is paying its warehouse workers and distribution people an extra $2.00 per hour as a reward for the frenzied pace. People were already buying clothes, books, diapers, household items, sports equipment, kids toys and beauty products on Amazon. Now they’re simply doing way more of it, with the local mom-and-pop stores no longer a viable alternative.

Plus, as I mentioned before, there’s Amazon Video, which likely has quite a few new subscribers in the last month.

Like NFLX, Amazon stock is already trending upward, though its losses (down 10% from its highs as of this writing) have been a bit deeper. AMZN has long maintained a high price-to-earnings ratio, yet has kept growing despite its perennially lofty valuation. Now it’s never been cheaper.

AMZN being a growth stock AND a value stock makes it an almost no-brainer buy.

Zoom Video (ZM)

Now for the non-household name portion of my stocks benefitting from coronavirus.

Three weeks ago, not many people knew about this stock. Now it’s perhaps the single hottest large-cap stock on the market. Zoom Video is a cloud-based video conferencing company that allows corporations and businesses to hold video meetings. With most of the world now working from home, people are downloading the Zoom app by the hundreds of thousands – 600,000 people have downloaded it in the last week alone!

As a result, the Zoom app has (sorry) zoomed from 87th on the iPhone daily downloads list to first. And while the rest of Wall Street has tanked, ZM stock has soared. Just look at this year-to-date chart:

That’s a 107% gain … at a time when the market has fallen roughly 30%. Not a bad trend! And following a decent-sized pullback on Tuesday, ZM looks pretty buyable for the next leg up.

Blue Apron (APRN)

People still need to eat. And while most are still making the trip to their local grocery stores, those squeamish about risking being around other people are discovering Blue Apron, which mails ready-to-cook meals right to your doorstep. Since coming public at 140 per share in June 2017, Blue Apron stock has been a bona fide bust. It entered this year with a share price of just 6, and dipped as low as 2.10 a month ago today. The stock, and the company, seemed dead. Here’s what’s happened since:

If you’re scoring at home, that’s a 283% return in a month. With much more business coming Blue Apron’s way in the coming weeks and perhaps months as Americans shelter in place, I doubt APRN’s run is over. In fact, it appears to be building a nice-looking base that could result in another big gap higher, especially if the market has already bottomed.

It’s probably not a stock you want to own beyond this year. But given where it was headed a month ago, APRN is perhaps the single stock benefitting from coronavirus most.

More Stocks Benefitting from Coronavirus

Want to know what other stocks are holding up well, and in fact benefitting from, this global nightmare? Our Cabot Top Ten Trader advisory has plenty more recommendations. Every Monday, chief analyst Mike Cintolo identifies 10 of the market’s strongest growth stocks. To learn what names Mike recommended this week, simply click here.

In the meantime, stay healthy, stay safe. And above all, stay home!

[author_ad]