The overarching narrative of the bull market in 2023 has been the dominance of the mega-cap tech stocks. Companies like Nvidia (NVDA), Amazon (AMZN), Apple (AAPL), and Meta Platforms (META) have seen skyrocketing valuations and so much growth that they compelled a special rebalance of the Nasdaq to limit the impact of their excessive weighting.

But the rally is broadening out. And if we include stocks outside large-cap land, none of those names even make the top 10 list of the best-performing stocks of 2023 (NVDA is 23 on the list if we expand it to include mid-cap names).

[text_ad]

So, to give these overlooked high-flyers their due, we’ve screened for the five best-performing stocks so far this year with a mid-cap (+$2 billion) valuation or above.

The rationale for using that mid-cap cutoff is twofold. 1) Volatility: As you may know, small-cap stocks tend to be more volatile than their large-cap peers. By screening for larger companies, we can exclude more volatile issues that may have skyrocketed on speculation alone (even with our higher cutoff we did have names like that sneak onto the list). 2) Liquidity: This goes hand in hand with volatility, but smaller-cap companies with low liquidity present a practical problem for investors. Namely, how do you build an adequately sized position if shares simply don’t change hands?

The answer to that rhetorical question is that you need to gradually average into those thinly traded names, sometimes over periods of days or weeks. This can be onerous as it takes special handling, but more importantly, it’s also more difficult to trade out of those positions, so it requires a high level of confidence in the underlying name.

So, with those caveats in mind, these are the five best-performing stocks of 2023 with mid-cap valuations (or higher).

The 5 Best-Performing Stocks of 2023

Carvana (CVNA)

Market cap: $10.6 billion

YTD return: 1,035%

Carvana, the auto seller that operates car vending machines, is not only one of the aforementioned speculative names that made the list, it’s in the pole position having returned more than 1,000% in 2023. The company saw shares crater in the second half of 2022 on the heels of an oversized debt burden and fears of a potential bankruptcy.

Shares rebounded to start 2023 on progress with debt holders, namely large capital restructuring that could allow the company to stay afloat. But what’s really prompted the outperformance is the (unfortunate) return of the meme stock frenzy. Carvana, with more than 38% short interest (number of shares outstanding borrowed to sell short), became the latest short squeeze candidate among the extremely online investing crowd.

Although it’s the best-performing stock in 2023, we all saw how this played out for AMC and GameStop, and shares are probably best avoided due to the speculative nature of the run.

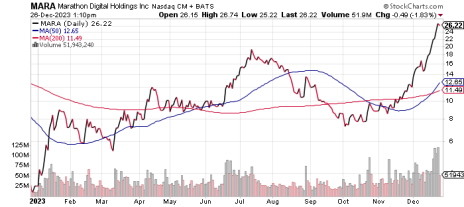

Marathon Digital (MARA)

Market cap: $5.8 billion

YTD return: 673%

Marathon Digital is another new-era stock that’s also something of a blast from the recent past. The company is a Bitcoin miner and its fortunes are highly levered to the performance of the cryptocurrency, which is also having a banner year (up 150%+ YTD).

As of the end of November, the firm has about 14% of its market cap on the books in cash and Bitcoin, which offers a tad more ballast than you might otherwise expect from the company, although Bitcoin’s volatility makes its value as a core holding tougher to rely on.

The firm has lost money the past few years, largely due to the price swings of Bitcoin, and shares are highly volatile (Beta over 5) so this is definitely not a core holding. That said, shares are buy-rated by a few analysts (although currently trading over their price targets), and look technically strong, entering uptrends any time market sentiment is bullish, as you can see above. MARA has actually outperformed Bitcoin over the last five years, but it’s best considered a Bitcoin play above all else.

ImmunoGen Inc. (IMGN)

Market cap: $8 billion

YTD return: 525%

ImmunoGen is a commercial-stage biotech that produces biologics and antibody-drug conjugates (ADCs) for cancer patients. The company is being acquired by AbbVie for $10.1 billion in cash (about $31 per share) in a deal that’s expected to close in mid-2024.

Shares ran higher over the summer on positive news about the company’s ovarian cancer drug and price target hikes by covering analysts, but with the shares trading roughly even with their pending acquisition price, buyers are now simply being paid to bide time until the acquisition is completed.

CleanSpark (CSLK)

Market cap: $2.1 billion

YTD return: 464%

CleanSpark is another Bitcoin mining firm, with an eye on maximizing sustainability, that just barely made the list with a market cap of $2.1 billion.

Like Marathon, it’s carrying a handful of buy ratings from covering analysts and is currently trading above their price targets. It’s also got a track record of losing money while trading with a hefty Beta of 3. The twist with CleanSpark is that their data centers operate primarily on low-carbon power. Although a side-by-side look at the two charts would indicate that investors and traders aren’t drawing much of a distinction.

Prior to the acquisition of and name change to CleanSpark, the firm was known as Stratean Inc., and their focus was drawing power “from the trash can to the gas can,” by designing, engineering and manufacturing “a revolutionary ‘stratified’ downdraft gasifier... to create a logical solution for profitably handling MSW, Coal, Plastics, Municipal Sewage and many other feedstocks.”

MoonLake Immunotherapeutics (MLTX)

Market cap: $3.7 billion

YTD return: 457%

MoonLake is a Swiss biopharmaceutical company developing treatments for skin and joint issues that reported positive Phase II results for sonelokimab to treat moderate to severe plaque psoriasis and, recently, psoriatic arthritis.

The company’s “Nanobodies” treatments are antibody-derived therapeutics that promise greater ease of manufacturing and more precise targeting of immunological disorders.

In the company’s most recent Q3 report, they indicated that they have adequate cash to initiate Phase III trials for sonelokimab. Per CFO Matthias Bodenstedt, “MoonLake has very healthy capital reserves at the end of Q3, which we expect to fully fund the Phase 3 programs in both HS and PsA and bring sonelokimab to regulatory filing. Building on the successful readouts in now three indications, we have also reserved a meaningful budget to initiate work in additional indications. We expect to announce more details on those plans in the next quarter. Our cash burn continues to be materially lower than that of peers, highlighting our cost efficient setup and allowing us to focus on long-term value creation for shareholders, patients, and clinicians.”

Like all research-first biotechs, this stock’s ongoing performance will be tied to progress with the FDA.

There you have it, the best-performing stocks of 2023. Of the five, only one seems to have meaningful upside potential. Carvana is entirely too speculative for my tastes, the Bitcoin miners too dependent on cryptocurrency prices, and ImmunoGen is already priced for the acquisition. That leaves us with MoonLake, whose fate now largely lies in the hands of Phase III trials and the FDA.

[author_ad]