Amazon(AMZN)—The Early Days

Best Revolutionary Stocks

Tesla Motors?

---

One of my favorite T-shirts is one I got from Amazon.com back when the company only sold books. On the front it says, “Amazon.com. World’s Largest Bookseller.”

On the back is a big color graphic of the Statue of Liberty, poking out above a massive sea of books, and evocative of the final scene in Planet of the Apes.

I’m not sure if I bought it or if it was a gift from the company. You see, I was a good customer of Amazon from the start, and I do remember that on two consecutive Christmases, founder and CEO Jeff Bezos sent me (and presumably thousands of other customers) coffee travel mugs.

Looking closely at the books in the image, I can identify four, the latest of which was published in June 1998. But I still don’t remember how I acquired the shirt.

Anyway, I was wearing it recently when my 14-year-old niece Lily asked, “What’s up with the shirt?”

I said, “It’s from Amazon, back when they only sold books.”

She said, “Really? I thought they always sold everything!”

Understandable, since she’s only 14.

So I told her about Amazon’s early days, and I’m going to review them here because there’s a powerful message in Amazon’s story for anyone who wants to make big money investing in stocks.

Amazon’s first web site was launched in July 1995. The business was in Bezos’ garage, and in its first six months, he sold nearly a million dollars’ worth of books.

The next year, 1996, revenues were $16 million.

And the next year, revenues were $125 million!

But all that time, the company never turned a profit, and all that time, the common wisdom was that Amazon would founder, as bookstore giants Borders and Barnes & Noble got their act together and put the upstart out of business.

Today, knowing that Borders is long dead, it’s hard to remember those days. We all see Amazon, now the largest retailer in the world, as an obvious success. But way back then, when the company was losing money, it was hard to imagine how big and profitable the company would get!

For investors who could read charts, however, there was a clue! You see, Amazon came public in May of 1997, and it was the behavior of the stock, more than anything else, that justified Cabot’s initial buy rating on January 2, 1998.

Here’s what the chart looked like.

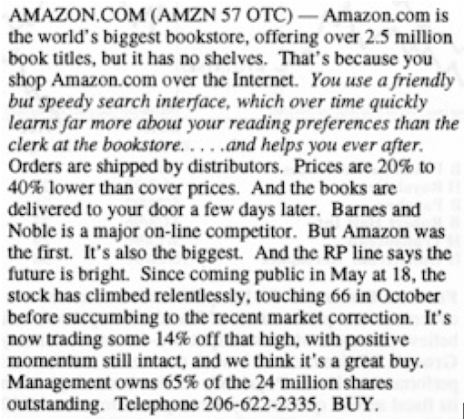

And here’s what we wrote in Cabot Market Letter at the time.

Now, many, many people would have a hard time buying a stock that had tripled in the previous six months. After all, most people like bargains! But investing in revolutionary companies isn’t about finding bargains; it’s about getting on board the rocket ship before the masses, and it’s about staying on board as long as the stock keeps going up.

So we bought Amazon.

Later that year, the company expanded into music, video and computer games.

And in December 1999, Time magazine named Bezos the Person of the Year, recognizing Amazon’s impact on America. By then, the stock, like many Internet stocks, was red-hot.

At Amazon’s peak, which coincided with that Time Magazine cover, our profit in the stock hit 2,223%. (Along the way, we did recommend that people take some profits.

And when we gave our final sell advice on the stock, in January 2000 (because the stock was breaking down), our profit was 1,291%.

Yes, AMZN is even higher now. It’s roughly tripled in the 13 years since we sold it. But holding on wouldn’t have been easy! In the two years following our sale, AMZN fell hard, like the entire market. And even when the company reported its first profit in the fourth quarter of 2001, the selling didn’t stop. AMZN didn’t surpass its old peak until 2009!

Today, AMZN is a fine investment for conservative accounts, but if you want the kind of rocket-ship gains that AMZN brought us 15 years ago, you’ve got to find the next Amazon.com! Or more precisely, you’ve got to find revolutionary stocks with the potential to be the next Amazon!

And that is the focus of our upcoming series, which you can read about here over the next ten weeks.

--- Advertisement ---

We’re Going to Send You Our Entire Buy List Tonight!

2013 will be remembered as one of the most profitable years on record. I can say this with 100% confidence because we’ve already pocketed 79% gains in Equinix, and we’re sitting on a 148% gain to date in LinkedIn, a 88% gain in Qihoo 360, a 53% gain in Michael Kors and this bull market is far from over.

Our time-proven technical indicators are forecasting a major breakout ahead for a select group of stocks that continue to outpace the market by a country mile. In fact, the numbers we are seeing indicate that the stock market’s rocket ride to 15,500 is just the beginning of a bold new bull run.

The last time all three of our Cabot Market Letter indicators hit the same threshold, my readers grabbed a 440% rise in Ascend Communications, a 559% profit in QUALCOMM and a 307% rise in Crocs.

We see similar profits headed your way, if you add our newest recommendations to your holdings NOW before the next big run up begins.

---

Best Revolutionary Stocks

To find revolutionary stocks, start with these rules.

Rule #1 when hunting for revolutionary stocks is to ignore valuation. Wall Street likes to count things, and price/earnings ratios are their favorite measurement. But if you focus on P/E ratios, you’ll never invest in revolutionary companies like Amazon.com.

Rule #2 is to use your imagination. This is difficult for most investors. It’s much easier to look back than look ahead. But ahead is where the big profits are. In the case of Amazon, having the imagination to see that little company putting Barnes & Noble out of business was key.

Rule #3 is to pay attention to management. It’s my contention that the best revolutionary stocks are those of companies led by visionaries. In fact, just off the top of my head, I listed these revolutionary stocks of my lifetime. Most—perhaps all—were led by exceptional managers: Apple, Blockbuster, eBay, Google, Green Mountain Coffee Roasters, Home Depot, IBM, McDonalds, Microsoft, Netflix, Oracle, Research in Motion, Starbucks, Tesla Motors, Teva Pharmaceuticals, Walmart, Yahoo! and Xerox,

Rule #4 is to invest only when there’s potential for a major increase in perception. If you invested in Amazon when Jeff Bezos was on the cover of Time, you lost money. Similarly, and more recently, if you bought Apple (AAPL) when it made headlines as being the most valuable company in the world, you lost money. To make big money, you’ve got to invest when skepticism is high!

For example, last December, when Tesla Motors (TSLA) was trading at 34, JP Morgan initiated coverage on the stock and gave it a price target of 37 for December 2013. That’s a whopping 8% advance in 12 months. JP Morgan, of course, is very good at counting things. But they’re not very imaginative! And they, like many investors, were skeptical of what Tesla could achieve.

At the same time, I had the stock rated buy for my Cabot Stock of the Month readers, but with no price target. And I kept it rated buy in the months that followed (as TSLA skyrocketed), remembering the lessons I learned in AMZN and other great stocks. Today, my readers are looking at profits in TSLA of over 300%, and they’re holding on for more.

But should you buy it now?

More precisely, considering its recent rocket-like performance, is Tesla still one of the best revolutionary stocks to buy? Or should you look elsewhere?

Well. I am currently in the process of compiling a list of the best revolutionary stocks to buy now. I started this process by asking all the Cabot editors to submit to me a few candidates. After reviewing them, and narrowing the list down to 10, I will present the list, in alphabetical order, over the next 10 weeks. Maybe Tesla will make the cut, maybe not. Either way, it will be interesting.

In the meantime, I recommend that you take a risk-free subscription to Cabot Stock of the Month, to get my latest advice on not just Tesla but on every stock in my portfolio. By the way, the average gain on these stocks is 53%. Over the same period, the S&P 500 is up just 15%!

For details on Cabot Stock of the Month, click here.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Editor of Cabot Stock of the Month

The List of our 10 Best Revolutionary Stocks

Our first revolutionary stock is from a company that has the top online rental sites in the U.S., France, Germany, Spain, Britain and Brazil...

Sign Up FREE for the Cabot Wealth Advisory Here!