The Music Evolution Through the Years

Apple Dominates Digital … but Pandora Dominates the Cloud

Best Revolutionary Stocks: Pandora

Not so long ago, when all music was live, a talented musician could make a decent living—provided he didn’t blow his earnings on booze or drugs or get cheated by an unscrupulous manager.

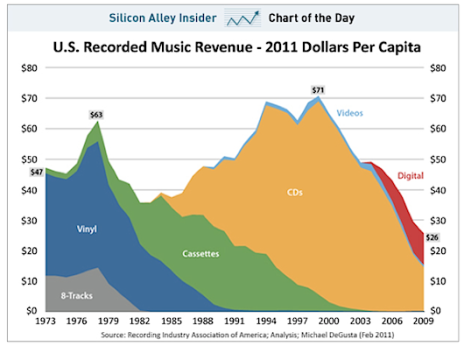

Then recorded music came along, with vinyl records dominating the scene for decades and enriching the fortunes of companies like Victor, Columbia, Seeburg and Sun. As time went by, the best musicians sold more records and got richer. But as recorded music replaced live music, fewer live musicians made a living wage.

Then came the tape era, featuring first reel-to-reel and then 8-track—which sometimes played parts of two songs at the same time when the tape was misaligned (in my youth I fixed more than a few). When vinyl record sales peaked in 1978, it was thanks to cassette tapes, which were less trouble in both the home and the car. And less than a decade later, cassettes began to be replaced by CDs.

Conspiracy theorists saw a corporate plot to squeeze more money from hapless consumers by continually introducing new formats, and to a small extent, that was true. But the bigger story is that every new format brought an improvement in the combination of fidelity, convenience and price.

Then, in 2001, Apple introduced iTunes to the world. CD sales plummeted, and they continue to fall to this day.

Interestingly, iTunes wasn’t built by Apple. It was developed by Casady & Greene and called SoundJam MP. But Apple bought it in 2000 and renamed it, and by piggybacking first the iPod and then the iPhone onto this music system, Apple led the way in the digital music revolution over the past decade, becoming the most valuable company in the world in the process.

I started using iTunes in 2001, by converting my CD collection to digital, copying only the “good songs.” Soon after, I stopped buying CDs. I now have 11,845 songs, including 2,491 songs that I’ve bought from Apple. It sounds like a lot, but in fact, it’s only enough to play nonstop for 31 days. And after a while, the same songs get old; I want new music.

So more and more, I do what most young people who dislike buying music do; I go to the Cloud, which is the newest battleground in the ongoing music revolution continues!

Which brings me to today’s Revolutionary Stock.

Pandora (P) was first recommended by Cabot Top Ten Trader on April 1 of this year, when it was trading at 14. Here’s what editor Mike Cintolo wrote.

“Pandora, making its debut in today’s Cabot Top Ten Trader, is an Internet radio service that lets listeners create up to 100 personalized stations on which they can listen to unlimited hours of free music and comedy. The company also runs Pandora One, a paid subscription service. The company’s Music Genome Project is an ambitious program to analyze and categorize all of pop music to allow users to find exactly the music they want. Pandora’s users listened to 2.7 million hours in Q4 2012, and are estimated to have listened to 4.0 million hours in Q1 2013, a 46% increase. Revenue comes primarily from advertising, with subscriptions and other sources making up the other 13%. Pandora is a major holdout from the domination of Apple’s iTunes as a music source, and some analysts speculate that an Apple deal with Spotify might take a bite out of Pandora’s market share. But with over 125 million registered users, Pandora is a successful business right now.”

Four weeks later, with the stock still trading at 14, Mike added, “Pandora’s listenership has been on the increase, with March’s figures reflecting a 40% jump in listener hours from year-ago levels. Active listeners numbered 69.5 million at the end of March, up 36%. Pandora’s earnings dipped to a four-cent loss per share in Q1, reflecting higher royalty costs for the music that it streams. Pandora’s advertising revenue hit $109 million, while subscription and other revenue came in just over $16 million. Revenue per thousand listener hours (RPM) increased by 22%.”

Since then, we’ve seen the second-quarter earnings report, which revealed revenues growing 55% from the year before, and the loss per share expanding to $0.12.

But two important metrics argue that the future is bright here!

First, the number of institutional investors holding the stock continues to grow; it’s now at the highest level since the company’s IPO in June of 2011. And second, the stock itself is advancing!

Soon after those April recommendations in Cabot Top Ten Trader, Pandora launched itself higher, topping 19 in May and 20 in early July. It’s currently on a reasonable correction, toying with its uptrending 25-day moving average, so technically, the picture is bright.

Looking at the big picture, and thinking way back to the debut of those vinyl records, here’s what I see.

With every major new music technology, a new corporate name took precedence.

When tape came along, you didn’t see Columbia leading the way. They were defending their position in vinyl!

And when digital music on your computer came along, you didn’t see Sony leading the way. They were busy defending their position in CDs!

So as we transition from the in-computer digital music era to the cloud-based era, history tells me Apple isn’t going to execute the transition well. That doesn’t mean that Apple will fail; no doubt they will hold onto many users who are too entrenched in their habits to change.

But Pandora has a great start in the Cloud-based music paradigm, and thus the odds are that Pandora will be the leader in the years ahead.

The weeks ahead will bring seven more revolutionary stocks like Pandora, and I look forward to presenting them to you.

In the meantime, I recommend that you take a look at Cabot Top Ten Trader, to get ongoing advice on investing in all the market’s leading stocks.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Editor of Cabot Stock of the Month

Follow our “Best Revolutionary Stocks” series. Sign Up FREE for the Cabot Wealth Advisory Here!

Best Revolutionary Stocks – 2013:

Our previous revolutionary stock has cemented its position as the world’s largest professional network, with 225 million members around the world...

Our fourth revolutionary stock is a late entrant to the Chinese browser/search business, but it’s gaining market share fast...