Apple’s Gold iPhone

A Little More Tesla Motors (TSLA)

Best Revolutionary Stocks: Yelp

---

I’ve been a working man—never unemployed—since I was 22 years old. And every one of those years was spent working for companies striving to make a profit by supplying customers with products and services they would voluntarily pay for.

Furthermore, the majority of those years have been spent working at Cabot, studying great companies like Intel and Apple and Google and eBay that were thriving by providing their customers with what they wanted. So I know how free markets work, and I believe in them.

Yet the other day I happened to read something that was critical of free markets that rang true.

It was a brief synopsis of John Kenneth Galbraith’s classic economics text, “The Affluent Society,” published in 1958, which included the thesis that free markets oversupply luxuries and thus divert money from public goods.

In particular, I was struck by Galbraith’s contention that commercial advertising stimulates demand for unnecessary goods and services—because he wrote that in 1959, hardly imagining the kind of commercial advertising we are subject to today.

And then last week, Apple announced a gold iPhone.

Now, nobody needs a gold iPhone; black will do the job just as well. But Apple knows, and you know, that millions of people are going to want those gold iPhones. And we all know that Apple’s very hip ads are going to increase demand for these status symbols even more.

As a business owner and capitalist and investor, I’m cool with that, for all the obvious reasons. I love companies that grow by meeting the demands of their customers.

But as an observer who long ago cut out advertising from most of my daily life, I think it’s worth reflecting—at least for a few minutes—on the role of advertising in our lives. And the easiest way to do that is to think about your life.

If you weren’t exposed to so much advertising on a daily basis, might your life be better? More pointedly, might it be more your life and less the life of you as a potential consumer of someone’s products and services?

One of my friends publishes a periodical survey of consumer habits, which is eagerly bought by companies looking to sell more and more of their goods and services. The data they have on consumers is amazing—even scary if your thoughts trend that way.

The publisher, of course, argues that the data allows companies to serve consumers’ needs better, and to some extent that is true. But when advertising creates needs, as with Apple’s gold iPhone, I believe a line has been crossed, and the question is, is that good or bad?

If you care to think about it and comment, I’ll reprint the best answers.

--- Advertisement ---

We’re Going to Send You Our Entire Buy List Tonight!

2013 will be remembered as one of the most profitable years on record. I can say this with 100% confidence because we’ve already pocketed 79% gains in Equinix, and we’re sitting on a 148% gain to date in LinkedIn, a 88% gain in Qihoo 360, a 53% gain in Michael Kors and this bull market is far from over.

Our time-proven technical indicators are forecasting a major breakout ahead for a select group of stocks that continue to outpace the market by a country mile. In fact, the numbers we are seeing indicate that the stock market’s rocket ride to 15,500 is just the beginning of a bold new bull run.

The last time all three of our Cabot Market Letter indicators hit the same threshold, my readers grabbed a 440% rise in Ascend Communications, a 559% profit in QUALCOMM and a 307% rise in Crocs.

We see similar profits headed your way, if you add our newest recommendations to your holdings NOW before the next big run up begins.

---

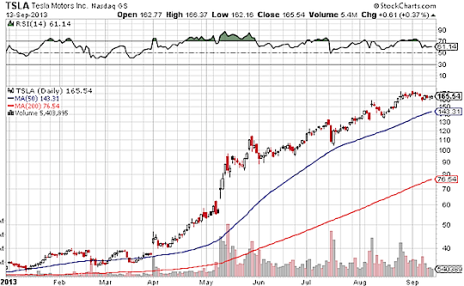

Speaking of comments, my September 9 column on Tesla Motors (TSLA) as the eighth revolutionary stock included a chart of the stock since inception, that showed a long base and then a strong advance that kicked off this April and hasn’t stopped since.

One of my readers, F.K. from Jekyll Island, Georgia, commented, “the chart is what most would refer to as parabolic ..... which you didn’t mention .......”

Well, I didn’t mention it because I don’t agree, and to illustrate my point I’ll use a different chart, looking at TSLA’s performance this year alone.

Looking at this chart, you can see that for the first three months of the year, TSLA was pretty quiet.

March 31 saw the stock’s first big buying surge, on news that sales of Model S sedans were running ahead of expectations. That kicked off a five-week ascent that took the stock up 55%.

Then on May 8 came the company’s actual first-quarter earnings report. That sparked another wave of buying that took the stock up 95% in just three weeks! By some definitions, that might have been a parabolic rise.

But since that high near the end of May, TSLA has calmed down a lot. In fact, in the 15 weeks since then, the stock is up “only” 52%. Its growth rate has cooled, not accelerated.

By definition, a parabolic curve is one whose slope increases over time. Iomega and Taser are two stocks that traced out parabolic curves that I remember well. Parabolic curves provide a great way to make profits fast, provided you can sell before the stock collapses. In my opinion, TSLA has definitely not gone parabolic.

By my analysis, the stock is still acting normally; it’s acting like a growth stock that more and more investors want to own. And I think they have good reason, as I wrote at length in last week’s column.

For further guidance on buying and owning TSLA, you need look no further than my weekly updates in Cabot Stock of the Month.

---

Moving on, it’s time for another revolutionary stock. If you haven’t yet read the reasoning behind this Special Feature on investing in Revolutionary Stocks, you should; you can find it here.

BEST REVOLUTIONARY STOCK NUMBER NINE: Yelp (YELP)

Here’s what I wrote about Yelp in late June when I recommended the stock in Cabot Stock of the Month:

“Earlier this month, I was in Washington D.C. at a conference, and one night I found myself with a group of colleagues at the bar in a very popular restaurant. But when we asked if there were tables available for dinner, the hostess told us the wait would be 30 minutes. “So I stepped outside, opened the Yelp application on my iPhone, and quickly found a perfect substitute just a block away that was not only less crowded but less expensive as well. When it comes to finding local businesses, Yelp is unbeatable.

“Then, last week, back here in Salem, someone drove by in a car and threw a Yellow Pages book on my front step. I threw it right in the recycling bin.

“In short, I’ve made the switch. With Google and Yelp and other specialized apps at my fingertips, there’s no reason to use the Yellow Pages anymore. Yet the Yellow Pages is still a $6.9 billion market in the U.S. and a $16 billion market globally! Eventually, that business—along with coupons and flyers—will dry up as we all go digital, and Yelp is likely to be a major beneficiary.

“Yelp launched its business in San Francisco in 2004, creating its name by combining and shortening the words “Yellow Pages.” The San Francisco market is now mature but still growing, and every market the company has entered since then—Yelp is currently in 97 markets in the U.S., Canada, Europe and Australia—has followed the same growth trajectory, though somewhat faster. In short, growth is predictable—and that growth is not slow! The group of markets launched in 2005-2006, for example, grew 59% last year!

“For revenues, Yelp depends on advertising, of course. Local advertising currently accounts for 70% of revenues, while brand advertising accounts for 21%, with the remainder coming from other services. And there are still many more advertisers to attract. In fact, of the estimated 53 million local businesses in the firm’s targeted regions, only 1.1 million have claimed their Yelp sites and just 45,500 are advertising on Yelp. So the growth potential for the company, which has no debt, is still huge.

“And as more business get listed, they will attract more Yelp users who become business patrons—one study showed that just having a decent presence on Yelp can boost sales by about $8,000, with that number tripling if it’s combined with marketing efforts. And as more of these users write anonymous reviews for businesses, their presence on the site will attract more advertisers, creating a self-reinforcing cycle similar to the one that once made giving away fat yellow phone books a profitable venture.

“But you can’t take a fat phone book with you when you leave the house, and with 45% of Yelp activity now on mobile devices, the future is clear. Yelp’s revenue growth rates are very healthy and cash flow is positive. Expansion activity has kept earnings in the red so far, but that should change in the quarters ahead: analysts are estimating earnings will hit $0.16 per share in 2014.

“Lastly, as I said at the top, Yelp is the hands-down leader in content and viewership and thus is the odds-on favorite to win as local advertising goes increasingly digital.”

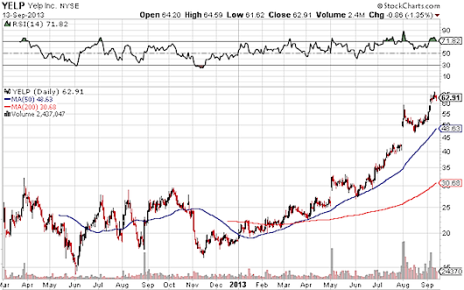

I went on to analyze the chart, which had a very high-potential pattern at the time. Buyers who followed my advice and bought are now sitting on profits of more than 95%. (This is truly a bull market!)

But that doesn’t mean YELP’s ride is over, as the chart of TSLA should have taught you. Yelp’s story is very much intact, and there are still far more potential buyers of the stock than sellers. So I still like it, long-term.

But if you really want timely investing advice, I recommend you become a regular reader of Cabot Stock of the Month, where I recommend a new high-potential stock every month and keep you updated their progress every week! If you’d like to join my very happy and prosperous readers, click here.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Editor of Cabot Stock of the Month

Follow our “Best Revolutionary Stocks” series. Sign Up FREE for the Cabot Wealth Advisory Here!

Best Revolutionary Stocks – 2013:

The eighth stock in our revolutionary stock series is from a company whose goal is get the world to transition from its polluting fossil fuel transportation infrastructure to one based on highly efficient battery-powered transportation...

Our final revolutionary stock is from a company that describes its offering as “a revolutionary rich communication social platform that engages users in real-time online group activities through voice, text and video”...