By Chloe Lutts

---

Happy Birthday to Us

One Stinker of a Company

And Two Stellar Ones

---

This year marks the 30th year of the Dick Davis Digests’ publication. In addition, later this week, the Investment Digest will publish its 700th issue.

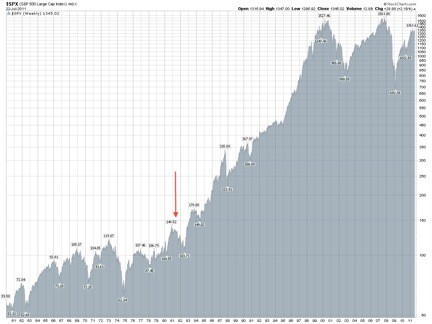

Dick Davis started the Digest in 1981, in the middle of a two-year recession. You can see by the orange arrow on the chart of the S&P below that it wasn’t a very good year for the market.

But the Digest succeeded anyway, and got to live through the fantastic run up that followed. Look at it!

We’re not the only ones turning 30 this year; one of our contributors, The CHEAP Investor, was also founded in 1981. In a recent article celebrating its anniversary, Editor Bill Mathews summed up some of the biggest changes of the last 30 years. He did a great job, so I’ll just let him speak:

“When we started the newsletter in 1981, researching a stock was much more labor intensive. Stock prices were obtained from the Wall Street Journal or by calling a broker. In order to review a company, we called its Shareholder Information department and asked them to mail us the latest 10K and 10Q and press releases. Then we checked the S&P Stock Reports and Value Line books in the library. Today, we type in the stock symbol, and a world of information is revealed online. The Internet has revolutionized our ability to obtain information. The problem today is, with so much information, how do you sift through all the hype to find the good stuff? That’s why we simplify our research by specializing in stocks under $5 per share. We ignore high-priced stocks, options, warrants, mutual funds, and bonds, concentrating on one area and doing it well. We stick with the reputable finance search engines like Yahoo and Google and the SEC filings and pay no attention to message boards.

“Investors have changed a lot over the years too. There were no day traders in the 1980s. Everything moved slower back then, and most investors were happy to buy a stock and hold it for long term. Today, so many investors want to buy a stock and sell it for a fantastic profit the next week. They follow the hot stock newsletter, analyst or blogger of the moment; and if they are unhappy after a few weeks, they are on to the next one. We learned a long time ago that searching for a quality, undervalued stock, buying it near the 52-week low and holding on until the market takes the price upward works best for us. Following that strategy has proven profitable for both The CHEAP Investor and our subscribers. Thanks to all our loyal subscribers and hard working staff for 30 great years!”

Though our modus operandi is different from The CHEAP Investor’s, I’d like to thank all of our subscribers as well--we couldn’t have done it without you.

Today’s stock pick is inspired by a few good articles I’ve read lately: two about very good businesses, and one about a bad business.

Let’s start with the bad news: Borders is going out of business. According to most sources, Borders simply couldn’t compete with Amazon.com (AMZN) and other online book retailers. The company’s own announcement of its decision to liquidate cited three “headwinds” that led to its demise: “the rapidly changing book industry, eReader revolution and turbulent economy.”

But there had to be another problem as well: Barnes & Noble (BKS) is facing all those same challenges, and is faring much better.

In an excellent article in the online magazine Slate, Annie Lowrey recently hit the nail on the head: “The better reason for its demise is that Borders had long lost its competitive edge on many fronts, from corporate strategy to coffee. It died by a thousand--OK, maybe just four or five--self-inflicted paper cuts.” She goes on to detail several huge mistakes Borders made that were the real reason it couldn’t compete in today’s bookselling environment.

First, there was its disastrous online strategy: Borders actually outsourced its online sales to Amazon in 2001, handing online customers over to its competitor at a time when more and more customers were moving online.

Second, unlike Barnes & Noble, whose Nook e-reader came out hot on the heels of Amazon’s Kindle, Borders dithered on the e-reader front. It finally introduced its own offering, the obscure Kobo, a year ago.

Third, Borders’ attempts to diversify were misguided: While its big bet on CDs and DVDs paid off at first, “the same forces killing the bookstore also killed the record store and the video store” and the company failed to take the next step. Meanwhile, Barnes & Noble was drawing customers into its stores with exclusive Starbucks Coffee outposts.

Finally, Lowrey writes, Borders thought its competitive edge could come from offering an unparalleled variety of books, so it opened huge big-box stores. But the Internet is much, much better at offering variety, so Borders’ strategy--and all those giant stores--became a liability.

At bottom, you can blame the Internet for Borders’ death, but it was the company’s own fault that it failed to adapt.

Also in Slate recently: a profile of Method, a ten-year-old company that makes Green cleaning products. Founders Eric Ryan and Adam Lowry have succeeded by doing exactly what Borders didn’t do: identifying and following trends early, and finding a genuine competitive niche.

When Method was founded in 2001, consumer demand for Green products was picking up, but product offerings were still lacking. Ryan and Lowry had the idea to introduce a line of Green cleaning products that not only worked, but that looked and smelled better than anything on the market. That turned out to be exactly what consumers wanted, and Method is now one of the fastest-growing private companies in the U.S. I use and love their products myself.

Today’s final story of business success is about a company you can actually invest in: IAC/Interactive Corp. (IACI). I was reminded to take another look at this company by a July 29 Financial Times article about the company’s subsidiary, Match.com, an online dating service. The article highlighted Match.com’s relatively new matching algorithm, introduced over the last two years in response to the company’s growing number of users. The new algorithm’s main distinction from the old system is that rather than just taking into account a user’s stated preferences, such as their ideal partner’s height and income, it also attempts to infer their unstated preferences: by tracking the profiles they look at, for example.

Match.com and other dating sites generate about a quarter of IAC/Interactive Corp.'s income. The company also owns Ask.com, The Daily Beast and over 50 other online brands. In January, David R. Fried, editor of The Buyback Letter, chose IACI as one of the Digest’s Top Picks for 2011. David wrote:

“IAC/InterActiveCorp is the company behind Match.com and Ask.com, as well as more than 50 other website properties that make up the eighth-largest network of websites in the world, with 246.3 million unique visitors. A new CEO, Greg Blatt, just took over for Internet pioneer Barry Diller, who remains chairman (and is still the largest individual shareholder); Diller will focus on growth and ‘the next new thing.’ IAC has a whopping $1.2 billion in cash on hand currently (about $13.79 a share), a nice nest egg for Blatt, who has said he views buybacks as the most effective means of returns. Going forward, he said IAC will evaluate potential against price, in determining what mix of M&A and buybacks make the most sense. Meanwhile, Match.com has seen big growth, with sights set on the international market. IAC is also focused on its tool bar business--in the most recent quarter, IAC increased its active tool bars 55% to 97 million. (IAC puts customized search tool bars on browsers and generates fees when the tool bars are used.) In December, IAC bought out large shareholder Liberty Media (LPTCA) in exchange for Evite and Gifts.com, as well as $220 million. We expect continued growth, and we like the large cash cushion, which helps moderate the results of any volatility.”

That was published in the January 5 issue of Investment Digest, and the stock has made a steady climb since then, from 30 to about 37--until last week. IACI reported second-quarter earnings on July 27, and the stock gapped up from 37 to 42 overnight. It is now drifting gently downward--normal after a gap up--and is in the 41 area. Months of building momentum followed by a strong gap up are near-surefire ingredients for stock success, and I think IACI will deliver handsome profits in the months to come.

Of course, if you’d been an Investment Digest subscriber and bought after the original recommendation back in January, you’d already have a 40% profit!

Wishing you success in your investing and beyond,

Chloe Lutts

Editor of Investment of the Week

P.S. Chloe Lutts is the editor of Dick Davis Investment Digest where you’ll find dozens of great stock recommendations (like IACI) published twice each month. Get the top stocks ideas from the best minds on Wall Street for just pennies a day when you subscribe. Click here to learn more!