Every January, when the new year starts to write its story, I like to look back at the old one shrinking in the rear-view mirror. My question is always the same: What were the top stocks of the previous year, and why?

Partly, of course, I’m trying to gain some insight into what it takes for a stock to streak ahead of its fellow equities and really soar.

But I’ve been doing this long enough to know that the answer to the “why” question will usually be something unpredictable and non-reproducible, like a biopharmaceutical company that finally catches a break in a clinical trial or a go-ahead from the FDA to market a new drug.

Every year I also look for a convenient cutoff, a percentage gain that gives me enough stocks to get the flavor of the year, but not so many that I wind up squeezing the orange after all the juice is out.

[text_ad]

This year, the minimum gain to make my list is 250%, a feat that 17 stocks managed.

Wanting to avoid a pack of meaningless penny stocks, I applied the usual limits to my search: Check only for stocks that are liquid (averaging 300,000 shares traded a day at year end) and finished the year trading above 10, which is somewhere around the lower price limits of most institutional portfolios.

In 2016, I found 14 stocks that gained more than 200%, but that was a weird year for top stocks. It featured an unusual mix of beaten down commodity and industrial stocks in its top 14, including four specialty chemical firms, two oil & gas companies, two fabless chip designers and two coal companies.

But 2017 was a Bull Market’s bull market, with a more usual selection of stocks dominated by biomedical issues. This year the list will eventually include 17 stocks that gained 250%! (I calculate gains from the stock’s closing price on the last trading day of December 2016 to its closing price on December 29, 2017.)

Today, I’ll only write about the overall winner, the Top Stock of 2017. Then, if you’re interested, I’ll give you a chance to sign up to receive the whole 17-stock report.

The big winner for the year is a very special case, and it makes for a great story.

The Top Stock of 2017

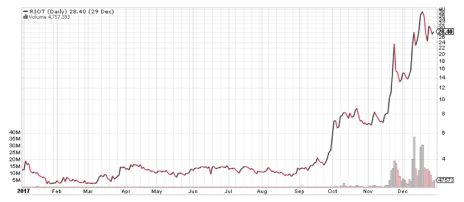

Riot Blockchain (RIOT, 3.42 to 28.4, 729%) — As you’ll see from the chart (below), RIOT was a virtual flatline through the end of August. And that portion of the stock’s year was a very different story than the one the company ended the year with, because when the year started, Riot Blockchain was Bioptix Inc., a mild-mannered maker of diagnostic equipment for the biotech industry headquartered in Colorado. (The deeper story is that Bioptix was formerly a company called Venaxis that bought BiOptix Diagnostics in 2016, but I digress.)

The board of Bioptix realized that the company was a loser and looked around for a better horse to ride. (Bioptix’s patents were licensed to Ceva Sante Animale S.A., a private diagnostics company, for $2.5 million, or so, plus a little royalty stream.) Seeing the wave of interest in bitcoin, the board decided to focus on that opportunity, and announced in early October that it would change its name to Riot Blockchain and concentrate on investments in blockchain assets, bitcoin and bitcoin mining, plus other cryptocurrencies and security software.

Bioptix stock began the year under 4, but started to show some life in September, then exploded higher in October, both before and after the Riot Blockchain announcement. Under its new symbol, RIOT nearly reached 10 on October 11, then relaxed until the middle of November, when it blasted off again, eventually reaching 46.2 on December 19.

A sharp pullback in late December dropped RIOT back to its 28.4 close for the year; if it had been able to hold that high, its gain would have been 1,250%. Unfortunately, that’s how things go in speculative bubbles. Riot Blockchain is making investments in companies like Coinsquare, a Canadian exchange for digital currencies and actively seeking other opportunities.

This is the strangest top stock for any year I can remember, as cryptocurrencies lost nearly $200 billion in value on December 22. But that’s not stopping opportunistic companies like Riot Blockchain or Long Island Iced Tea Corp., another abrupt corporate makeover that changed its name to Long Blockchain (LTEA) on December 26.

I’ll get to the other 16 top stocks of 2017 within a week or two. Stay tuned by checking back with Cabot Wealth Network website!

[author_ad]