These transportation stocks are benefitting from the quicker-than-expected economic recovery

It’s easy to forget the huge debt of gratitude we owe to the transportation industry. For without the continual movement of goods by sea, air and land, the economy would quickly grind to a halt. It’s no exaggeration to say that transporters keep the wheels of commerce running smoothly (literally and figuratively).

In the last several months, transport companies have worked overtime to alleviate shutdown-related supply chain disruptions. In the early stages of the pandemic, analysts tended to take a dim view of the transport industry outlook. But the leading transporters have risen to the occasion and, in many cases, exceeded expectations. Here we’ll look at how the industry has survived (and thrived) in the current climate, and we’ll also discuss some transportation stocks that should benefit from continued economic recovery.

Let’s begin this industry overview with a look at the railroads. Rail shippers are an essential part of the economy, facilitating the smooth transport of goods from producers to end users. In many cases, it’s cheaper for domestic shippers to move product on the rails than other forms of transport.

[text_ad use_post='129623']

Historically, the state of the railroad industry has been used as a barometer for the health of the broader economy. While rail transport isn’t quite as important to the U.S. economy as it once was (railroads haul just 15% of U.S. tonnage today, compared with 70% for truck freight), it’s still a vital component of the economic big picture. As such, it demands our attention.

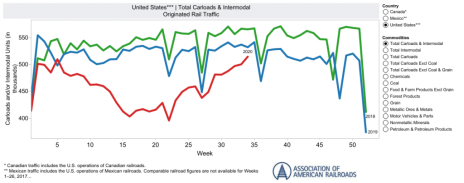

Despite a harsh economic climate earlier this year, the railroad industry outlook is improving. After hitting a multi-year low in May following COVID-related shutdowns, total U.S. carload and intermodal rail traffic has increased steadily since then. The following graph (red line) illustrates the ongoing recovery in rail traffic in the last few months. While it hasn’t yet reached the levels associated with prior years, it’s well on the way to a full recovery, with intermodal shipments leading the way.

Source: AAR

Transportation Stock #1: Norfolk Southern (NSC)

One of the leaders in this space is Norfolk Southern (NSC), which operates 19,500 route miles in 22 eastern states and the District of Columbia, with rights to Canada via the Canadian Pacific Railway.

While the company’s second-quarter revenue dropped 29%, the decline was due to the volume impacts of COVID, as well as low energy prices. Despite this, the firm managed to achieve record train performance, train speed, terminal dwell and shipment consistency in Q2, while other service metrics were near record levels. All three of its business groups (coal, intermodal and merchandise) also showed improving revenue per unit.

In the first six months of 2020, free cash flow was a record at $1.2 billion (largely due to fewer capital additions and timing of income tax payments). Moreover, total operating expenses were down 21%.

With impressive cash generation and strong liquidity, NSC continues to distribute cash to shareholders (it has been a steady dividend payer for years) despite lower revenue in the first half. It maintained its dividend while repurchasing 1.3 million shares (about $200 million). At the end of Q2, the company had over $1 billion of cash on hand, with less than $100 million of debt maturities in the next year. Analysts also see the railroad’s revenue decline bottoming out later this year, with a consistent rebound in the top line anticipated for 2021 and 2022.

All told, NSC is well positioned to face potential economic headwinds. And if the economic recovery continues as expected, Norfolk Southern shares should continue to trend higher in the months ahead.

Transportation Stock #2: Canadian National Railway (CNI)

Another rail shipping stalwart is Canadian National Railway (CNI), which operates Canada’s largest rail system encompassing 20,000 route miles across Canada and parts of the U.S. The company is heavily exposed to the oil and gas business via its intermodal market, which is expected to see volume declines in the coming months. Yet grain shipments are expected to improve, along with fertilizer and other farm commodities.

On the financial front, Canadian National generated $C1 billion in free cash flow during Q2 (a quarter of severe recession) and management offered eye-popping full-year free cash flow guidance of $C2.5 billion for full-year 2020. As CEO Jean-Jacques Ruest put it, “CN is built to last.”

Technically speaking, CNI stock has spent the entire summer above its rising 50-day line. I would suggest using this as a stop-loss guide if you’re long CNI.

Transportation Stock #3: Werner Enterprises (WERN)

After big COVID-related setbacks earlier in the year, the trucking segment of the transportation industry has made an impressive comeback in recent months. According to industry data, U.S. truckload freight volumes continue to rise as shippers make significant headway in restoring broken supply chains.

Leading this charge is Werner Enterprises (WERN), a truckload carrier of general commodities with coverage throughout North America, Asia, Europe, South America, Africa and Australia. Because a sizable portion of Werner’s revenues are derived from essential goods delivery (85% of its Q1 revenue came from food/beverage and home improvement retail), its financial results were a lot stronger than other trucking firms in the last quarter.

While the top line was 9% lower in Q2 and per-share earnings were 2% lower, Werner saw a steady a recovery of One-Way Truckload freight volumes from its customers as they reopened, with the trend continuing into July. Dedicated freight volumes were also strong in the quarter, and management said it was encouraged by recent conversations with customers about their freight trend expectations going forward. Wall Street agrees, with forward revenue estimates trending higher in the next few quarters.

Werner stock, meanwhile, has evidently priced in a full recovery in the shipping business and the chart looks enticing. If you’re long WERN, I suggest using the 50-day line as a rolling stop-loss guide.

Transportation Stock #4: FedEx (FDX)

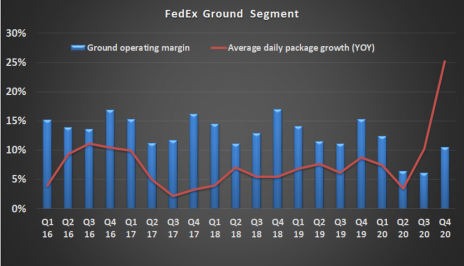

Leading the pack among the major transporters is FedEx (FDX), which has experienced an impressive rebound in shipping volumes thanks to this year’s massive increase in e-commerce and home delivery demand (illustrated in the following chart).

Source: Fool

FedEx exceeded analysts’ expectations in July, and the firm’s fiscal fourth-quarter earnings of $2.53 per share on revenue of $17.4 billion was a welcome surprise on Wall Street (beating consensus estimates of $1.52 per share on sales of $16.5 billion).

Looking ahead, in addition to e-commerce, FedEx plans to focus on business-to-business opportunities. Management also believes it can drive growth through increased penetration in healthcare (specifically in medical devices, pharmaceutical and testing equipment segments). Management also says the firm is seeing opportunities emerge within the industrial sector.

From a technical perspective, the stock has become stretched from its 50-day line and is vulnerable to a pullback in the near term. But the bullish momentum it has generated since bottoming in March (and intermittent “pauses that refresh”) should be sufficient to keep the upward trend intact.

In conclusion, after a rocky start this year, the transportation industry has stabilized and looks to be on a solid growth path going forward. Although some degree of uncertainty surrounds the economy in the months immediately ahead, the companies mentioned here are well positioned to survive any unforeseen headwinds and are poised to benefit from a continued economic recovery.

If you want the best-performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week chief analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]