Today, I’m going to give you four potential leading stocks to keep an eye on for when the market finally gets going again - and the familiar patterns each of them is following. But first, a word on the market...

We’re five weeks into this market correction/consolidation, during which time the major indexes have been about as news-driven and volatile as we can remember. In fact, overnight and intraday news, rumors and tweets regarding tariffs, Hong Kong, yield curves and general global economic weakness has caused the Nasdaq to rise or fall by at least 1% in 15 of the past 24 trading days!

My first thought on this is simple: While I’m encouraged by the recent bump up in stocks (my intermediate-term indicator could go green early next week if all goes well), it’s not a time to be playing heavily in the market. Some nibbles here or there are fine, and I’m not saying you should be preparing for another Great Recession. But there’s not much being made right now on the long or short side. So might as well wait patiently for it to end.

[text_ad]

On a positive note, the upside of such a hectic environment is that it becomes easier to discern which stocks are truly strong. Granted, you have to apply a little logic to the situation—if a growth stock shows resilience in this environment, there’s a good chance it will do well once the sellers run out of ammo.

But what does “resilience” exactly mean? Well that’s the trick, as I like to look for specific chart action that hints at big investors accumulating on dips and unwilling to sell shares during the endless bad news/gap downs seen over the past month. To be clear, this isn’t voodoo—when I look at a chart, it’s less about patterns than just reading supply and demand, which can’t be hidden given how much money institutional investors are swinging.

Plus, there’s also action that can be spotted that significantly raise the odds that the next retreat will be buyable. They’re not near-term buys, but they’re worth keeping an eye on.

Long story short, now’s a great time to be flipping through charts of stocks with great stories and numbers, looking for stocks in pole position to lead the next upmove … whenever it begins. Assuming a stock is in a general uptrend (resilience near a 52-week low has less meaning), I’m looking for four specific types of action (some of which overlap a bit) in potential leading stocks that I’m putting on my watch list. Let’s take a look:

4 Types of Leading Stocks

Leading Stock Type #1: Higher Lows vs. the Market

What it Means: I wrote about this a bit in last week’s Cabot Growth Investor, and it has to do with “fitting” a stock’s recent action to the market’s. For instance, you can see the Nasdaq has had three sharp slides during the current correction, each one finding support near the 7,700 level (give or take). Thus, one of the first things I’m looking for when I run through charts is the action during August—did the stock hit lower lows while the market was holding up, or did it continue hitting higher lows during that time? If it’s the latter, it’s worth keeping an eye on.

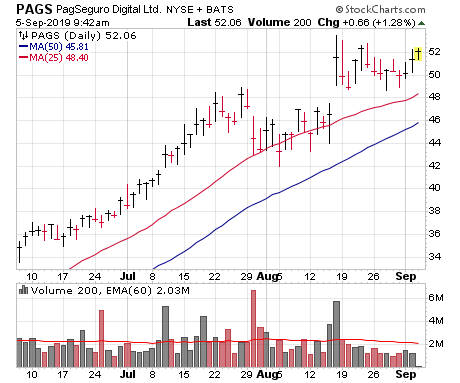

Example: Happily, there are many examples of this, especially among stocks that reacted well to earnings during the past couple of months. Two examples: PagSeguro (PAGS), a fast-growing payments outfit in Brazil, which I would think would be scraping bottom given the trade war and Argentina’s horror show. Instead, the Brazilian stock hit a low of 42 in early August, 44 in mid August, and after gapping up on earnings, was only able to pull back to 49 during last week’s selling wave. Throw in some tightness in recent trading (centered on 50) and 30%-ish growth estimates and this one looks intriguing.

Leading Stock Type #2: PPB—Pullback Post-Breakout

What it Means: During a market correction, you’ll often have some stocks that, during a rally attempt, will race to new highs, breaking out of a consolidation. That’s great to see, but the market environment isn’t ready to “allow” the stocks to run higher. So what happens? These stocks then pull back, and if that retreat is skimpy, it’s further evidence that the weak hands are out and big investors are supporting it on dips.

Example: HubSpot (HUBS) hasn’t been a huge leader in the software field this year, but that may be changing as we head toward year end. The stock looked done for in early August, but a bullish reaction to earnings catapulted the stock to new highs late last month. And so far, look at HUBS’ pullback—calm and controlled, on low trading volume. Ideally, HUBS will pull in a little further and then explode higher whenever the market enters a new uptrend—providing an entry point.

Leading Stock Type #3: Base Setup

What it Means: This one is easy. It’s simply a stock that’s perched near its highs but has basically chopped around for at least a few weeks, or ideally longer. It may have hit slightly lower lows or had some shakeouts during that time, but net-net, the stock’s been consolidating in a reasonable range—and if it powerfully breaks out when the market kicks into gear, it can mark a solid entry.

Example: Exact Sciences (EXAS) has had a few wobbles (especially in late July/early August), and has seen sellers come in on the upside a couple of times when it tried to get going. But net-net, the stock has basically hovered between 110 and 123 (plus or minus) since the start of July. The longer EXAS can hold up, the better the chance the stock can blast to new highs when the bulls retake control of the general market.

Leading Stock Type #4: Early-Stage Pullback

What it Means: In this case we’re looking for stocks that (a) broke out of their initial base sometime in the last few months (as opposed to 18 to 24 months ago) and (b) have shown outstanding strength, clearly defining themselves as leaders. While it’s not near a good entry point currently, these are names you want to watch, and consider nibbling at if/when they dip to their 50-day lines for the first time.

Example: Novocure (NVCR) has a potentially revolutionary system for treating cancer, and that helped the stock break out of a 10-month rest near 57 in June. And then the stock went ballistic! All in all, shares rallied 16 of 17 weeks to a high near 99 before finally pulling back during the past two-plus weeks. A dip toward the 50-day line (now near 80 and rising quickly) and some support (usually best not to catch a falling knife) would be intriguing.

As I wrote above, it’s not worth doing a ton of buying until the market kicks into gear; the vast majority of stocks are doing more chopping than trending right now. In the meantime, I’m busy building a shopping list of stocks that look ready to lead the next upmove. To see what other leading stocks are on that shopping list, click here.

[author_ad]