If you had bought all 10 stocks in my “Marijuana Investor” report back in August, your portfolio would be up 165% today.

If you had invested $10,000, your investment would have increased to $26,900 and you would be looking at a $16,900 gain in just 4 months!

While all ten of the stocks gave us quick double-digit returns, profits in five of the stocks exceeded 200%!

Our Best Marijuana Stock: Up 473% in 4 Months!

Furthermore, as the highlight of your portfolio, you’d have a fat 178% profit in the biggest gainer of all, Aurora Cannabis (ACBFF), the fastest-growing producer of marijuana in Canada.

And that’s in just four months!

Granted, the timing was favorable. Not only are we in a broad-based bull market that shows no signs of weakening, but there were two major fundamental developments in those months that gave great confidence to marijuana investors who were paying attention.

[text_ad]

First, investors were reassured to learn that there would be minimal barriers to intra-province marijuana commerce in Canada when the drug is legalized for recreational use next year.

Then, alcohol behemoth Constellation Brands (STZ) (parent of Corona and Modelo beer, Robert Mondavi wine and Svedka vodka, among others) bought 10% of Canopy Growth—a strong vote of confidence in the sector.

Still, I think the past four months were just the beginning—the kickoff to a major uptrend that will last for years, even decades—as legal marijuana, both medical and recreational, spreads inexorably across Canada and the U.S. (Not to mention Uruguay, where it’s already legal, Mexico and other countries.)

You Don’t Have to Be Canadian!

While the early action in the sector has been in Canadian stocks (especially growers), simply because Canada is years ahead of the U.S. on nationalizing legal trade, you don’t have to be Canadian to take advantage of this trend.

In fact, all the stocks I recommended are easy for you to trade, whether you live in the U.S. or Canada, or even the scores of other countries where we have readers.

Best Marijuana Stocks Share These Four Factors

As I researched the 105 stocks that were my marijuana universe back in August, I paid special attention to these four factors.

- Price. Generally, higher price is better, especially in young industries like marijuana. The vast majority of marijuana stocks trade for less than a dollar, but many trade for less than a penny—and that’s high-risk territory!

- Trading volume. Generally, higher volume is better, as it enables more predictable chart patterns. Also, higher trading volume is a clue that institutions are getting interested.

- Market capitalization. Here again, higher is better. A market capitalization that is substantially higher than a company’s revenues tells you that the market, looking ahead, sees value in a stock.

- The stocks’ charts. Charts reveal the day-to-day changes in perception by all investors with a financial interest in a stock, and are a critical tool for interpretation. I couldn’t live without them.

Sure, I also paid attention to the fundamentals of each company: their business models, their revenues and growth rates and (where applicable) earnings. I also looked at management, barriers to entry, and even debt levels. But I believe it was the technical factors that provided an edge in the past quarter and I believe technical factors will prove equally valuable in the quarter ahead.

My Next Marijuana Stocks Report

I’m currently working on the next report of “Cabot Marijuana Investor” and the future continues to look bright for the industry.

Money continues to flow into the companies, many of which have completed successful secondary offerings.

Many of these companies are buying smaller private firms in the industry, both competitors in their own space and companies in complementary segments of the industry.

One Canadian grower, for example, has bought two outfits that make growing systems, which can be sold to home users.

Another has filed a patent for a method of shipping live plants to consumers.

Another bought a property that was designed to meet the stringent requirements of the medical marijuana industry of Germany!

And another has begun shipments of cannabis oil to Australia, where it’s being used to test the effectiveness of THC and CBD in battling pain and cancer side effects.

In short, the industry is moving rapidly, as the players gear up for legalization of recreational use in Canada in the summer of 2018, legalization in California in January, and legalization in the entire U.S. somewhere beyond that.

117 Marijuana Stocks to Choose From

My database of marijuana stocks has now expanded to 117 stocks, and I have no doubt that it will get larger. The industry is following the pattern taken by internet stocks in 1990s—and that was certainly profitable!

But sifting through those 117 stocks takes a lot of work, so the best move you can make is to get my next report and focus on the 10 that I’ll choose to highlight.

Some of these 10 stocks are repeats from the previous report, and some are new, but for every one of these stocks, I provide:

- A summary of the business.

- An update on what has changed since my last report

- An analysis of the company’s fundamental growth prospects.

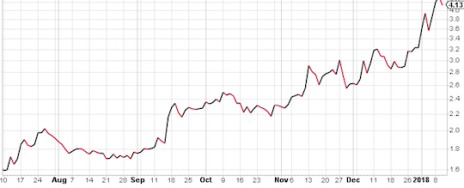

- An analysis of the stock’s chart. This one, for example, looks pretty good to me right now.

- Most important of all, you’ll get clear instructions on how to invest in the stock, particularly whether you should buy now or wait for a better entry point.

The Bottom Line

The bottom line is that the marijuana industry is in the early days of a great growth phase, and the winners will see their stocks soar in the years—even decades—ahead.

Getting in early is the best strategy, particularly if you have a trustworthy guide to the stocks to help you identify the best investments.

And “Cabot Marijuana Investor” is the best guide you can buy to invest in these stocks.

To reserve yours, click here now.

[author_ad]

*This post has been updated from the original version, published in November.