My brother-in-law used to be a spine surgeon; now he’s a hospital executive.

He’s also a car nut, trading in his cars every couple of years for something better.

Right now he drives a Maserati coupe in the summer and a Porsche Cayenne in the winter.

But he recently bought his wife an Alfa Romeo Stelvio (it’s also an SUV), and he says that drives better than the Porsche, even though it costs quite a bit less.

Well, I had a chance to drive it recently, and here’s what I thought.

It’s noisy!

Noise, Vibration and Harshness

Sure, it accelerates quickly and grips the road well and the interior is comfortable, but to me all those positives are cancelled out by what automotive engineers call NVH, or noise, vibration and harshness.

[text_ad]

There’s the noise of the 280-horsepower four-cylinder engine, as it revs up and down in response to my demand for power. There’s the vibration of the eight-speed transmission, as it shifts up and down to select the proper gear. And there’s the harshness of the ride as the lightweight aluminum body is thrust down the road with me in it.

Admittedly, some people like those aspects of performance cars. All that noise is a clear sign that something is happening!

But over the past five years I’ve come to love the opposite in my Tesla Model S, which can outperform all those cars in near-silence, with minimal vibration and harshness.

And I can confidently say I’ll never buy a car powered by an internal combustion engine again.

(I’m not going to show you a picture of a Tesla; you can see those on the news every day! But there is a cool car below.)

Just Like Color Television

In one way the switch to an electric car has been like many other switches I’ve made in my life that I won’t go back on.

After I bought a color TV, I never bought another black-and-white one.

After I bought a cell phone, I never bought another wall phone.

After I bought a DVR, I never watched live commercial TV again—with the exception of the Super Bowl.

So it’s clear to me that as more and more people experience the calm performance of an electric car—regardless of the manufacturer—more and more people will stop buying gasoline-powered cars. Eventually electric cars will dominate—and someday the roar of a powerful internal combustion engine will be as a rare as the steam from a steam-powered car is today.

Like this one, which I found this summer in the Owl’s Head Transportation Museum in Maine.

That’s a 1908 Stanley Steamer, a street version of the car that in 1906 covered the measured mile at Ormond Breach Florida at a speed of 127.66 mph. (Try doing that in a Prius!) The record so devastated the gas-car world that they boycotted the races the following year and effectively banned Stanleys from ever competing again at Ormond-Daytona.

Established industries are frequently threatened by revolutionary new technologies, and sometimes the establishment wins.

Volkswagen (VWAPY) vs. Fiat Chrysler (FCAU) vs. Tesla (TSLA)

But more often, it’s the new and better technology that wins, which is why I want to show you the long-term charts of Volkswagen (VWAPY), Fiat Chrysler (FCAU) and Tesla (TSLA), the three companies that made those cars above.

Here’s Volkswagen, the very German company whose most memorable feat in recent years was getting caught cheating on emissions tests. The brands Volkswagen, Audi, Skoda and Porsche account for 81% of the company’s revenues.

VWAPY stock peaked at 28.36 in late 2013, fell heavily in 2015 as the emission scandal unfolded, rallied for two years, and has been heading lower all this year. In the latest quarter, revenues grew just 6%.

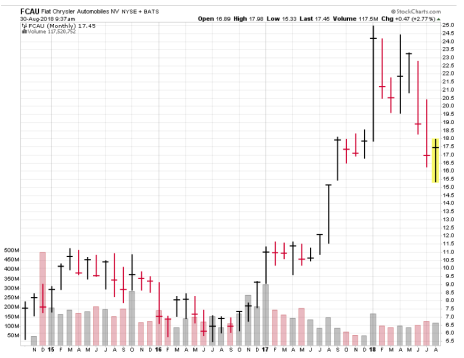

Here’s Fiat Chrysler, the international conglomerate (main headquarters in the Netherlands, financial headquarters in London) that’s home to Jeep, Dodge and RAM as well as Alfa Romeo and Maserati.

FCAU didn’t come public until late 2014, so this is a shorter chart. The stock peaked at 24.95 in January of this year and has been heading down since. In the latest quarter, revenues at Fiat Chrysler grew just 6%, the same slow pace as Volkswagen.

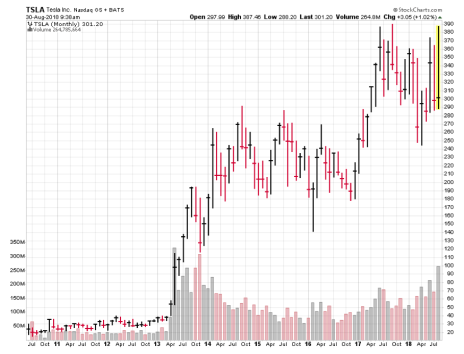

And here’s Tesla, the U.S. company that’s revolutionizing the industry by building electric cars in California, of all places—and selling them as fast as they can make them while using no dealers and doing no advertising.

The stock peaked at 387 in June 2017 and has been trading in a (very) loose range between that and 280 since, still in a long-term uptrend. In fact, you can see that the lows of this year correspond to the highs of 2014-2015; resistance became support. In the latest quarter, Tesla’s revenues grew 43%.

In short, the revolutionary new car company is winning.

Now, that doesn’t necessarily mean it’s a great investment today. Short term, anything can happen, especially in the environment of heavy news coverage that surrounds both the company and CEO Elon Musk today.

But long term, I remain very bullish on both the company and stock as Tesla focuses on its mission “to accelerate the world’s transition to sustainable energy.”

And as always, I’m digging for the next Tesla stock in my Cabot Stock of the Week. Sectors where I have exciting young stocks today include cybersecurity, digital payments, online used car sales, curated clothing shopping and delivery, remote physician services, mass communications systems for public safety warnings and cloud storage of law enforcement video. It’s an exciting time, and I’d love to share some of these stocks’ details with you.

To learn more, click here.

[author_ad]