I’m seeing some interesting things from housing stocks these days. I’ll tell you which ones in a bit. But first, let me start things off with my take on the market as a whole…

There’s not much new to say when it comes to the overall market in my view—yes, this week has brought another round of coronavirus-related selling, as some of the financial impacts of the virus (Q1 results could be iffy for many firms) are beginning to be felt.

Even so, the real question is whether the market handles this more like a temporary event (think of a strike at GM or Ford—it hurts profits for a few months but the long-term earnings power of the company is rarely affected much) or something that’s going to have lots of aftereffects.

[text_ad]

As usual, I’ll just take my cues from the market, and on that front, the evidence hasn’t changed much—the trends of the major indexes and most leading stocks are up, though we’ve clearly already had a big four-plus month run in the market that’s left many stocks extended to the upside. Don’t get me wrong: I do think the long-term breakouts in many stocks, sectors and the major indexes (the S&P 500 lifted out of a 20-month consolidation in November) bodes well when looking down the road.

But intermediate-term, the advance isn’t in the first inning. That’s no reason to get overly cautious—you should be holding most of your strong, profitable stocks—but I am looking harder for stocks that appear to be earlier in their intermediate-term uptrends. And if the stock is part of a sector that has the same traits, all the better.

That’s exactly what I’m seeing in the housing group, where a bunch of stocks have gotten going from early-stage bases since the turn of the year. Yes, I realize that there are worries surrounding the sector (a new housing bubble, etc.), but some of the hard data (housing starts, permits, etc.) are improving, and just going by the charts, it certainly looks like big investors think better times are ahead.

Housing Stocks to Watch

We’ll start with the iShares Home Construction Fund (ITB). You can see that, while the group has advanced nicely from the late-2018 market wipeout, it’s only a few weeks out of a nearly two-year long period of no net progress.

Not surprisingly, I’m seeing that among many individual housing stocks, too.

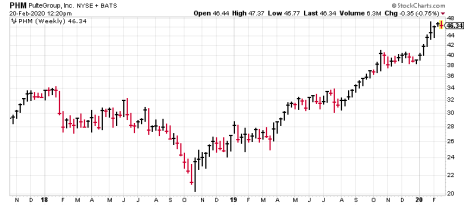

PulteGroup (PHM) actually broke out a few months before the sector as a whole and has remained very strong.

D.R. Horton (DHI) is pretty much in gear with ITB.

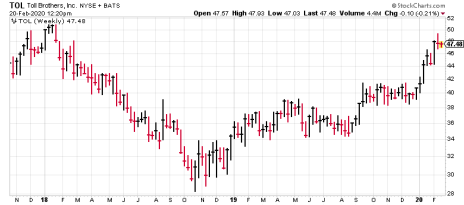

And even Toll Brothers (TOL), while still shy of its 2018 high, is catching up quickly.

Note that all of them showed nice, tight action over the last few weeks of 2019 (usually a sign of accumulation) and have taken off in 2020.

I do think homebuilders can do well, not just because of their stock charts, but also their low valuations (11 to 13 times earnings, and DHI and PHM also have modest 1%-ish dividend yields) and the simple fact that they’ve been mostly out of favor for a couple of years.

The Best in Class: Zillow (Z)

That said, as a growth guy, I’m more interested in housing stocks that offer a unique growth story. And there are two that fit that bill, one of which is Zillow (Z). (The other one, Redfin (RDFN), also has a fantastic story that I’m just as high on.)

Zillow is best known for its popular real estate website, which has 173 million unique monthly visitors, which it uses to create leads for real estate agents, who advertise on the platform. But that business, while improving, isn’t overly exciting here—so-called premier agent revenue was up just 6% in the fourth quarter.

Instead, the excitement surrounds the firm’s home buying business, dubbed Zillow Offers, which is now available in 23 markets in the U.S. And in Q4, Zillow sold 1,902 houses, bought 1,787 and held more than 2,700 in inventory. All told, the segment produced $603 million in revenue, and while it’s still losing money, metrics are improving and, long-term, Zillow thinks it can make a couple of percent on each home sale (on average), which would add up to huge money.

The stock just went nuts on earnings this week, and while it’s extended short-term, the power behind the move should lead to higher prices over time.

[author_ad]