Growth stocks have run wild of late, with many stretched to the upside. But Lululemon stock looks like its big run may be yet to come.

It’s been a month or so since my last Cabot Wealth Daily column, and obviously a lot has transpired in the market and the world since then—and, thanks to the holiday, I’ve also had a bit of time to step back and think about it all. So let me start with one thought before I get into some stock stuff – namely Lululemon stock.

Old Market Precedents May Be Gone

First, I spend a lot of time at the beach in the summer (I live in a beach town), which has me reading a lot of books—most of it pleasant garbage (think fantasy or witty sci-fi books), but occasionally I’ll re-read an old classic from the investment arena. Sure enough, the other day, I was flipping through Reminiscences of a Stock Operator, one of the all-time great investing books, and came across a passage about one chartist he knew and how he eventually went wrong:

“There is an extremely able man … a graduate of a famous technical school … who devised charts based upon a very careful and minute study of the behavior of prices in many markets. He went back years and years and traced the correlations and seasonal movements; he used his charts in his stock trading for years. They tell me he won regularly—until the World War knocked all precedents into a cocked hat. (emphasis mine)

“I heard that he and his large following lost millions before they desisted. But not even a world war can keep the stock market from being a bull market when conditions are bullish, or a bear market when conditions are bearish. And all a man needs to know to make money is to appraise conditions.”

[text_ad]

I’ve been thinking about this passage a lot in recent days and have come to two main thoughts. Number one, this episode from 100-plus years ago is why I like to respect the trend. Yes, you can (and will) get whipsawed here and there, which stinks. But if you argue with the market in a big way, it eventually take a major bite out of your wealth.

Second, though, and more to the point, the passage made me think of today—it’s possible this once-in-100-years pandemic and corresponding policy response from the Fed (QE to the moon) and Uncle Sam (gazillion dollars of spending), not to mention the psychological impact of the virus (far more work/play/learn at home, often all at once) could be sending normal precedents into the abyss … at least for now.

For the record, this isn’t me turning crazy bullish; I actually trimmed a bit from my Cabot Growth Investor advisory portfolio last week. But flexibility has been the key to success this year, and it’s important to be open to all possibilities, both on the downside, but also that something unique is going on. We’ll see!

Lululemon Stock Looks Like a Breakout Candidate

Moving onto stocks, it’s obviously been hot and heavy of late, especially among growth stocks, which have generally continued their jaw-dropping runs. However, it’s at these times, when many stocks are making big moves, that I like to write about the value of a stock doing nothing.

You see, big moves (up or down) are what get attention, especially when the market is going up. But if you’re looking for good buys, you’ll often do better looking for generally strong stocks that have quieted down for a bit—usually, these stocks are actually setting up their next move.

For instance, look at Cloudflare (NET), a leading cloud network player that came public late last year and was volatile as all get-out, with nearly every week swinging up and down by 10% or more, even after the market began to calm down in April. But then look at what happened in May—while the hot money went elsewhere, NET built a nice, flat zone under 30, with the final week having the tightest weekly range (not much movement) in months. The next week? It catapulted to new highs on gigantic volume!

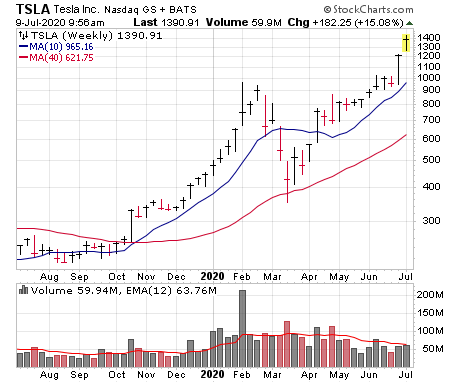

Tesla (TSLA) was another example—it had huge moves up (into February), down (with the market in March) and back up (through April). And then it went dead; check out how small its weekly ranges were in mid-May compared to the prior couple of months. The breakout in Tesla stock came above 870 and it’s had a massive move since.

Of course, not every tight area will lead to an explosive rally, but the point is that tightness often tells you that the weak hands have moved on and big investors are picking up shares in a given price zone.

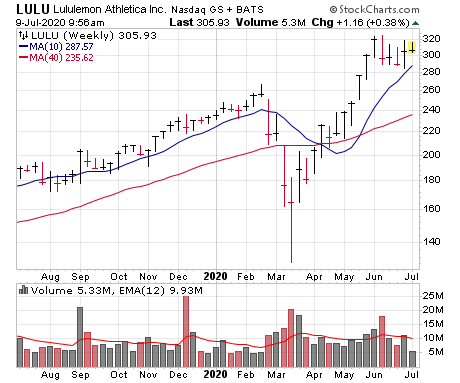

Right now, there aren’t as many tight situations given what’s going on, but one idea I’m keeping an eye on is Lululemon (LULU), the leader in athleisure wear that’s had a great history of success. Indeed, while Q1 was a bummer and Q2 is expected to show the same due to virus-related drops in demand, analysts see business quickly recovering. And the market has been ahead of that, with LULU not just recovering its crash losses but showing an accelerated upmove in May that easily brought the stock to new highs. Now look at the last few weeks—after a nearly 200-point move, Lululemon stock shares have calmed down in a 30-ish point range (for the most part), with this week’s range small and tight.

It’s not quite as classic as NET or TSLA, but it’s the same premise—if the buyers come around for Lululemon stock, it doesn’t look like there will be many sellers to stand in the way.

[author_ad]