As an investor and the Chief Analyst of an advisory dedicated to profiting from the Greentech stock mega-trend, I’m not terribly concerned in the long run about the Supreme Court’s decision to block the ability of the Environmental Protection Agency (EPA) to regulate the carbon output of power plants.

There are a few reasons for my optimism. The most compelling is this: clean energy is cheapest. It’s cheaper than coal and cheaper than natural gas. That means the market will win out, climate change deniers or not.

[text_ad]

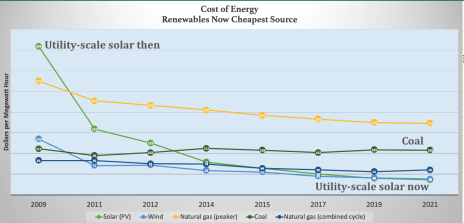

Below, I have created a chart using data from the investment bank Lazard Freres. For many years now, Lazard annually examines the average cost of utility-scale energy in the U.S. To keep the chart as simple as I can, I’ve only put the prices for every other year, and dropped some power sources Lazard also includes, like geothermal and nuclear. Those omissions don’t affect the big picture in my opinion.

Source: Lazard Freres Levelized Cost of Energy version 15.0, October 2021

On the top left side, the green line is the levelized cost of energy for unsubsidized solar photovoltaic crystalline, the most commonly installed utility solar. In 2009, it cost $359 per megawatt hour for utility solar. Clearly, it was the most expensive energy source then. Follow that line to 2021, the latest year Lazard published data. It’s now the cheapest, at $36 per megawatt hour – with no subsidies.

The next cheapest is that blue line that almost overlaps with solar on the right hand side. That’s wind power, at $38 per megawatt hour. Above them, at $60, is a natural gas combined plant – that is, a natural gas plant that uses multiple methods to generate power from gas, and operates constantly. Above it, at $108, is coal. At the top right, the yellow line at $173 per megawatt hour is a natural gas peaker plant – the power plant utilities build to provide extra electricity only sometimes, such as when heat waves get everyone running their air conditioners.

So let me restate what this chart shows: Solar and wind power are about 38% cheaper than fossil fuel alternatives. With no helping hand from the government, they are nearly one-third the cost of coal. That’s amazing.

The solar and wind industries have been consistently hammering down their costs every year – coal and gas haven’t, because by and large they can’t. Technology keeps figuring out ways to convert more sunlight to electricity; coal keeps being the same rock in the ground.

Keep in mind, too, renewable energy continued to improve its cost proposition late last decade even under a federal administration that was at best indifferent to clean technology. In fact, solar and wind are so cheap there are many situations today where it is actually cheaper for utilities to build new renewable energy farms and simply walk away from the existing gas and coal plants they have than continue to operate them.

An existing coal plant costs between $37 and $47 per megawatt hour to operate today – the levelized cost of new-build solar and wind is cheaper in almost every instance, as cheap as $26 per megawatt hour, according to data compiled by Lazard. Blocking the EPA’s ability to police the environment may lower coal and gas’ expenses somewhat, but the trend is clear. If you’re a utility, or an investment firm loaning money to a utility, or a buyer of utility stocks, which business do you want to be in?

“Even being among the best operating coal-fired generators doesn’t guarantee that a unit is financially viable or is the lowest-cost option for consumers,” the U.S. based Institute for Energy Economics and Financial Analysis said in a report a year ago.

But What about Bad Weather?

The argument that we have to keep fossil fuel plants and pay their excess prices in our utility bills is that bad weather – rainy days and stagnant air – means renewable energy isn’t generating power all the time. Setting aside the fact that’s never true for some forms of clean energy (hydro, geothermal and nuclear), adding utility-scale storage works today and by and large solves the weather problem.

One example from the public markets: NextEra Energy (NEE), a utility operator in Florida that also owns Greentech assets in New Hampshire and Wisconsin, says that to build brand new wind and solar with storage will cost between $25 and $37 a megawatt hour by late this decade. The natural gas and coal plants it already owns will cost $35 to $75 per megawatt hour to operate, in contrast. On top of that, NextEra management told investors in mid-June inflation will hammer its fossil fuel plant economics, resulting in solar and wind becoming about 50% cheaper than a new gas-fired power plant in its markets. NextEra shares trade at about 25 times the coming year’s earnings, with an expected dividend yield of more than 2% in 2022. Not bad.

Now, one thing the Supreme Court can’t mandate is eliminating the current bear market for stocks. Inflation fears have growth stocks, including Greentech, in a downtrend right now. Once the market is confident the Fed has a handle on inflation, I expect that downtrend to reverse back to a bull market pretty quickly. But we’re not just sitting around waiting for that to happen; we’re already taking steps a to profit today as the market creates some compelling value plays.

2 Momentum Plays on Greentech Stocks

Recently, I advised my subscribers to buy warrants for two Greentech stocks. The warrants are so cheap in the current bear market they offer a very good chance of a multi-bagger return in coming years because of the rate the warrants can convert to common shares – they’re at a deep discount. If you believe in clean tech and these business models like I do, I expect returns of 100% to 500% on the positions.

We’re already up 60% from mid-May on one of the positions, a producer of solar power and storage in more than dozen states. The other, a long-term utility-scale power storage business whose main product doesn’t rely on rare earth metals or lithium, is still a buy today. The risk with both is that investor demand doesn’t return for solar and energy storage stocks and our warrants never get in the money.

Nothing is guaranteed in the markets, of course, but the trend is clear: clean energy keeps getting more cost competitive. A court edict isn’t going to change that reality.

Do you own any Greentech stocks? If so, tell us about them in the comments below!

[author_ad]