WMT Stock Building Momentum

Wal-Mart (WMT) released an excellent third-quarter report last Thursday. Revenues grew 4% (the fastest rate in many years!) to $123 billion, while analysts had been expecting $121 billion; and earnings grew 2% to $1.00 per share, while analysts had been expecting $0.97. In response, WMT stock soared on more than triple average volume (a good sign) to gain 11% in one day.

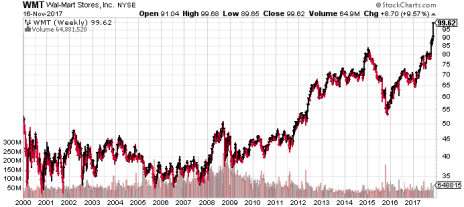

Here’s the chart.

It looks good.

On the other hand, here’s Wal-Mart’s chart since the 2000 market top, showing that while WMT stock has gained 45% over that time, it’s actually underperformed the broad market.

Last week’s blast took the stock out to new highs, but is there any reason to believe that the character of the stock will be different going forward? After all, such surges have happened before, but after every one, the stock reverted to its plodding behavior—or worse.

After the 2004 surge, the stock promptly turned around and gave it all back, heading south for 12 months before turning around!

So how can we know if this uptrend is real for WMT stock?

[text_ad]

One strategy is to dig into the fundamentals, which is what most Wall Street analysts do.

The best thing they see at Wal-Mart is an aggressive push to fight Amazon (AMZN) on its own turf, by going online. This means not only selling its own goods online, but also buying up successful online retailers (Jet.com, Modcloth and Bonobos) that have great potential for growth.

And it’s working, to some extent; in the third quarter, the company’s e-commerce sales grew 50% from the year before (with acquisitions a big part of the growth).

But the trouble I have investing in Wal-Mart is that the company is HUGE. Its annual revenues are $495 billion. When you get that big, it’s simply hard to grow!

Furthermore, Wal-Mart is a stock that everyone knows, so there’s zero chance that it’s going to be the next hot stock on Wall Street.

Also, the stock isn’t even cheap! It’s got a price/earnings ratio of 21!

So when it comes to WMT stock, I’ll pass.

Amazon (AMZN) Still the Better Retail Stock

As to Amazon, here’s its chart in recent months.

And here’s its chart since the market top in 2000.

See the difference?

AMZN stock has been trending strongly up since 2008, and the odds are very good that it will be even higher a year or two from now. That’s how trends work.

Sure, Amazon is no undiscovered stock, either. But its sales are “only” a third of Wal-Mart’s. Plus, Amazon’s revenues grew 34% in the last quarter, thanks in part to its fast-growing cloud operation. That’s real growth.

Sure, Amazon looks expensive, with a price/earnings ratio of 285 as I write. But that’s partly because Amazon doesn’t prioritize earnings; it prioritizes growth. Jeff Bezos knows that he can worry about earnings later.

Granted, there’s zero chance that AMZN is going to be the next hot stock on Wall Street. But at least the stock has a real uptrend.

Bottom line: If I had to choose between the two, I’d choose AMZN stock, easily.

But I don’t have to choose between those two.

I’ve got many more stocks to choose from—stocks that are not as big, not as old and not as well known.

For example, two of my top performers in recent months have been stocks that are helping to enable the revolution in digital payments—and I’m not talking about Bitcoin or Ethereum.

No, I’m talking about PayPal (PYPL) and Square (SQ).

PayPal (PYPL)

PayPal, of course, is the company that was incubated by eBay for more than a decade before it was spun off in 2005. That was just over two years ago, and since then, PYPL stock has roughly doubled.

With $12 billion in revenues, PayPal has become a global standard for transferring money. It’s used in 200 countries. But it’s still far smaller than Amazon and Wal-Mart, so it has plenty of room for growth. And as the world’s commerce grows, and more and more money moves digitally, I’m confident PayPal will benefit.

In the third quarter, PayPal’s revenues grew 21% to $3.2 billion, while earnings grew 31% to $0.46 per share. The stock’s price/earnings ratio is 41. Not bad.

And its chart looks great.

Every month, more and more investors are waking up to the fact that there’s a great growth story developing here and they’re buying the stock. That’s the kind of stock I like!

Square (SQ)

As to Square, it’s the smallest company of these four, with annual revenues of $2 billion. Square began its business by providing small retailers with dongles that turned smartphones and tablets into point-of-sale devices, and allowed them to process credit cards and provide other services that bigger retailers do. And Square is continually expanding its suite of services.

In the third quarter, Square saw revenues grow 33% to $585 million, while earnings zoomed to $0.07 per share, up from a penny a year ago.

Square came public in late 2015, just a little after PayPal, and its chart looks super.

In fact, this chart shows SQ climbing in 13 of the past 14 weeks! Clearly, investors are getting excited about SQ.

Maybe that’s because the company is projected to grow earnings 65% in 2018. Or maybe it’s because Square has begun testing an integration with Bitcoin. But it’s clear to me that more and more investors are climbing on the stock every week because they see the company’s great growth potential.

Which One to Buy?

I enjoyed owning Amazon long ago, when it was still an unrespected fast-growing company. In fact, I made 1,200% in the stock!

But today Amazon is too big for me. Today I like PayPal (PYPL) and Square (SQ).

In fact, I recommended both these stocks to readers of my Cabot Stock of the Week earlier this year.

In PayPal (the relatively conservative investment), they have a profit of 29%, while in Square (SQ), the more aggressive investment, they have a profit of 184%.

If you’d like to join them, and get on board more fast growers as they come along, you can get details here.

[author_ad]