Well, we’re in the homestretch of the year, and after a month of writing like a maniac, I’m doing some R&R, playing with the kiddos, enjoying some time with the in-laws (no, really) and trying a few new bourbons. I hope you and yours have a terrific New Year’s, too.

That said, the market is never too far from my mind, and this time of year I also like to review some past trades, look ahead and share my 10 Year-End Investing Tips - tips that range from psychological to methodological to chart-based.

All of these investing tips should help you make (and keep) more money in the year ahead, so let’s dive in.

10 Investing Tips for 2018

1. A year ago, I took a sticky note and wrote “Stay Dumb” on it, and stuck it on my cubicle. It was good advice all year, as 2017 was another reminder not to overthink things—whether it was angst over politics or predictions of doom for the market because of the lack of a pullback, there were a bunch of reasons to bail out or stay away from the market. But, of course, this ended up being one of the smoothest bull market years on record, and it was gangbusters for growth stocks.

[text_ad]

1a. As an add-on investing tip, I know the political fever has been high (to say the least) on both sides this year. But politics and other debates belong at the kitchen table (though hopefully not over the holidays!) or at the bar. When it comes to your portfolio, just keep your eyes focused on the market itself. I know it’s hard for many investors to separate one from the other, but I’ve learned it’s necessary during my 18-plus years of doing this.

2. One thing I’m watching closely as the calendar flips is many of the big growth stock winners of this year that also broke out of huge consolidations earlier this year—stocks like Alibaba (BABA), PayPal (PYPL), Arista Networks (ANET) and others. They all had smooth uptrends for many months, then suffered some intense selling pressure after Thanksgiving. I think these stocks probably need more time to consolidate, maybe even another couple of months. But unless the bull market collapses, the odds favor these leaders having another leg up down the road.

3. Speaking of the bull market, Ryan Detrick of LPL Financial had an interesting study recently. The S&P 500, it turns out, is almost historically “overbought” according to one popular measurement. (The weekly 14-period RSI is above 80.) If you remove repeat occurrences (signals within six months of each other), this condition has only occurred eight other times since 1950. From these points, the S&P actually rose an average of 5.7%, 10.8% and 13.8% over the next three, six and 12 months, respectively. Thus, the odds favor 2018 being another bull market year.

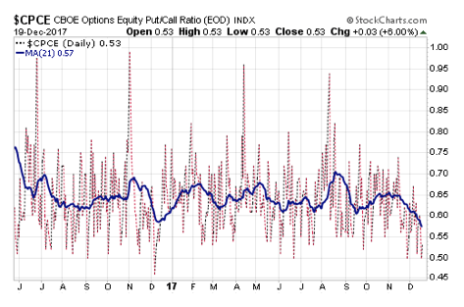

4. That said, short-term, there’s no question that investor sentiment is getting stretched—various measures of sentiment, from put-call ratios (equity put-call ratio with a 21-day moving average shown below) to money flows to aggressive funds, are showing that investors are getting giddy. I never trade based on sentiment, because it’s very inexact, but usually when we see these types of readings, the environment gets trickier going forward. Thus, if you buy, pick your spots, and be sure to honor your stops in case the sellers take control.

5. I get a bunch of people asking for investing tips on bitcoin and cryptocurrencies, and while I haven’t studied them as much as I should have, here are my general thoughts. First, similar to the overall market, it certainly seems like risk is high in the short-term—we saw that last week when bitcoin fell something like 35% in just a few days! There’s no question the sector is very frothy here; just last week, a company that makes iced tea said they’re going to put all their money into these digital currencies, sending the stock up a few hundred percent on the day! So a cooling off period wouldn’t be at all surprising.

6. Longer-term, though, just from a student-of-the-market perspective, my guess is that stuff like bitcoin does go higher. Why? Because, up until a few weeks ago, the only people who owned it were the true believers, so it doesn’t seem like a major, major top is near. It’s an area I’m exploring, and would love to find a real company using it in an innovative way. There are a couple I’m monitoring, like Overstock (OSTK), but nothing I’m close to buying yet.

7. A more investable area I’m keeping a close eye on as the calendar flips is commodity stocks. The group was hot immediately after the U.S. Presidential election, but then did nothing all year. Now, though, I’m seeing some good charts in energy and elsewhere. Freeport McMoRan (FCX) and Diamondback Energy (FANG) are two potential new leaders, though there are many others that look intriguing as well. Just be aware that, as always, commodity stocks are fickle and volatile, so buying right is important.

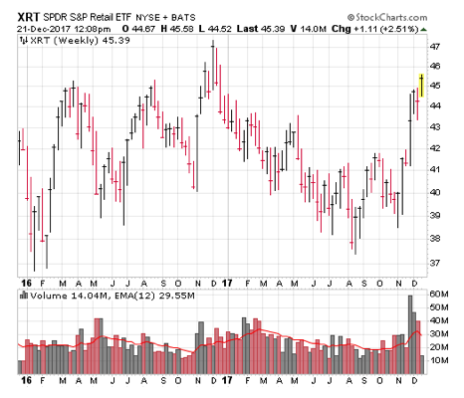

8. I’m also very intrigued by retail stocks, which also sat out the dance for most of the year (at least through October) due to worries about slow mall traffic and Amazon taking over the world. (See chart of SPDR Retail Fund, XRT.) Retail is always one of my favorite growth sectors, as the best stocks possess the combination of rapid and reliable growth that big investors are willing to pay up for. The group could cool off after the holiday season, but I’m optimistic 2018 will be a good one for them. The recent tax cuts don’t hurt, either, for the companies or consumers.

9. As for lessons learned, even if you’ve had a very profitable year (and I hope you did!), now’s a good time to go back and look at your worst trades of the year and figure out if there are any common themes. One thing that happened to me a couple of times is I got shaken out near the lows due to market weakness. A recent example: ServiceNow (NOW), which dove when growth stocks were getting croaked back in early December; I sold the next day, just as the stock was beginning a big march back to its highs! Shakeouts are going to happen, of course, and you don’t want to learn too much from this year (most sales looked “bad” in retrospect because of the bull market). But if the overall market’s trends are still OK, it might pay to sell just half of a stock that has a possible shakeout, or put in a tight stop near the low of that day’s move. It’s something I’m going to study a bit more in the weeks ahead.

10. On the flip side, it’s also healthy to look at a few big winners this year that you didn’t buy and figure out what made you stay away. Sometimes those reasons are valid (I never bought Arista Networks (ANET) in Cabot Growth Investor because I had a small worry about their legal battle with Cisco), but sometimes they’re not and can lead to some new do’s or don’ts for your trading. Last year, for instance, I completely missed on Nvidia (NVDA), that year’s top institutional-quality growth stock, mostly because the earnings estimates showed tame growth. I still look at estimates quite a bit, but I incorporated other screens, too, so I don’t miss potential winners. That adjustment was a big reason that I bought Shopify (SHOP) in early January, which had no earnings but rapid sales growth and a good story. It was one of my bigger winners this year.

Now, if you want more investing tips for 2018, I highly recommend getting a subscription to Cabot Growth Investor. It will allow you to grab market’s fast growing stocks as we always look for the next Amazon.

Just this year, my readers grabbed 119% gains in Shopify, 104% gains in Universal Display, 56% gains in Alibaba, and our readers doubled their money in 2017 as the model portfolio outperformed the S&P 500 by 100%! With our market timing indicators flashing the green light, we expect a great year in 2018.

Start your investing journey with us here today.

[author_ad]