It’s been a volatile year. As shown below, the Dow Jones Industrial Average (DJIA) has bounced around a lot in 2023, but it is just a bit above the range in which we began the year.

And sector-wise, year to date, Technology, Communication Services, and Consumer Discretionary have led the way, with Utilities, Consumer Staples, and Healthcare, at the bottom of the pack.

U.S. Sector

| Name | Symbol | YTD | 1 Year |

| Technology |

XLK | 44.26% | 37.14% |

| Communication Services |

XLC | 42.68% | 40.48% |

| Consumer Discretionary |

XLY | 24.96% | 13.91% |

| Industrial |

XLI | 4.42% | 2.97% |

| Basic Materials |

XLB | -0.41% | -3.64% |

| Financial Services |

XLF | -0.85% | -4.69% |

| Energy |

XLE | -4.64% | -7.83% |

| Real Estate |

XLRE | -6.88% | -11.27% |

| Healthcare |

XLV | -7.05% | -6.31% |

| Consumer Staples |

XLP | -7.50% | -6.30% |

| Utilities |

XLU | -14.44% | -12.39% |

Looking at these performances, I began reviewing some of the age-old investing strategies that are touted around this time every year: The Santa Claus Rally (the belief that markets rally between the last five trading days of December and the first two trading days of January, on positive market sentiment), the January Effect (the expectation that stock prices will rise in January following a year-end sell-off for tax purposes), and the Dogs of the Dow.

[text_ad]

I have written several times about the first two adages, but haven’t addressed the Dogs of the Dow for a while, so I thought it might be interesting to look at that strategy as we near the end of the year.

The Dogs of the Dow is a tactic popularized by money manager Michael B. O’Higgins in 1992. It means simply investing in the ten highest dividend-yielding stocks from the DJIA after the market close on the last day of each year. The thinking behind the strategy is that those high yields have been the result of falling stock prices.

The formula for dividend yield is:

Using this formula, it’s easy to see that as the price of shares decline, the dividend yield becomes larger.

The sentiment for the strategy: invest in the stocks that are trading at very low valuations, and your chances of some hefty gains during the next year are pretty good, especially if the reasons for the declining valuations are temporary.

There are a few variations:

1) Dogs of the Dow X; buying the seven highest dividend yield stocks

2) Small Dogs of the Dow; buying the five lowest-priced of the ten highest-yielding Dow stocks

3) Small Dogs of the Dow X; buying the three lowest priced Small Dogs of the Dow stocks

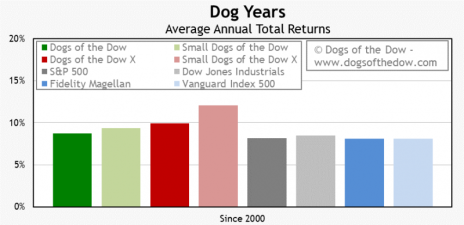

The historical returns for these strategies since 2000 are depicted in the graph below, along with other broad index gains during the period.

Source: dogsofthedow.com

Overall, as you can see, for the past 20+ years, the Small Dogs of the Dow X have led, but each of the strategies have performed the S&P 500…over time.

That, of course, doesn’t mean that each year has been a winner. The Dogs of the Dow strategy tends to work best when the market is declining or when gains are predicted to be somewhat restrained.

Here are the results from last year.

| Symbol | Company | Price 12-20-22 | Yield 12-30-22 | Price 11-10-23 | Yield 11-10-23 | Return |

| VZ | Verizon | 39.40 | 6.62% | 35.71 | 7.45% | -9.4% |

| DOW | Dow | 50.39 | 5.56% | 49.48 | 5.66% | -1.8% |

| INTC | Intel | 26.43 | 5.52% | 38.86 | 1.29% | 47.0% |

| WBA | Walgreens | 37.36 | 5.14% | 20.76 | 9.25% | -44.4% |

| MMM | 3M | 119.92 | 4.97% | 92.81 | 6.46% | -22.6% |

| IBM | IBM | 140.89 | 4.68% | 149.02 | 4.46% | 5.8% |

| AMGN | Amgen | 262.64 | 3.24% | 267.31 | 3.19% | 1.8% |

| CSCO | Cisco | 47.64 | 3.19% | 52.59 | 2.97% | 10.4% |

| CVX | Chevron | 179.49 | 3.16% | 142.95 | 4.23% | -20.4% |

| JPM | JP Morgan Chase | 134.10 | 2.98% | 146.43 | 2.87% | 9.2% |

Source: dogsofthedow.com

As you can see, the results are mixed, with five stocks in the black, and five in the red.

Currently, the following DJIA stocks have the highest dividend yields:

| Stock | Current Price | Estimated Dividend[For the next year] | Dividend Yield (%) |

| Walgreens Boots Alliance | 20.76 | 1.9300 | 9.30 |

| Verizon Communications | 35.71 | 2.6800 | 7.50 |

| 3M | 92.81 | 6.0300 | 6.50 |

| Dow | 49.48 | 2.8000 | 5.66 |

| IBM | 149.02 | 6.6800 | 4.48 |

| Chevron | 142.95 | 6.3100 | 4.41 |

| Goldman Sachs | 325.51 | 11.5000 | 3.53 |

| Amgen | 267.31 | 9.1200 | 3.41 |

| Coca-Cola | 56.72 | 1.9000 | 3.35 |

| Johnson & Johnson | 147.25 | 4.8800 | 3.31 |

Source: indexarb.com

I ran these companies through my stock evaluation system and came up with three that could be possible buys for 2024:

Verizon Communications Inc. (VZ), rated Weak Buy, is a mega-communications company, but is trading at a P/E of just 7.19. That’s pretty cheap, but it’s most likely because Verizon is in a shrinking industry. However, its dividend is well-covered, and if you are in the time of life when decent yields are more important than rapid price appreciation, then VZ may be a good stock for you.

International Business Machines Corporation (IBM), founded in 1911, is a tech behemoth that has survived and thrived throughout many market and sector booms and busts. The company is rated Strong Buy, primarily due to its rising star in the artificial intelligence (AI) arena. The stock trades at a P/E of 19.23. IBM is one of the stars of my Cabot Money Club Stock of the Month portfolio also. I continue to believe it is very attractive at this price.

Amgen Inc. (AMGN) develops, manufactures, and delivers human therapeutics worldwide. It focuses on inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology, and neuroscience areas. The stock currently trades at a P/E of 19.01, and is rated Buy.

The company’s revenues have been under pressure, but analysts believe that is due to change, thanks to Amgen’s recent acquisition of acquisition of Horizon Therapeutics, a biotech focused on rare diseases. Horizon’s attraction was Tepezza, the first drug for thyroid eye disease (TED) approved by the FDA. Also, the company has seen a 30% revenue acceleration in its Humira biosimilar, Amjevita. I would consider this a buy as well.

As I mentioned above, the Dogs of the Dow is but one popular investment strategy for end-of-year portfolio analysis. No one strategy is right all the time, but when you dig down deep into the individual stocks, you may just find a good stock or two for your Christmas stocking!

[author_ad]