4 Stock-Picking Tips You Can Use to Find Big Winners

One Great Drug Stock ---

One of the goals of everything we do here at Cabot is to make you a better investor. Sure, it’s easy to simply recommend specific stocks. But doing that is like giving you a fish, when we really want to teach you how to catch your own fish.

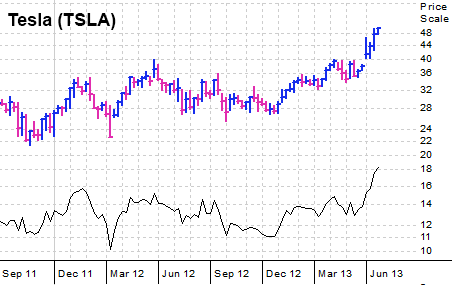

So today I want to give you a few stock-picking tips and focus on a few of the “tricks” I use to find really big stocks, and specifically, how they applied to the discovery of Tesla Motors (TSLA), which has been a winner for my Cabot Stock of the Month subscribers and which I still think has enormous growth potential.

(Note: I’m well aware that I’ve written about Tesla a couple times already in the past few months, and if you’re getting tired of it, I apologize. The fact is, my latest comments (last Tuesday) brought some responses that are included below, and that are relevant to this discussion.)

For example, one reader forwarded this, found on the Internet.

“If you leave a Tesla parked for too long, its background systems—which are permanently running—can drain the battery all the way down, at which point the car is effectively useless unless you purchase a new battery from Tesla for about $40,000 … on a fully charged battery, a Tesla can last about 11 weeks without a recharge, after which it will become completely useless.”

This is true, or at least it was when I first read this post over a year ago. But that fact alone doesn’t necessarily mean the company won’t sell cars and make profits!

In fact, Tesla works very hard to ensure that their car’s batteries don’t get drained to zero, with numerous warnings when the charge gets low. Owners can even request that their vehicle alert Tesla if the battery charge falls to a low level.

And if you use your imagination, you can certainly envision what people might say if a company like Ford (F) were introducing the first gasoline-powered car in a world that had previously relied on electrics. Critics would warn, “It’s a rolling bomb. One crash and all that gasoline will ignite and burn up the driver and all the passengers!”

Somehow, we all live with this risk. Conclusion: the fact that the battery in a Tesla can be drained to zero is not a major problem.

Another Internet post, sent by a reader, notes that Tesla “sold more than 4,750 cars in the first quarter … There is no economy of scale at that level, which is what eventually will doom the company … global electric car sales have faltered, buried by clean diesel, falling gas prices and a clear preference among buyers of hybrids for the Toyota Prius, and much higher end equivalents, such as the Porsche Panamera S Hybrid. The Porsche sells for $96,000 or better and is, by many measures, a better sports car than Tesla makes.”

The first part of this post ignores the fact that the company is growing production rates. What kind of analysis is that?

The second part is just plain wrong, as sales of all alternative-power vehicles continue to grow. The chart below, admittedly, looks more than two years into the future, and is almost certainly imprecise about that. But the trend is clear.

And the third part of the post ignores the fact that the Tesla Model S was named “2013 Car of the Year” by both Motor Trend and Automobile Magazine. I’d say that’s a whopping omission.

So, Stock-Picking Tip Number One is to LOOK AT THE BIG PICTURE. When you read bad news, ask yourself if there’s another side of the story. And when you read good news, do the same. Even before the Internet became so influential, there were media that presented only one side of the story, most commonly because they had a vested interest. Now, with the Internet allowing almost anybody to express an opinion, the situation is worse. But that doesn’t mean your investment results have to suffer.

If you have half a brain, you’ll ask yourself whether the author has an axe to grind. Is he a short-seller trying to profit by pushing the stock down? Does he work for a competitor? You can’t know, of course, but you can work hard to get the entire picture, and in that pursuit, the Internet can be a big help.

Stock-Picking Tip Number Two is to USE YOUR IMAGINATION. This is difficult for many people, who are better are seeing risks than opportunities, but it’s especially difficult for people who have been trained as stock analysts, and who focus heavily on numbers. Imagination involves seeing what lies far beyond today’s numbers, and it’s a vital skill in finding big winners.

But anyone relying on numbers would have had trouble buying Tesla until now, as it was just three weeks ago that management announced that it expected to announce its very first profitable quarter when it released this year’s first quarter results.

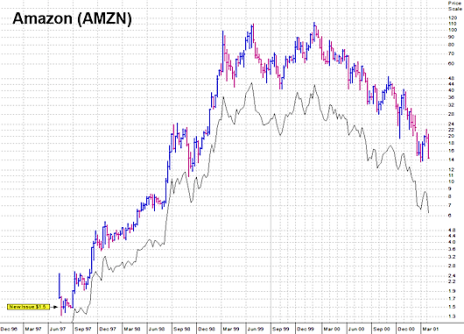

Similarly, anyone who waited for Amazon.com (AMZN) to turn a profit would have missed a huge part of that stock’s advance. When Jeff Bezos first rolled out the service, most “experts” predicted that Barnes & Noble and Borders would kill it. Well, we bought AMZN in January 1998 and locked in profits of over 1290% when we sold in January 2000. That was more than two years before Amazon.com posted a profit!

And look which book company is dead now!

When thinking about Tesla, a lot of people have trouble seeing beyond the next quarter or two. Even if they can get beyond the story of the dead batteries, they still have trouble looking beyond the fact that the company only makes expensive cars; they can’t imagine the company making sensible battery-powered cars for the mass market—even though CEO Elon Musk has said that’s one of his goals!

They can’t imagine a world where fewer and fewer people use gas stations; after all, that’s the world we’ve all grown up in.

And they can’t imagine a world where you order a car and it’s built precisely to your specifications and you pay the exact list price, no more and no less.

But you’ve got to try to stretch your brain to see the best opportunities!

For example, when Netflix (NFLX) debuted its DVD by mail service in 1999, skeptics found it hard to believe the company could make money. They found it hard to believe that people would give up on their local video stores. But history has proven those skeptics dead wrong.

Stock-Picking Tip Number Three is to TRUST THE CHART. If you look back at Amazon’s chart, you’ll see that it was rising rapidly when we bought it. That told us some big investors were buying the stock, despite the naysayers, and by following that money, we were able to make big money too. If you look at Tesla’s chart since its IPO, its main trend is clear, too; this stock is going up. Big investors are getting on board here, too, as skepticism slowly gives way to cautious optimism.

Stock-Picking Tip Number Four is to CONSIDER THE VALUE OF TOP MANAGEMENT. Jack Welch, Larry Ellison, Bill Gates, Jeff Bezos and Steve Jobs all became renowned for their managerial capabilities, from their ability to visualize the future to their abilities to inspire their followers. In the case of Tesla, many have compared founder and CEO Elon Musk to Steve Jobs—in part because both Apple’s and Tesla’s products are beautifully designed and in part because Apple (AAPL) so recently was an excellent stock.

It’s not a bad comparison, but it does fall short in one important aspect. Steve Jobs was a master showman, famed for his “reality distortion field,” which could make others see the world as he did. Elon Musk, by contrast, is not good at PR; he takes umbrage easily at slights that Jobs would have shrugged off, and his tweets in reaction to unfavorable comments have more than once given the impression that his time would be better spent on strategy and engineering than marketing.

But what Musk lacks in PR-savvy, he compensates for with brilliant strategic thinking, and a willingness to tackle big, world-changing projects. His successes already include PayPal, which revolutionized online payments, and SpaceX, which revolutionized space transport. Tesla is his biggest current project, and his track record says he’ll succeed here, too.

So there you go. Four “tips” that can help you pick big winners. Every one was useful is identifying Tesla as a potential winner more than a year ago, and every one suggests that the stock has vastly more upside potential.

But should you buy now?

Well, short-term, TSLA is clearly high; it’s up 42% year-to-date and up 27% since the end of March, thanks to the news that the company would turn profitable in the first quarter of this year. Buying here brings with it a lot of short-term risk.

But there are ways to get on board, as the days go by, that can reduce that risk, and if you become a subscriber to my Cabot Stock of the Month, I’ll help you do just that. For details, click here.

--- Advertisement ---

Double Your Money Every 21 Days

Cabot Options Trader uses the market’s volatility to bring subscribers huge profit-making opportunities. Just check out these gains:

* 94% gain on a Freeport McMoRan (FCX) Call in only 3 days!

* 100% gain on a Goldcorp (GG) Call in 8 days!

* 190% gain on a Cisco (CSCO) Put in 7 days

Subscribers are leveraging small stock moves into big profits on both the up and the down sides. Test-drive

Cabot Options Trader for 60 days FREE and lock in our lowest price ever—just $1.61 a day. Why not grab these quick gains for yourself?

---

Sticking with the theme of finding great high-potential stocks, the practice of focusing on strong charts is one that will never steer you wrong. In fact, I keep an ever-evolving list on my desk of leading stocks, and one that keeps popping up is Onyx Pharmaceuticals (ONXX).

Now, biology is my weak suit, so I won’t claim to understand exactly what makes Onyx such a great company. What I do know is that it’s targeting the cancer market, and that’s huge. Furthermore, I know that the company turned profitable way back in 2008 (though recent investments have put it temporarily in the red again), so management is capable.

Onyx’s biggest seller is its Nexavar tablet, which targets liver cancer and advanced kidney cancer. Second are its Stivarga tablets, which treat metastatic colorectal cancer. In clinical trials are drugs to target liver, kidney, thyroid, breast, and non-small cell lung cancers, gastro intestinal stromal tumors, multiple myelomas, hematologic malignancies and more.

With a stock hitting new highs, a company capable of making a profit, and a huge potential market, ONXX is attractive right here. But earnings will be reported May 7, and volatility should be expected, so I don’t recommend just jumping on board right here.

What I do recommend is taking a no-risk trial subscription to Cabot Top Ten Trader, so you can see Mike Cintolo’s latest advice on the stock, and get timely advice on investing in other strong stocks as well!

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Editor of Cabot Stock of the Month

---

Related Articles: