Beer

Anheuser Busch is Shrinking

Craft Brewers Alliance is Growing

---

--- Advertisement ---

Reap Huge Profits from the American Energy Boom

Our upcoming webinar will show you how to turn crisis into opportunity with the best stocks in the energy sector. Take advantage of our early bird discount when you sign up by June 18 and save 50%! And hurry, there are less 200 seats available. Secure yours today!

---

Last week I was sitting at a sidewalk table at Brasserie Beck in Washington, D.C., enjoying a plate of mussels, the company of my wife and a “Lost and Found Abbey Ale” when I said to myself, “It’s high time I got around to writing that piece on beer distribution that’s been sitting in the back of my head for a while.”

So, with the stock market in correction mode, and (hopefully) some of your investable assets sitting on the sidelines waiting for better opportunities, here it is.

Nearly a century ago, before Prohibition was enacted in 1919, beer distribution in the U.S. was controlled by the breweries, who exercised great control over retail operations, to the extent of owning shares in bars and forbidding the sale of competing brewers’ products. Big names included Schlitz, Miller, Best and Anheuser-Busch.

Thirteen years of Prohibition killed off many brewers, though some survived by selling near beer, malt syrup and root beer, among other products. But when Prohibition was repealed they found their previous power reduced by laws that gave individual states control over alcohol regulation.

Those laws gave rise to the middlemen known as distributors. Top distributors in the U.S. today are Reyes Beverage Group, Silver Eagle Distributors, Goldring Holdings, Ben E. Keith Beverages, Manhattan Beer Distributors, TOPA Equities and Andrews Distributing Company.

So today, no major brewer can sell directly to a retailer. Instead, the brewer must sell to a distributor, who is legally bound to treat all retailers equally. The upside of this is that most retailers offer a great variety of beers, and that there are no sweetheart pricing deals. The mere presence of the distributors limits the power of the mega-brewers. The downside is that the third party in the chain increases prices to consumers; the middleman has to eat. And some people (I used to be one) think that the presence of the middleman makes it difficult for fledgling brewers to get a toehold in the market.

But take a look at the situation in Germany, England, Ireland and other big beer-drinking countries that escaped the forces of the Temperance movement!

In those countries--just as in the U.S. before Prohibition--the brewers have substantial power in retail establishments. They may be owners, or financial supporters, and they typically supply glasses, taps, and other equipment, with the result that in many restaurants, all the beer comes from one brewer, and your only choice is which of their styles to drink.

As result, people in those countries have fewer choices among beers than we do in the U.S.

Sure, Germany has some 1,300 breweries producing about 5,000 brands of beer. But the vast majority of that beer is consumed locally, near where it is brewed. That means you always get fresh beer, which is good. But you don’t always get much choice ... and as an American I like choice!

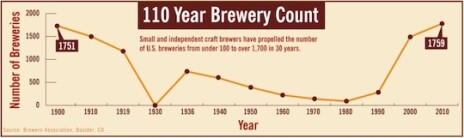

The U.S., by contrast, now has more than 1,700 breweries, more than at any time since the late 1800s. (See chart below.)

And thanks to our system of independent distributors, you can buy many of their brews far from their place of origin. Lost Abbey of San Marcos, California, brewed the “Lost and Found Abbey Ale” I enjoyed in D.C. (And it was delicious, with “aromas of figs, raisins and candied fruits” that come in part from the addition of a raisin puree to the mix.)

Even better, in a growing numbers of states, there are exceptions to the old laws, exceptions that favor smaller brewers. These exceptions allow smaller brewers to sell directly to retailers and/or the public; to pay lower excise taxes than the mega-brewers on the first, say, 20,000 barrels; to own retail establishments; and more.

Granted, the mega-brewers Anheuser-Busch Inbev and MillerCoors still have 80% of U.S. market, but the smaller brewers are gaining ground. While total U.S. beer consumption was down about 1% last year (consumption in Germany was down 3%), and sales of good old Budweiser in the U.S. plummeted 9.5%, life is good for smaller brewers.

Just under the two giants, for example, but far smaller, are these brewers:

#3 Pabst, which includes Old Milwaukee, Colt 45 and Schlitz and has 2% of market.

#4 Yuengling, which is America’s oldest brewery, as well as Barack Obama’s favorite brew.

#5 Boston Beer, maker of Sam Adams and publicly traded as SAM, which has seen revenues grow every year since 2004.

#6 Sierra Nevada, winner of the EPA’s “Green Business of the Year” award in 2010.

#7 New Belgium, brewer of Fat Tire.

#8 North American Breweries, investor/acquirer of Genesee, Dundee, Pyramid, Magic Hat and MacTarnaham’s.

Some of these are regional brewers, some are national, and some are craft brewers, though many craft brewers no doubt hate to see the fat cat investors of North American Breweries muscling into their industry.

In any event, the craft beer industry, which includes the vast majority of brewers in America, saw volume grow by 11% last year, and revenues grow by 12%.

Craft brewers now make up 5% of the market. And that tells me that while mass-market brews continue to dominate, the distributors are in fact to be thanked for helping the craft brewers provide a wealth of alternatives.

--- Advertisement ---

Has the Bull Market Finally Had It?

The shocking answer could make you 50% richer or 50% poorer, depending on what you do now! Make no mistake about it--the bull market is entering a dangerous new phase. One that will soon affect all the stocks you own.

The next market move we see headed our way in the next 30 days could be the biggest shocker of 2011. My free report reveals what you must do now to protect yourself and profit. Get it now!

---

Which brings me to today’s stock.

Ranking ninth by volume on the list of American brewers is Craft Brewers Alliance (HOOK), which trades on the Nasdaq.

The company’s roots go back to 1984, when Kurt and Robert Widmer founded Widmer Brothers Brewing Company in Portland, Oregon.

Today Widmer produces at least a half-dozen classic American and European brews, from the light “Widmer Brothers Hefeweizen” to the dark “Pitch Black IPA.” Revenues last year were $146 million.

And the company is growing by acquiring.

In 2008, Widmer merged with Redhook Ale Brewery of Seattle, adopting the name Craft Brewers Alliance. Redhook makes a half-dozen beers.

And in 2010, the company acquired Kona Brewing, the largest craft brewer of Hawaii. Kona, too, makes a half-dozen beers.

Last year, 49% of revenues came from Widmer, 32% from Redhook, which has a second brewery in Portsmouth, New Hampshire (which I toured last month), and 19% from Kona.

But there’s a far bigger fish in the ocean, in the form of Anheuser-Busch (BUD), which, recognizing the growth potential of craft brewers, took a stake in Widmer Brothers in 1997 and now owns 36% of Craft Brewers Alliance.

The two Widmer Brothers still own 18% of the company, and continue to hold the reins. But there’s no question the company has growth on its mind, and there’s no question that Anheuser Busch’s excellent national distribution system, as well as the presence of two Budweiser suits on Craft Brewers Alliance’s board of directors, will help the craft brewer achieve it.

In the first quarter, revenues at the company grew 18% from last year to $32.3 million, while earnings were unchanged, at a penny a share. Analysts are expecting earnings of 15 cents this year, up from 10 cents last year, but there’s no consensus for next year, and that’s just as well, as I think another acquisition is likely.

Judging from the chart, other investors are bullish, too. The stock has nearly doubled in the past year, from 5 to nearly 10, and the trend remains clearly up. But there is one big caveat, and that concerns trading volume.

Average daily trading volume in HOOK is just 42,000 shares a day, and at a price of 10, that’s less than half a million dollars a day. That’s very light, and a definite reason to be careful with this.

Finally, there’s valuation. On a price-to-sales ratio, HOOK looks good. While BUD trades at 2.5 times revenues and SAM trades at 1.6 times revenues, HOOK is trading at just 1.2 times revenues. On the other hand, if you look at price-to-earnings, you come up with the opposite conclusion. But you can’t trust numbers blindly; you’ve got to know what’s behind the numbers. And I know HOOK’s earnings are temporarily depressed because it’s investing in the future.

Now, no Cabot advisory has recommended HOOK. It’s simply too thinly traded. But I did find it interesting--even attractive--in light of my findings about the beer industry. If I were investing in HOOK, I’d wait for a pullback of at least 10% before buying. I’d keep my commitment small. And I’d use a strict stop in case the stock--unlike the beer--disappoints.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Publisher

Cabot Wealth Advisory

Editor’s Note: Timothy Lutts is the editor of Cabot Stock of the Month, which helps subscribers diversify their portfolios and shows them how to profit using several different investing philosophies to pick winning stocks. And the price is so low, you’ll recover it from your very first profitable investment. Get started today!