Building an investment portfolio is, quite frankly, pretty darn scary. Here’s what you need to know so you can make money and stop worrying about losing everything.

There’s a lot of mystery around building an investment portfolio. Individual investors can make significant gains and create a very comfortable retirement account. But to be blunt, there isn’t a whole lot of information out there that’s clear and concise for new investors. At the same time, it’s easier than ever to invest, thanks to online brokers. This is, unfortunately, not a great mix.

Don’t take that the wrong way. We’re very much in favor of making it easy to invest. But some websites and apps fail miserably in giving their customers the tools for success. Some, like Robinhood, are notorious for the “gamification” of stock trading, pushing young, inexperienced investors toward extremely risky trades. And that was before the GameStop (GME) fiasco.

[text_ad]

On the flip side of that, the brokerage industry has a long history of charging high fees, requiring minimum trades and balances, and generally setting barriers that keep new potential investors away.

In short, this leaves most investors relying on a 401k or other employer-sponsored account that, assuming you even have one, contains no guarantee of enviable gains. Just look at the many retirement accounts that were depleted in the 2008-2009 market crash.

There is a positive to all this, however. Building an investment portfolio is very possible. And you don’t need to take significant risks, spend big money, or even know a lot about the inner workings of Wall Street.

Building an investment portfolio that will make money without stressing you out

There are plenty of good reasons to invest through a broker. Building an investment portfolio on your own does require some work and attention. But as we’ve often said, no one cares about your money as much as you do. So how do you do this?

First, decide on an investing platform. Investopedia and NerdWallet both offer in-depth comparisons of several online brokers. They all have particular selling points; some allow cryptocurrency investing, others specialize in retirement accounts, and so forth.

Once you’ve set and funded an account, sit still. It’s tempting to jump right in, but you need a strategy. Whether you’re building an investment portfolio with $100 or $10,000, there are smart ways to move forward.

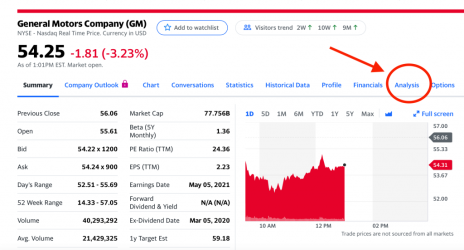

It’s helpful at this point if you can do some analysis of stocks, but it’s not necessary. Make a list of 20 to 30 companies that you might want to invest in. Look up Wall Street’s earnings per share (EPS) estimates for those companies. Yahoo Finance offers a very simple, easy way to do this. Search for your company. You’ll get a screen that looks like the one below, then click on “analysis.” That will bring you to a screen where you can look at the EPS.

Next, cross companies off your list that are not experiencing EPS growth.

Pick four or five of the remaining companies representing various industries and sectors to keep in your stock portfolio.

Invest equal dollar amounts in each of those companies’ stocks. When you have more money to invest, buy more shares of the company with the lowest dollar value in your portfolio. (It’s also okay to add another stock to your portfolio.)

Monitor the profit outlooks for your companies. Sell when profits stop growing.

Some ideas for structuring your investment portfolio

When you’re building an investment portfolio, you can take several different approaches, but always bear in mind there are no guarantees in the stock market. Blue-chip companies like Johnson & Johnson (JNJ), IBM (IBM), and Coca-Cola (KO) aren’t going out of business anytime soon, so it’s nice to have stocks like these in your portfolio.

At the same time, aggressive stocks, while riskier, can give you triple-digit returns. If you want to own fast-moving aggressive stocks, but don’t want to live and die with every tick, then buy smaller amounts, dollar-wise, of the stock at the outset. There’s nothing wrong with owning a smaller dollar amount of a very volatile stock.

Whatever direction you choose, always invest in stocks that coincide with your risk profile. Not every stock will match your investment objectives, nor will every one become a home-run. Read a stock’s profile carefully and evaluate its investment in relation to your other stocks.

Our advice is that, when fully invested, you should own no fewer than five stocks, but put an upper limit at 12 or 15 stocks. You can balance aggressive and conservative, safer stocks. You can stick entirely with conservative stocks. You can even alter your approach over time.

Investing on your own isn’t as scary as you think. Managing your own money is empowering and educational, and profitable. An easy way to begin is to get your copy of our FREE report, How to Invest in Stocks: How Stocks Work, How to Calculate Return on Investment, and Other Investing Basics.

Have you found any tips that are especially helpful in building an investment portfolio? Share your ideas in the comments.