I bet, like me, you can remember a few things about 1965. That year, the average salary of Chief Executive Officers was a mere $819,000—or about 20 times the salary of the average employee, according to the Economic Policy Institute (EPI). In most cases, it seemed justified. After all, the leader of the company had a lot more responsibility than his average worker.

But did you know that since the 1970s, CEO pay has risen almost 1,000%, whereas the salary for the average worker has gone up only 11%?

[text_ad]

To further break down that amazing statistic, I reviewed a recent study by PayScale and Equilar, which calculated the CEO compensation/average worker ratios for CEOs of 168 companies with annual revenues over $1 billion.

Are you ready? Drumroll, please. That number is 70-to-1. That’s the average. Some of those CEOs are taking home more than 300 times the median pay of their employees—not counting options—cash only.

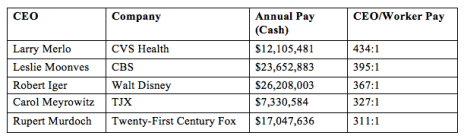

Here’s some examples:

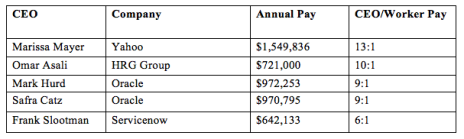

Contrast that to the lowest ratios in the survey:

You’re probably thinking, “Well, I can see why Marissa Mayer, who was just ousted by Verizon’s purchase of Yahoo, has a much lower pay ratio.” After all, the company did not make the much-anticipated comeback in its fortunes under her reign. And sure, that makes sense, but in reality, the health of a company doesn’t always correlate with that CEO/worker pay ratio.

And neither does stock performance. In fact, some of the worst-performing stocks have the highest paid CEOs! And vice-versa.

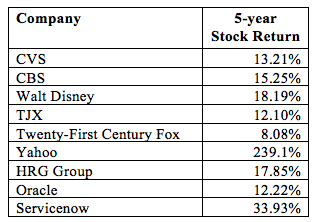

Let’s look at the stock performance of the companies cited above.

As you can see, of the stocks I mentioned earlier, Yahoo—which was severely outgunned by its competitors in the last few years—actually had the best stock performance over five years! Doesn’t make much sense, does it?

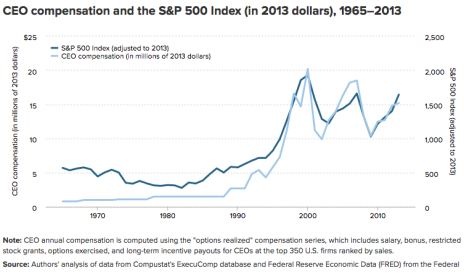

You can see from this Business Insider chart that CEO pay has risen hand in hand with the returns of the S&P 500.

But again, that’s an average. It doesn’t tell you anything about specific CEO compensation vs. stock performance. The reality differs. MSCI researched 800 CEOs at 429 large and midsize companies in the United States from 2006 to 2015 and found that “companies with lower total summary CEO pay levels more consistently displayed higher long-term investment returns.” The study’s conclusion: “One-hundred dollars invested in the 20% of corporations with the top-paid CEOs would have grown to $265 over the study’s 10-year window. Meanwhile, $100 invested in the companies overseen by the lowest-paid CEOs would have increased to $367.”

One of the most egregious displays of disparity is the compensation of former J.C. Penney CEO Ron Johnson, who made 1,795 times the average of his employees’ salaries.

Most investors are unaware of these facts. And unless you hold a controlling interest in the company, you probably can’t do much about it.

The 2010 Dodd-Frank Wall Street reform law was supposed to change the secrecy surrounding CEO pay by mandating that the ratio of CEO pay/worker pay be disclosed beginning next year.

That may not happen, as Wall Street is fighting it, and it looks like its efforts are succeeding, as the regulators are trying to delay enforcement. But more than 100 institutional investors, including unions, pension funds, activist investors, state treasurers and consumer advocacy groups, are asking the SEC not to delay the rule’s implementation. We’ll see how that works out, but I believe the current sentiment in D.C. will delay it.

At any rate, it behooves you as an investor to find out whether the CEOs of the companies in which you invest are being vastly overpaid for their performances. You can find out just how much your companies’ CEOs are earning in the (1) the company’s annual proxy statement, (2) the company’s annual report on Form 10-K and (3) registration statements filed by the company to register securities for sale to the public.

Bottom line, you can vote with your money. If the companies are not getting better, stronger, and creating substantial investor gains—compared to the growth of their CEOs’ compensation—you don’t have to invest in them, do you?

[author_ad]