Crude oil prices dipped below $50 a barrel on Thursday for the first time since OPEC decided to cut production in late November. Predictably, energy stocks tumbled accordingly—the Vanguard Energy ETF (VDE), whose holdings include the likes of Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP), was down 1% in early Thursday trading.

It’s normal for energy stocks to dip when the price of oil falls sharply. But there seems to be extra weight attached to the $50 mark, a level that oil prices had managed to stay above for more than three months prior to yesterday. Since July 2015, when prices sank below $50 a barrel for the first time since 2009, crude oil has only poked its head above $50 on three occasions, never rising higher than $54.

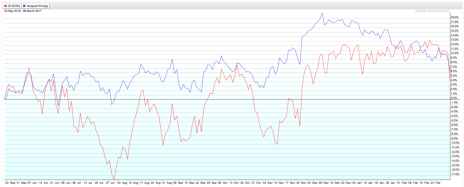

Look at what’s happened to energy stocks (again, as measured by the VDE) each time oil prices have spiked above $50 in the last year (oil prices are in red; VDE is in blue).

This chart demonstrates two things: first, how oil prices and energy stocks tend to move in tandem, and second, how energy stocks have prospered the few times oil prices have spiked, at least when compared to what’s happened to them when crude oil has dipped. Prior to the big up-move in November and December, the net effect of all the ups and downs in oil prices was that energy stocks had barely budged for a year. But the OPEC-fueled price spike finally moved the needle for energy stocks in a meaningful way.

[text_ad use_post='129629']

Now, if oil prices plunge as much as they did last June and last October, that could erase much of the gains in the energy sector from the past three-to-four months. The good news is that the floor for crude oil prices after these big dips keeps getting higher—$35 last April, $39 last August, $42 in November. If that pattern holds, oil may only tumble to about the mid-$40s this time, which could limit the damage in oil stocks.

Of course, this is the first time oil prices have dipped below $50 a barrel since Donald Trump became President and OPEC slashed production for the first time in seven years. Those two factors could make this latest oil pullback shorter lived and less damaging to those who invest in oil than previous declines.

Still, oil companies are struggling to make money with oil prices at half of what they were two years ago—neither Exxon, Chevron, or ConocoPhillips has grown profits since the third quarter of 2014. That’s expected to change in a big way this year—all three companies (and others) are expected to grow EPS by double digits in 2017.

Once energy companies start to grow their bottom lines again, that could extend the upside for energy stocks if and when oil prices do bounce back. And if recent history tells us anything, oil prices aren’t likely to stay below $50 for long.

[author_ad]