The following is a guest post by Chris Douthit of OptionStrategiesInsider.com.

When I was a kid, I used to dream of being a professional baseball player competing in the seventh game of the World Series. There were two outs in the bottom of the ninth, my team is down by three, bases were loaded, and I was at the plate.

Sweat dripped off my forehead as the pressure mounted. The probability of success was significantly stacked against me, but somehow, I swung my bat and deposited the ball over the left-field wall to win the World Series.

As an adult, my dream hasn’t changed, but the game has…

Being a professional trader isn’t all that different. There is an enormous amount of pressure to swing at the right trades and let the bad trades sail on by.

This is why every trader dreams about buying a stock at the very bottom only to watch it explode higher, profiting substantially in the process.

But there’s one problem with the dream: Most traders are too afraid to swing the bat when presented with the opportunity, even if presented with the perfect stock chart pattern, such as a falling wedge, or one of several other technical setups.

To even be in that position means either the market as a whole or an individual company would have just been decimated.

Buying at the bottom or very close to the bottom is a terrifying proposition. The secret is to understand that feeling of fear, because it’s also the feeling of opportunity. Every pulse in your brain is telling you to get out, stocks are crashing, it’s a bad situation.

Though that might be true, traders who give in to the fear will continue to be sidelined when an incredible opportunity presents itself. Experienced traders understand that fear, then put it aside while focusing on logic and fundamentals to make intelligent trading decisions.

COVID-19 Strikes

Most of us should have no problem remembering what it was like when COVID-19 hit last year. There was panic and a lot of it, but it turned out to be one of the best buying opportunities in our lifetime.

Looking at the SPDR S&P 500 ETF Trust (SPY), do you remember what you felt like on March 23, 2020?

This would’ve been the ultimate time to get off the bench and swing the bat. However, most people were likely paralyzed with fear. It’s certainly not a bad thing to be fearful, but you should recognize that feeling because that is the feeling of opportunity if used correctly.

Mark Zuckerberg Heads to Capitol Hill

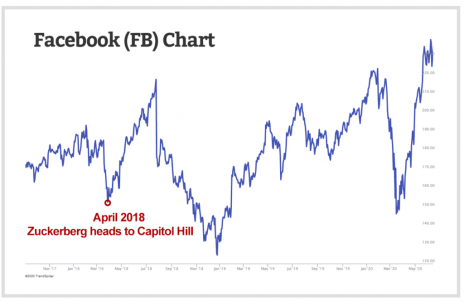

Facebook (FB) has undoubtedly been a quality investment for investors who’ve been able to maintain their position through the wild ride. Still, there’s been plenty of opportunities to pick up the stock at a discount over the last couple of years.

It’s no secret that Facebook is likely to get some much-needed regulation. Every time the conversation starts to heat up, the stock tends to go south. I remember back in April 2018, when Zuckerberg testified before the Senate about Russian election interference, the data breach, and Cambridge Analytica’s fallout.

Things were looking quite grim for the social media giant and its founder.

Many people sold, they couldn’t take the short-term pain. But for those who jumped in during the brief selloff, they would’ve enjoyed nearly a 50% return over the following three months.

The fact is it’s hard to jump in and buy when everybody else is selling, but to get that grand slam trade that you dream of, that’s precisely what you have to do. With that said, it has to be in the right name and the right situation, but when things look bad is when discounts can be had.

I’ve seen several situations over the past decade, where markets dropped and implied volatility skyrocketed, that have led to massive returns if treated appropriately. The point is, if you sit on the sideline when a quality company has momentary turmoil, the massive upside potential will, without a doubt, slip through your fingertips.