The last few years have turned the world upside down in many ways. Everything from how we work, attend school, shop and even spend our leisure time has been disrupted. That includes the sport of golf and golf stocks.

In recent years, golf has seen its active player numbers steadily decline as baby boomers age and youngsters eschew this traditional country club sport.

Who would have thought that its popularity would surge during a pandemic?

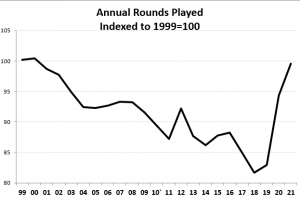

Despite the pandemic, golf rounds played in America were up 14% in 2020 and another 6% in 2021, according to industry research firm Golf Datatech. Golf is the rare sport that can be played while maintaining social distancing.

[text_ad]

In fact, as you can see from the chart below, also courtesy of Golf Datatech, interest in golf has reached levels not seen since 1999.

For those of you that may not have been following at the time, those years were early in Tiger Woods’ career and a period of great interest in the sport.

Golf Stocks Benefiting from Renewed Interest

Golf Stock #1: Topgolf Callaway Brands (MODG)

Companies such as Topgolf Callaway Brands (MODG) bounced backed from the COVID-19 pandemic, posting strong sales and profits as golfers with cabin fever escaped to golf courses across the globe.

Even with the decline of pandemic-related shutdowns, Topgolf Callaway is reporting strong results per Chip Brewer, President and Chief Executive Officer of Callaway. “Our second quarter revenues increased 22%, reflecting increases in all major product categories, in all major regions and in all operating segments. Continued strong demand, along with market share gains, pricing and other business improvements we implemented this year have allowed us to outrun the ubiquitous inflationary pressures, unfavorable foreign currency exchange rates and staffing challenges. As a result, our Adjusted EBITDA increased 26%. While we are not immune from these macroeconomic headwinds, we believe we can continue to manage through them and our business remains strong overall. We are therefore increasing our full year guidance.”

ELY stock is up 145% since the pandemic lows but off 36% YTD. Last year’s acquisition of Topgolf is continuing to pay dividends, as a 24% improvement in that segment contributed to a 22% YOY revenue increase.

Golf Stock #2: Acushnet Holdings (GOLF)

Acushnet Holdings (GOLF), which owns Titleist and FootJoy, is another golf stock that indicated a big turnaround, and CEO David Maher told analysts in 2020 that “the game and business of golf have been incredibly resilient over the past few months.” The company said that demand for golf balls had been particularly strong, indicating a pickup in rounds played.

These sentiments were echoed in the company’s fiscal 2021 reporting, which reflected 30%+ net sales growth due to higher rounds played. However, those positive results were dampened by higher material and freight costs that led the company to miss earnings targets in the first half of 2022. The company reported year-over-year sales growth but a 16% decline in earnings.

GOLF stock is up a healthy 98% since the pandemic lows, but off 17% YTD.

Golf and investing have both been a big part of my life. When I was an investment advisor with a Wall Street firm, one of my marketing strategies was to make the rounds at country clubs to give luncheon talks to prospective clients.

The topic was, “The Traits Shared by Great Golfers and Great Investors.”

It is remarkable how many of the traits of world-class golfers can be applied to making all of us more successful investors. On top of the golf stocks I just gave you, here are some of the highlights of my talk that might help you as golf season is in full swing all across the U.S.

6 Tips for Being a Successful Investor and Golfer

Get organized with a smart, conservative strategy and realistic goals

This is very important. To get ahead, you must get organized. Great golfers always have a strategy in mind for every hole before they begin. They carefully chart a course and set specific targets that can be adjusted for different weather conditions. Unfortunately, amateurs (dare I say hackers) give little thought to strategy and usually have no plan at all.

Keep your head when things get rough

The roguish, stylish, and flamboyant Walter Hagen usually arrived on the first tee in black tie and always expected to hit three or four poor shots a round. This relaxed attitude led to him staying calm when the inevitable shot went astray. Remember, golf and investing are not games of perfection. When stock picks go south, cut your losses and get back into the game.

Be deliberate, patient, and play the probabilities

In golf and investing, patience and consistency is the magic formula. Having one great round or a few good stock picks in a row will not lead to success. The greatest golfer of all time, Jack Nicklaus, always played the percentages to keep his ball in play.

Proper preparation prevents poor performance

Professionals – in golf and investing – prepare carefully and follow a set and steady routine. Investors would do well to carefully emulate the pros. Don’t jump at every stock pick that comes your way. Do your research, find and stick with a proven investment strategy that suits your personality, time frame and financial goals.

Build a talented team

If you go to the Masters or any other professional tournament, you will notice that a pro does not go it alone. Most have swing coaches, sports psychologists, sports agents, financial consultants, and of course professional caddies to help them play at their peak potential. The same goes for investors. Get a good CPA and lawyer, plus some talented investment help from trusted and independent sources like Cabot Wealth.

Look overseas for value and growth opportunities

Golf has always been an international game. In fact, when the Masters tees of next month in Augusta, many participants will be international, hailing from countries such as China, Spain, France, Australia, Mexico, Thailand, Malaysia, Argentina, Columbia, Fiji, India, South Korea and South Africa. Are you equally open to scouring the globe to find companies trading at value prices all over the world?

Remember, investing, like golf, is not a game of perfection. Having the right mindset, strategy and preparation simply increase the probabilities of success.

Good luck with your golf and your investing! Which golf stocks are you investing in?

[author_ad]

*This post was originally published in 2019 and has been updated.