Editor’s Note: On Friday, we sent Cabot investors an invitation to join our newest service, Cabot Prime. If you missed your invitation to join, click here to view it now.

---

I’m not a fisherman—I haven’t been fishing in decades—but I’ve always liked the saying: Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime. Because fishing is a lot like investing. I could give you one stock to buy today—there are a slew of great candidates in this bull market—but you’ll be better off in the long run if I teach you how to do your own stock-picking. So today I’m going to review the two main investment strategies, growth investing and value investing.

And if it seems appropriate, I’ll give you a couple of fish (stocks) along the way.

Growth Investing Strategy

Growth investing is about identifying companies that are growing—obviously—and then buying their stocks.

Stocks like Alphabet (GOOG) or Amazon (AMZN) or Apple (AAPL) or Facebook (FB) or Snap (SNAP) (the owner of Snapchat) might be in this group.

But they might not.

[text_ad use_post='131504']

Because there are other factors to look for in addition to growth. In my book, the following characteristics are most desirable in growth investing.

- Growing revenues, ideally at a rate exceeding 15%.

- Growing earnings, ideally at a rate exceeding 20%.

- A good story, promising more of #1 and #2 for years to come.

- Improving investor perception, with room for further upside as more investors learn about the company.

- Growing institutional investor sponsorship, with room for further upside.

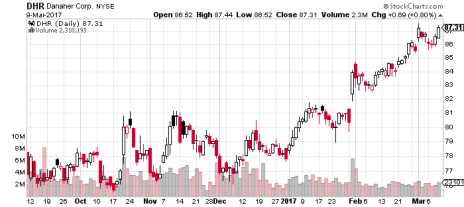

- A healthy chart, indicating that investors as a whole are growing more optimistic about the stock.

- A strong relative performance (RP) line, indicating that the stock is outperforming the broad market.

- Ample liquidity for smooth trading (our Cabot Top Ten Trader looks for average trading volume of at least $20,000,000 per day.)

- A price in the double digits (or higher).

- Capable management.

Alphabet (GOOG) meets a lot of these criteria, but its RP line has actually been flat since last March, indicating that the stock is only an average performer. Also, it could be argued that investor perception of the company/stock cannot get any better; certainly everyone knows about it!

Amazon (AMZN) is in a similar boat, though its chart is slightly stronger.

Apple (AAPL) is the biggest company of these, and thus having trouble growing; in 2016, both revenues and earnings at Apple shrank. As a result, AAPL looked worse than the two stocks above from mid-2015 until May 2016, but since then it’s been beating the market handily. The giant has strong momentum today.

Facebook (FB) is growing at a great pace, and its chart has been great, too.

That’s a big part of the reason the stock has been in Mike Cintolo’s portfolio in Cabot Growth Investor since 2013. (His readers have profits of roughly 260%, and you can join them by clicking here.)

Snap (SNAP) has revenue growth, but no earnings. Also, the stock is so new that it has no chart, so growth investors who need to see a healthy chart have to wait.

The one major issue I have with all these stocks, however, is that they are very popular. They are all well known. And that’s a problem because there’s less potential for new investors to discover them and push their prices higher.

My ideal growth company is a fast-growing smaller company with the potential to become as well known as those big companies—like this growth stock that’s been in my Cabot Stock of the Week portfolio for just a month.

This company, which I think has the potential to rival Salesforce.com (CRM) in the business software field, grew its revenues 35% last year to $1.7 billion. 2016 was its first profitable year—and when the results were announced in February, the stock gapped up to new highs, giving my readers a quick 20% profit. But I’ve been telling them to hold on tight, as there’s much more upside ahead.

(To join them, and get the full story on this high-potential stock, click here.)

Growth investing, in short, is about buying high and selling higher.

Value Investing Strategy

Value investors identify companies whose stocks are selling at low valuations—obviously—and hold them until they are substantially higher.

One way to identify these stocks is to look at stocks that have fallen substantially in recent weeks and months, like Chipotle Mexican Grill (CMG), GameStop (GME), Kroger (KR), Mattel (MAT), Rite Aid (RAD), Target (TGT), TripAdvisor (TRIP) and United Parcel Service (UPS).

Trouble is, just because a stock is down doesn’t mean it’s a good value.

Chipotle Mexican Grill (CMG) famously hit a low of 399 a year ago as worries about contaminated food impacted sales. At that point the stock was 47% off its high, a pretty big discount.

But that wasn’t the bottom for Chipotle!

So experienced value investors also look at fundamentals.

The most common of these are the stock’s price/earnings ratio and price/sales ratio.

Looking ahead—as good investors always do, there’s the forward price/earnings ratio based on future earnings, and the forward price/sales ratio based on future sales.

Also useful are the ratios of peers in the same industry, estimates of earnings growth rates, the company’s dividend coverage ratio and the trend of analysts’ earnings revisions.

And, if you’re a very thorough researcher like our Roy Ward, you also look at measures of quality, from the stability of the company’s growth to the ratings of the company’s bonds to the volatility of the stock.

Having done his thorough work, Roy is confident in giving a stock like this a Buy rating.

But there’s no rule that says undervalued stocks have to have weak charts.

So when Roy says that this stock is undervalued, I believe that too!

Stocks like this are frequently defined by the label Growth at a Reasonable Price, or GARP.

They’re growing, but they’re still good values.

If investing in either of these undervalued stocks makes sense to you, I strongly suggest you take a closer look at Roy’s offerings. But don’t just accept Roy’s fish; learn how to catch your own fish.

Note: I wrote a more thorough explanation of all the varieties of Cabot growth investing and value investing systems back in December and you can read that here.

[author_ad]