While the nation’s children (and millions of immature adults like me) are feeling increasingly excited about the approach of Halloween, the nation’s investors are feeling their usual queasiness about the onset of earnings season.

Halloween, here in Salem, Massachusetts where Cabot is located, is no laughing matter. Salem’s streets are already starting to fill with tourists eager to savor the thrill of walking through a town that’s infamous for its hysterical mistreatment of a small population of accused witches back in 1692.

Whatever. You build your tourist industry with the materials you have on hand, and while Salem has a world-class museum (the Peabody-Essex Museum) and one of the finest chocolate shops I know of (Harbor Sweets), it’s the witches, warlocks, fortune tellers, Halloween-costumed revelers and air of generally good-humored creepiness that pay the rent.

[text_ad]

For those of us who work at Cabot, the traffic jams and general craziness don’t generally make it all the way out to our location on North Street.

But we feel another kind of fright night when our stocks are getting close to their reporting dates. Any event that can punish a stock for missing revenue and earnings estimates by so much as a penny is justifiably scary.

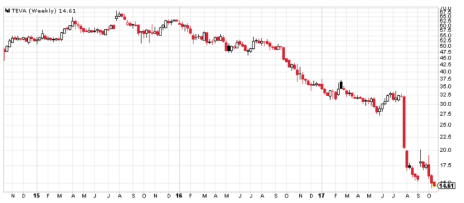

Stock markets have been so strong for so long that some investors have forgotten what a serious correction looks like. So, in the spirit of Halloween and general scariness, here’s a daily chart of Teva Pharmaceuticals (TEVA) showing what happened after an August 3 earnings report that disappointed on revenue.

If you make a poster-sized print of that chart, you can put it in your front yard with the fake headstones and spider webs and watch the sweat break out on the foreheads of the parents who understand the stock market. It’s a truly frightening chart.

So how do you prepare for earnings season? The best way to prepare is by sharpening your knife and knowing when to use it.

Or, to be more specific, you prepare by focusing on stocks that are in uptrends, and then setting a maximum loss limit for each of your growth stocks and then following it religiously.

If you had done that with TEVA, you wouldn’t have owned it in August. The stock has been in a downtrend since August 2015, falling from its high of 68 in late July to 31 on August 2, the day before the dire earnings news.

Trigger Warning: This is really scary!

I know for a fact that there were investors who owned TEVA for a long time who held the stock during the entire two-year pre-earnings downtrend. They told themselves that the downtrend would bottom out soon. They didn’t want to book a loss. They had faith in the story. And their position was already taking on water when the bad news sank it completely.

So here’s my advice for the October earnings season.

If you’re in a movie, don’t go to an isolated cabin in the woods with a group of teenagers. And especially don’t go to a spare bedroom—alone, without a flashlight—to investigate why the phones won’t work. (Or, even worse, alone into the basement without a flashlight to see why the lights went out.)

If you’re a growth investor with money at work in companies that are about to report quarterly earnings, don’t wait to figure out your loss limits until there’s blood on the tracks. You can still save your portfolio’s life if you just put a reasonable loss limit in place.

[author_ad]