Early in his career Warren Buffett had been focused on “cigar butt” investments. Cigar butt investments are companies that have been left for dead. They are like a cigar butt that has been left on the sidewalk. It looks gross and unappealing, but you can get one last puff out of the cigar for free.

In 1960, Warren Buffett’s investment approach changed after he read Phil Fisher’s seminal book, Common Stocks and Uncommon Profits. Buffett credits this book with changing his investment mentality forever as it convinced him to appreciate high quality companies.

While the main theme of the book was appreciating quality companies, Fisher spent considerable time discussing how to research individual companies. Fisher named his approach the “scuttlebutt method.”

What exactly is the scuttlebutt method?

[text_ad]

The Scuttlebutt Method, Explained

As Fisher described it, it involves conducting individual research on a company and talking to everyone associated with the company, its competitors, its suppliers, and its customers to gain firsthand information to better understand the company and its business prospects.

Scuttlebutt research is important because it is primary research, which enables you to develop higher conviction in your ideas and to better withstand volatility in the company’s share price.

Today there are a wide array of ways that professional investors can gain scuttlebutt.

You have probably heard of “expert networks.” In a nutshell, institutional investors can pay hundreds or thousands of dollars for a brief phone call with an “expert,” whether it’s a doctor with research expertise on a biotech drug or a former executive that can give insight into the credit card industry and how it is being impacted by Stripe, to name just two examples.

Most of us don’t have thousands of dollars to spend on “expert networks,” but there is another more cost-effective option. You can use the internet!

First, as Alex Jones recommends below, follow the companies of the stocks you own on LinkedIn to gain insight into company and industry news.

Jones also mentions podcasts as a great resource. When I was researching Drive Shack (DS), a leader in the traditional and entertainment golf market, I listened in to several episodes of the Golf Biz Podcast.

It helped me get a sense of industry trends.

It’s worked for other investors like Andrew Kuhn of the Focused Compounding hedge fund, who uses podcasts to conduct industry research.

Want to get a sense of whether a company that you follow is hiring (which probably indicates future growth)? You can use Visualping to set up a free account to monitor your company’s career page with daily alerts that highlight changes.

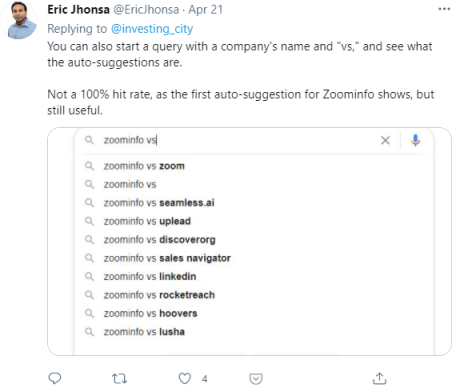

Want to determine who a company’s competitors are? Ryan Reeves and Eric Jhonsa have great tips, which are shown below.

Other Scuttlebutt Tips

Besides the investing tips I’ve outlined above, here are several others that I’ve found helpful:

- Read Amazon reviews of key products.

- Look at Better Business company reviews.

- Watch CEO interviews on YouTube. After watching the video ask yourself, “Is this a CEO who I would want to associate with?”

- Purchase the product that a company is selling to see how you like it. I was researching Arlo (ARLO) and I purchased one of their high-end cameras from Best Buy. I was able to test out the product and then return it for free.

I’ve used all of these scuttlebutt methods to identify high conviction ideas for my Cabot Micro-Cap Insider advisory, and so far it’s worked: the 15 stocks in my portfolio boast an average return of 57%.

If you want to know what micro-cap stocks I’m currently recommending, click here.

Have you ever tried any of these under-the-radar investing methods? How did it work out for you?

[author_ad]

*This post has been updated from an original version, published in 2020.