If you’re looking for a reason to invest in gold, a legendary pop star may have just given you one.

Prince, who died tragically last April, apparently owned no stocks, bonds or other financial assets at the time of his death, but did own 67 10-ounce gold bars. Total value? $836,166.70. Quite a haul!

[text_ad]

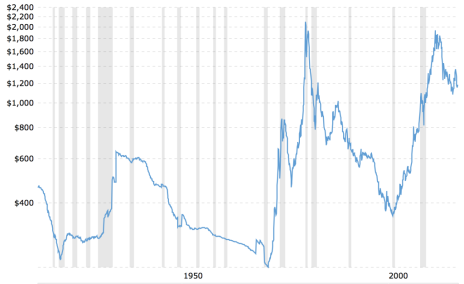

The catch, of course, is that it’s unclear when Prince bought those 67 gold bars, which means it’s unclear whether they were a good investment or bad investment. Let’s give the late pop star the benefit of the doubt and say he bought them in 2000, when gold was worth $300 an ounce. Today, gold is worth $1,173 an ounce—a return of close to 300% (see chart below)!

When you consider that stocks have risen roughly 50% during that 17-year span, an investment in gold looks even better. And as you can see from the chart, even if Prince decided to invest in gold anytime between the turn of the century and, say, 2008, the return would have been substantial.

Now, if he had invested in gold anytime since 2011, he would have been sitting on a sizable loss at the time of his death. Gold prices peaked around $1,900 an ounce in September 2011; they’ve been on (mostly) a downward spiral since, with the exception of the first six months of 2016.

For the first decade of the 21st century, gold was a good investment. It lived up to its reputation as a safe haven, as investors flocked to it after the dot-com bubble burst in 2000 and after the Great Recession of 2008-09. Gold is a nice hedge when stocks are plummeting and the dollar is losing value.

Since 2011, however, both stocks and the dollar have been on the rise; the dollar has achieved its highest value in 14 years, and stocks are touching new record highs on almost a weekly basis. So gold no longer has much value. And it’s not likely to have much value for the foreseeable future.

Just look at this 100-year chart of gold, courtesy of Macrotrends:

This chart is adjusted for inflation, which is why gold prices technically topped around 1980. But you can see the trend: when gold prices go in one direction, they tend to stay in that direction for a looong time—at least a decade or two. From their 1980 peak until their 2001 turnaround, gold prices were on a downward slog. Then they spent a whole decade on the uptick. Now we’re roughly five years into another bear market for gold. If history is any guide, a true turnaround in gold is likely years away.

Translation: you shouldn’t invest in gold anytime soon, no matter how much money the yellow metal may or may not have made for Prince! Now, most people (aside from filthy-rich pop stars known for being a bit … quirky) don’t invest in physical gold; they invest in gold stocks. And gold stocks have performed even worse over the last five years. The VanEck Gold Miners ETF (GDX) has lost more than half its value since the beginning of 2012, even after last year’s run-up:

When gold prices fall, gold stocks tend to fall even further. The reverse of that is true too, and value investors who made the savvy decision to invest in gold miners at their late-2015 bottom and sold sometime over the summer made quite a profit. (Just ask any subscriber to our Cabot Top Ten Trader advisory, where gold stocks were a frequent momentum-based recommendation of analyst Mike Cintolo in the first half of last year.)

But gold is a fickle commodity, and any run-up is short-lived. If you’re investing for the long haul, it’s best to steer clear—at least until the next stock market crash.

[author_ad]