My wife’s cousin’s son (yes, it’s a real person) may be the poster child for the highs and lows of investing in cryptocurrency.

He’s 21 years old, maybe 22, and was on track to graduate from college this past May, like his twin sister did that same month. Instead, he pulled out of school about 18 months ago—with three semesters left to go—but not because he had bad grades or because college just wasn’t for him. It was because he was too busy running his own investment blog focused solely on investing in Bitcoin, Ethereum and other forms of cryptocurrency.

Well, it wasn’t just because he was too busy running the blog. He made a lot of money investing in cryptocurrencies himself. How much is unclear—I heard this story not from the mouth of the young investing prodigy himself, but second-hand from his parents at a recent family get-together. They weren’t sure when he got in on Bitcoin, which other cryptocurrencies he’s invested in or how he came to start advising others about investing in cryptocurrency before he could legally drink a beer. But they know he’s making enough money through cryptocurrency investing that he no longer needs a college degree to help him find a high-paying job.

[text_ad use_post='129622']

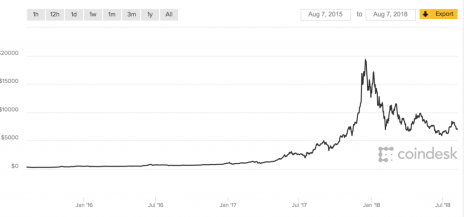

Check that: he made a lot of money investing in cryptocurrency. Now? Not so much—not with Bitcoin prices down 63% from their December 2017 peaks, and Ethereum having lost more than two-thirds of its value in the last seven months. One look at a three-year chart of Bitcoin and you can guess that my wife’s cousin got in on the cryptocurrency craze at some point during that massive 2016-2017 run-up.

On this day three years ago, one Bitcoin was worth a mere $263. Within two years, it was up to $3,431, and today Bitcoins are worth more than $7,000. But that completely yada-yadas what has happened to the cryptocurrency in 2018. As recently as last Christmas, the price of Bitcoin seemed destined for breaking the $20,000 barrier. Instead, it was met with a swift, harsh comeuppance from which the digital currency has yet to recover—and may not for quite some time.

Despite the steep crash in cryptocurrency prices, my wife’s cousin has yet to put his eggs in other baskets, apparently. He’s still all in on investing in cryptocurrency, perhaps in the hopes that this seven-month crash is little more than a temporary, albeit ugly, blip. It’s possible he’s right. Who am I to question the foresight of a 22-year-old who’s already made hundreds of thousands of dollars investing in an asset I admittedly know very little about?

But I do hope he diversifies, just in case Bitcoin prices don’t come roaring back. That’s not advice just for him—everyone should diversify. That’s true if you have a portfolio full of stocks. And it’s especially true if you’re fully leveraged in something as volatile, fickle, and illiquid as cryptocurrency.

Well before cyptocurrencies crashed this year, we at Cabot repeatedly warned readers about the dangers of investing in them. If you don’t believe me, read Chloe Lutts Jensen’s story on “The Danger of Investing in Bitcoin and Ether” from December 3, 2017—a couple weeks before the price of each then-wildly popular digital currency topped out.

If you invested in either cryptocurrency in 2016 or 2017, you probably made a lot of money. But the honeymoon is over, and investing in cryptocurrency alone no longer makes sense. Investing in stocks is, as it was a year ago and two years ago, the more reliable and sustainable play.

I hope my wife’s cousin branches out into stocks. Soon. Otherwise, he may want that college degree after all.

[author_ad]