In this holiday-shortened week, markets are almost certainly going to be quieter than in recent weeks, which means you should be able to find time to step back and make a game plan for investing in 2019. What are your investing strategies for the New Year?

Here are my suggestions.

Five Investing Strategies for 2019

Review Your Trades of 2018

Look at what you bought and why and when. See what worked and what didn’t. If you do this year after year, and you are honest with yourself, you will begin to see patterns—of both success and failure—and then you will be in a position to try to increase those successes and reduce those failures.

[text_ad]

Turn Off the TV

Seriously. When you watch TV you insert yourself right into the river that carries the masses on a journey of perception—perception driven by the thoughts and motives of others.

But the way to make money in the market is to do what the crowd is not doing, and to do that you need intelligence—even better, insights—that the crowd doesn’t have.

So don’t jump into that river. Instead, study charts; that’s how Mike Cintolo, Cabot’s ace growth investor, likes to spend his weekends. Or read a classic investing book, like A Treasury of Wall Street Wisdom, by Harry D. Schultz and Samson Coslow, or Being Right or Making Money by Ned Davis, or The Art of Contrary Thinking by Humphrey Neill, or The Money Masters by John Train or The Intelligent Investor by Benjamin Graham. There’s a lot of wisdom out there, but you have to look for it.

Look at a Few Long-Term Charts—Carefully

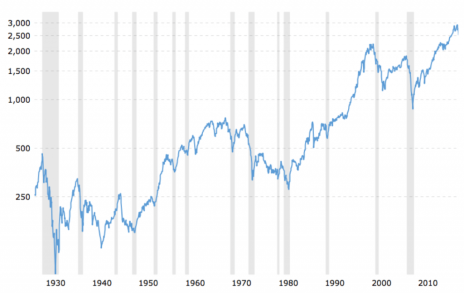

Here’s a 91-year chart of the S&P 500.

You can easily see the bull market of the past 10 years, and if you’ve been listening to today’s pundits, you probably believe that the bull market is over.

But look at the two previous bull markets, which ran from 1949 to 1968, and 1982 to 2000. The message they hold is that this bull market could run another eight years!

Get into the Hottest Sector

In the ‘80s it was semiconductor stocks. In the ‘90s it was dot.com stocks, followed by social media stocks. And for the past 10 years, cloud-based service stocks have been hot. Looking forward, the next iteration of those technology trends is certain to be profitable, whether it’s cybersecurity or digital personalization or artificial intelligence, so you should be alert to all those possibilities.

But also consider the fastest-growing industry in America!

The fastest-growing industry in America is cannabis, which became legal in Canada in October and is on track to become legal in the U.S. in the years ahead. Numerous companies in the industry are growing revenues at triple-digit rates—and most investors don’t even know their names.

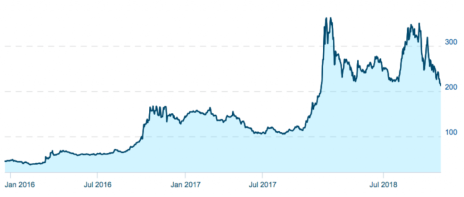

Here’s the 3-year chart of the Marijuana Index.

Looks like a decent time to start buying marijuana stocks. (And if you need a little help doing so, you’ve come to the right place - my Cabot Marijuana Investor advisory currently recommends 15 marijuana stocks, and has an average gain of 25.5% year to date. Click here to join!)

Try to Think Contrary

Looking at that chart above of the Marijuana Index, you can see that the sector peaked in October, on the exact day of Canadian legalization, as investors looking forward to that revolutionary day bid stocks higher and higher. But then there were no buyers left, and everyone who bought near Canadian legalization day lost money.

To win, you’ve got to think contrary. Sell when others are buying, especially if there’s an obvious peak event. And buy when others are selling, especially when there’s an obvious bottom event.

Put these simple investing strategies all together, and you can be a better investor in 2019!

Happy Holidays!

[author_ad]