In my latest Wall Street’s Best Investments newsletter, I featured a bank—SVB Financial Group (SIVB)—that caters to technology companies that are in need of venture capital (VC) funds. VC activity is hot right now—up 16% last year, to $84.2 billion—and up more than 100% from 10 years ago.

And the greatest focus is on funding unicorns—those companies with a market cap of at least $1 billion. They accounted for 73 deals, worth $19.2 billion last year—nearly 23% of total 2017 VC dollars. The trend has continued into 2018, with (so far) twice as many deals as last year, totaling $77 billion more than 2017.

SVB Financial’s largest client concentration is on venture capital-backed tech and life science companies in the U.S., and those areas are two of the hottest sectors in the IPO market this year.

It makes sense that if VCs are putting the bulk of their money into these two sectors, that they are the same sectors leading the IPO waiting list, since that’s how the VCs cash out.

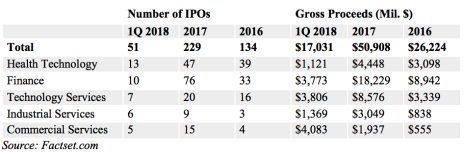

Of the 51 IPOs in the first quarter of 2018, 13 of them were in the Health Technology sector. Those deals averaged $334 million and raised $1.1 billion. Technology was third (after Finance), accounting for seven deals, worth $3.8 billion, with the largest, iQIYI(IQ), raising $2.3 billion.

[text_ad]

Here are the top five categories in the IPO market so far this year:

Deal Size is Increasing

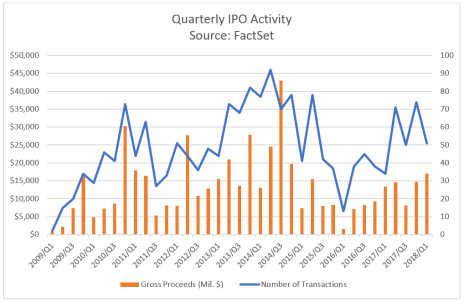

And as you can see by the following chart, average gross proceeds in the first quarter were the highest since 2014, totaling $17 billion gross proceeds, up 28% from the same period in 2017.

And the IPO market (just like the venture capitalists) is seeing larger deals, with 49% of all IPOs falling in the $100 million-to-$500 million range. And the VCs backed 13 of those first-quarter deals, averaging $191 million per deal, including Dropbox (DBX), which raised $756 million in March.

What’s Next for the IPO Market?

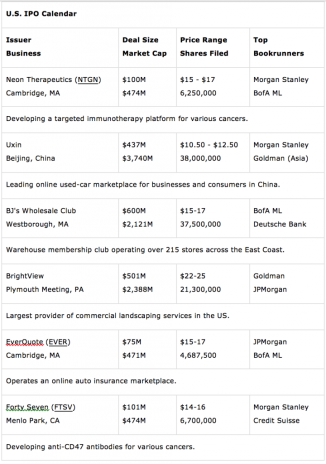

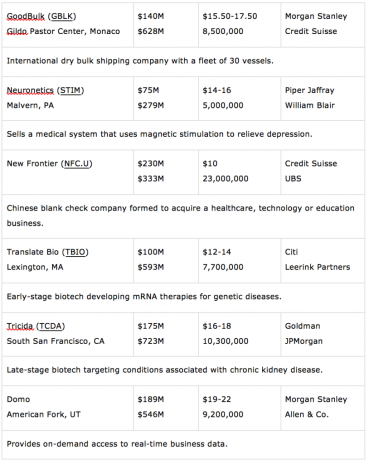

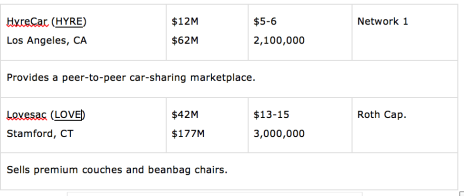

VCs and private-equity investors are anticipating that tech and biotech will continue to lead. Of the 12 upcoming IPOs this week, seven belong to those two sectors. Take a look:

Source: Renaissance Capital

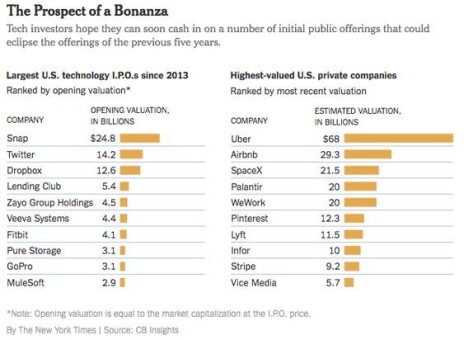

And looking further into the future, the following chart shows the largest tech IPOs of the past five years, along with the private companies with the highest market caps—sort of a wish list for IPOs (note that both Uber and Airbnb are supposed to IPO in 2019).

How to Invest in IPOs

It’s often difficult—unless you are a well-heeled brokerage customer—to get in on IPOs. And many times, it pays to wait until the hoopla surrounding an IPO dies down and the price settles into a normal range.

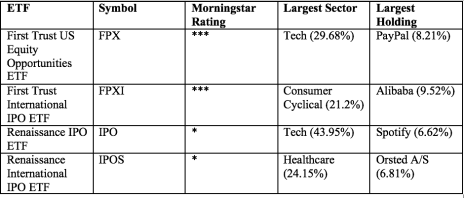

However, if you are just dying to take part in a few IPOs, you may want to consider an ETF. There are several ETFs that operate in this space:

Whether you buy one of these ETFs or not, it looks like Technology and Healthcare (especially Biotech) are going to be the favored sectors for the near future. But like with all investing, just make sure you don’t invest too heavily in any one stock or sector—diversification wins in the long run.

To find out about which stock picks Wall Street’s analysts are recommending, consider taking a trial subscription to Wall Street’s Best Investments.

[author_ad]