Buying and holding stocks for the long term is a good idea for a lot of reasons. But there’s an obvious one I was reminded of this tax season. Let me explain…

A Funny Story About Income Taxes

I don’t prepare my own income tax return; I just organize everything and pass it on to my accountant.

So I was in the midst of this process one recent Saturday—I had finished with the Federal information and was working on the additional information for the State of Massachusetts—when I came to a funny line.

It was this.

[text_ad]

“Would you like to pay the optional 5.85% rate?”

Now, the official tax rate in Massachusetts is 5.1%.

Thanks to an initiative petition passed by Massachusetts voters in 2000, the rate has dropped incrementally from 5.85% to the present 5.1%, and if all goes well, it will soon bottom at 5.0%.

So why are Massachusetts taxpayers being offered the option of paying the old, higher rate?

Because when Barbara Anderson, executive director of Citizens for Limited Taxation and Government, was working to craft the proposal, she sarcastically suggested that taxpayers could be given the option of paying the original high rate.

But you’ve got to be careful with sarcasm; it doesn’t work with some audiences.

In this case, that audience was the state legislators, who liked the idea enough to include it in the final language. And it’s been the law since; if you want, you can pay a higher tax rate in Massachusetts than you need to.

So how many taxpayers choose to pay the higher rate?

The only figure I could find was for 2013, when 1,083 people chose to pay the higher rate.

With slightly more than four million voters in the state, that’s roughly 0.026% of voters.

Which raises the question, “Who are these people?”

Do they truly feel it’s good citizenry to pay more than they need to, or are they just making a mistake, thinking that 5.85% is lower than some other number they’re thinking of? I wonder.

In any case, I wasn’t one of them.

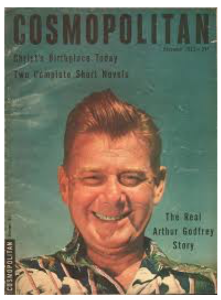

My stance is similar to that of Arthur Godfrey, who once quipped, “I’m proud to pay taxes in the United States; the only thing is, I could be just as proud for half the money.”

Speaking of Arthur Godfrey, he was the first man to appear on the cover of Cosmopolitan magazine.

That was in 1952, when the magazine was still targeting a general literary audience—before it evolved into a women’s magazine.

And that’s getting pretty far from the topic of investing.

So let’s get back to taxes.

Buying and Holding Stocks: One Way to Pay Less Taxes

Unless you’re like the 0.026% of people in Massachusetts who voluntarily paid higher taxes (through either patriotism or stupidity), you probably want to pay less in taxes.

One well-known way to pay less in taxes is to max out your IRA or other retirement account.

But what about the assets in your taxable account(s)? Is there any way—aside from investing in tax-free bonds that pay almost nothing—to minimize taxes there as well?

The answer is yes.

One very effective way to pay less in taxes is buying and holding stocks for the long term, with the intention of never selling—or at least deferring selling until your tax rate is lower, perhaps after you stop working.

As long as you don’t sell, you won’t have to pay taxes. And if you hold forever, and pass the stock on to your heirs, you’ll never pay taxes.

But what kind of stock can you hold forever?

In the old days, the answer might have been American Telephone & Telegraph (T) or International Business Machines (IBM).

More recently, the answer might have been Johnson & Johnson (JNJ) or Microsoft (MSFT).

Even more recently, the answer might have been Amazon.com (AMZN), Apple (AAPL), Alphabet (GOOG) or Tesla Motors (TSLA)—all stocks that have been recommended in our flagship growth advisory, Cabot Growth Investor.

But what if you’re just starting today? What stock (s) can you buy today that have an almost-guaranteed runway of growth ahead of them?

For starters, you should consider buying and holding stocks in our newest report, “10 Forever Stocks to Buy Now.” In it you’ll find 10 stocks—some familiar, some not—that all have great growth potential. To get your free copy, simply click here.

The sooner you start, the better.

[author_ad]