After Snap Inc. (SNAP) fell 43% on May 24, I went to my top research analyst, my teenage daughter, to find out if she and her friends were using the social media app less frequently. This one-person channel check is somewhat in line with famed investor Peter Lynch’s theory that you should “Buy stocks that you know.” And for better or worse, my daughter knows social media. Her answer to the SNAP question was a resounding “BUY” that would have made Jim Cramer proud!

“Dad, Snapchat is the new texting, and is way more popular that TikTok, which we still use, but is way less popular than it used to be,” she said.

“How about Facebook (META)?” I then asked. This question elicited a DEEP eye roll that only a teenager could deliver with such utter disdain. Ahhh, the joys of parenting! (Her top brand ideas, and my trades on those hot products, can be found at the bottom of this article.)

But back to Peter Lynch …

[text_ad]

Lynch is one of the most successful investors of all time, having managed the Magellan Fund at Fidelity for 13 years. The fund returned an average of 29% per year, largely using price-to-earnings-growth (PEG) ratios which was important to his individual stock calls.

However, Lynch also took great joy in discovering stock ideas while walking through the grocery store or chatting casually with friends and family, and buying stocks that you and I know. So the question becomes: Should we blindly buy the stocks of the companies we use? Yes … but maybe no.

Buy Stocks that You Know? Maybe Not All of Them

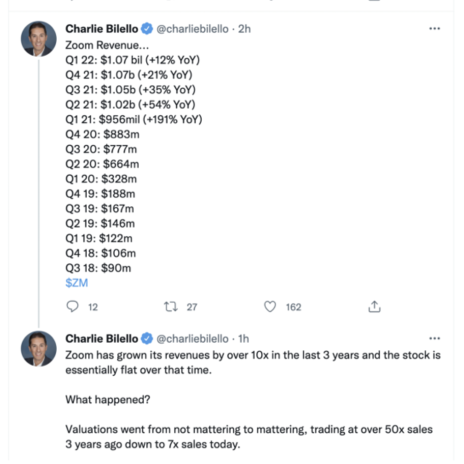

For example, during the pandemic, Zoom Video (ZM) went from a relatively unknown to a name brand. However, despite the company’s incredible growth, as shared by @charliebilello on Twitter (shown below), revenue growth and a product going mainstream doesn’t mean that the stock is a good long-term buy:

And we can see countless other examples of this in today’s market.

All of my friends have Pelotons (PTON), and now the stock is garbage.

Online gambling is becoming legalized across the country, yet the leader in that space, DraftKings’ (DKNG) stock, is down 80% from all-time highs.

Similarly, Spotify (SPOT), Zillow (Z), and Etsy (ETSY) have all become part of our lives, yet each of these stocks are down 70% or more from their 2021 peaks.

My point is, while Peter Lynch is a legend in the investing world, we can’t blindly follow his “buy what you know” thesis, especially in bear markets like the one we are currently mired in.

That being said, if you have interest in buying SNAP, or the other brands my teenage daughter likes, here are some ideas:

Buy the SNAP January 15 Calls for $2.30.

The most you can lose on this trade is the premium paid, or $230 per call purchased, if SNAP were to close below 15 on January expiration.

Also…

Buy the Lululemon (LULU) January 300 Calls for $31 (she and her friends live in Lululemon clothes)

Buy the Nike (NKE) January 120 Calls for $15.5 (“I HAVE to get the new Air Jordans”)

Let’s check back in on these trades in early 2023 to see if my daughter, using Peter Lynch’s system, can match his investing Midas touch.

How often do you buy stocks that you know? Does it matter to you - or not? Tell us about your successes - and misses - in the comments below.

[author_ad]