My Daughter’s Secret to Winning the NCAA Bracket Every Year

Every year the Mintz family fills out brackets for the NCAA tournament. The family member with the winning bracket then gets to pick where we go for dessert once the tournament is over. And every stinking year my daughter, who doesn’t watch a game all year, wins our little NCAA competition!

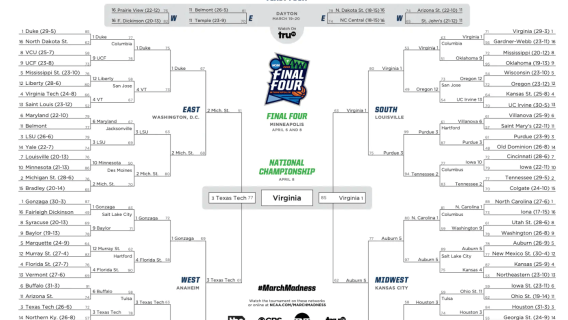

This year, I gave her bracket a look to figure out her secret.

Wouldn’t you know it, she picked every single favorite! She simply looked at the seedings, and went straight down the line picking the favorite over and over again. And then in the second round, she went back and looked at the seedings and again picked the favorites. Meanwhile, I’m wasting my time guessing which five seed will be upset by a 12 seed.

[text_ad]

I think this lesson of picking the favorites could easily be applied to investing as well. Why should we try to pick stocks like Bank of America (BAC) and General Electric (GE), which have been chopping around or declining for years, when the market is telling you that traders think these stocks are 16 seeds.

Instead, why not buy No. 1 seeds like Twilio (TWLO) and Zscaler (ZS), which seemingly make new highs every day!

And countless legendary traders agree:

“At the end of the day, your job is to buy what goes up and to sell what goes down.” -Paul Tudor Jones

“Buy rising stocks and sell falling stocks.” -Jesse Livermore

This line of thinking has largely kept me away from buying stocks that the talking heads on CNBC call “bargains at these depressed levels,” and instead I’ve bought stocks that stand out based on their stock strength.

Pick Stocks the Easy Way

Take, for example, Microsoft (MSFT), which I recently recommended to readers of Cabot Options Trader and Cabot Options Trader Pro. The stock was trading just short of all-time highs, surged higher on up days, and barely gave up ground on down days. MSFT looked like a No. 1 seed in the making.

Also, on top of the stock strength, option activity had been wildly bullish for weeks.

Here is a small sample of the trade alert I sent to readers making the case for MSFT:

Buy the Microsoft (MSFT) October 115 Calls (exp. 10/18/2019) for $7.80 or less.

Microsoft (MSFT) is a classic bull market stock that should lead if the market were to really get in gear to the upside.

And while MSFT stock looks great, what I really like about this set-up is the large bullish option activity in MSFT, which I’ve cited recently. Yesterday this action continued as a trader aggressively bought 10,000 June 115 Calls for $3.80, and today a trader has bought another 7,000 of these June 115 calls for $4.38.

To execute this trade, you need to:

Buy to Open the October 115 Calls

The most you can lose on this trade is the premium paid, or $780 per call purchased.

To pay $7.80 for a call just $1 out-of-the-money with eight months until its expiration in a potential market leader is a great risk/reward.

And since that trade alert was sent MSFT rallied from 113 to a new all-time high of 120 last Thursday, and our call position quickly gained nearly 50%.

At nearly the same time as I was buying MSFT calls, I also was concerned about the lack of strength in Ciena (CIEN) and ON Semiconductor (ON), which I had owned for months. And because of these stocks recent underperformance I sold these positions last week, though for profits of 80% and 48%, respectively.

This strategy of owning the strongest stocks and selling the weakest does not work in every market. At some point high-flying growth stocks will be out of favor and underperformers will go back in vogue. However, over time, as my daughter has figured out, picking the best of the best is the way to pick stocks - and certainly the way to win the Mintz family bracket challenge.

[author_ad]