We’re nearly halfway into the year, and it’s safe to say that 2025 hasn’t played out quite like anyone was expecting.

The S&P 500 is flat, up only 0.2%, the Dow is lower, by 0.8%, and the Nasdaq has declined by about 1%.

But underneath those otherwise mundane numbers has been a lot of volatility, especially in March and April.

And on the sector level, some sectors are outpacing those averages, while others underperform. And therein lies the advantage of sector investing.

To wit: if you invested in Utilities (+5.2% this year) or Industrial stocks (+7.2%), you’re probably quite content. However, if you bought Health Care or Consumer Discretionary (each lower by about 4%), you are probably second-guessing yourself. So, it’s important to be in tune with what stock market sectors are outperforming and which are lagging behind. But sector investing isn’t quite as simple as that.

So let’s dig a little deeper.

[text_ad]

Sector Investing Advantages and Disadvantages

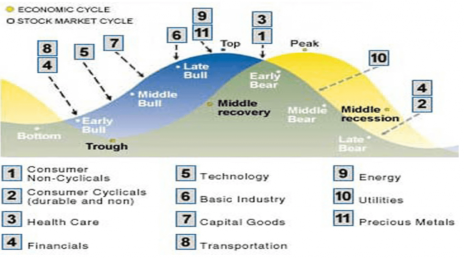

Some investors like to trade stocks based on their predictions for the economy, certain industries, or the market as a whole. Those focused on buying stocks in “bullish” sectors or industries will pay attention to the current economic cycles.

As you can see from the chart below, during certain market cycles, some sectors do better than others.

Fortunately, for investors trying to capture the biggest gains during the bullish periods, there are hundreds of sector mutual funds or exchange-traded funds (ETFs) from which to choose.

The list of available sector funds usually includes technology, financial, consumer cyclical, consumer staples, utilities, energy, natural resources, healthcare, real estate, and precious metals. But, note that each of these can be subdivided into even smaller sectors.

There is voluminous data on successful sector strategies, such as the huge gains from technology investing in the late 1990s and real estate investing in the early to mid-2000s. But we all know what happened to those sectors when technology went bust, and when the Great Recession hit. That’s the risk in sector investing. When the decline happens, it usually occurs quickly and is accompanied by significant drops.

You only need to look at the sector’s beta (volatility, as compared to the S&P 500) to ascertain the predicted volatility of the sector.

Beta: a measure of volatility relative to the broader market, as represented by the S&P 500, which has a beta of 1. A sector with a beta of 1 has historically exhibited the same level of volatility as the market. A sector with a beta less than 1 has historically exhibited less sensitivity to market moves, while a sector with a beta greater than 1 has exhibited more sensitivity to market moves.

The advantage to sector investing is diversification using a professional manager when you are not well-versed on a particular industry, as well as the potential for substantial gains when that sector excels. But the downside is significant risk, should you be on the wrong side of the bet.

For prudent investors, you might consider adding sector investing to your portfolio, but keep the allocation to maybe 5% of your holdings for each sector. You can also diversify by employing certain sectors for longer-term investing (those that are least volatile) and others for your short-term, more speculative funds.

[author_ad]

*This post has been updated from a previously published version.