Time to Take a Break

A Stock with Legs

Assets Segregate Liabilities Accumulate

Stock Market Video

A few weeks ago, I wrote an issue of Cabot Wealth Advisory about seven lessons that apply to both running (one of my favorite hobbies) and investing (a big part of my professional life). You can review that issue here.

One thing I didn’t discuss, but want to today because it’s especially timely, is taking breaks.

Most people who love to run (or really love any hobby), want to do it all the time. The problem is that too much physical activity can actually be harmful. Take it from me, increasing my mileage too quickly last week was a mistake. Now my Achilles tendon is sore and I’ve had to put the brakes on my training.

At first, I was upset about this. I love running, especially right now when the weather is so gorgeous. I also use running as a way to relieve stress and with my wedding fast approaching, I need all the stress relief I can get!

But not giving myself proper time to rest and take a break was taxing both physically and mentally. And the same is true of investing!

In fact, the infamous stock market trader Jesse Livermore once said, “Every once in a while you must go to cash, take a break, take a vacation. Don’t try to play the market all the time.”

At Cabot, we wholeheartedly agree with this philosophy. So our growth stock newsletters use our proprietary market timing indicators as a guide; they tell us when to invest aggressively, and when to retreat to the safety of cash. At times like the present, it’s especially important to heed their message.

As you likely know, the stock market has basically traded in a range for much of the year. This type of action can be especially frustrating--and fatiguing--for investors because there is little sense of which direction the market will go. You just have to wait and see.

Just this week, when the market really started to sour, Cabot Market Letter Editor Mike Cintolo recommended building up more cash, especially if you don’t have a lot in reserve yet. This strategy helps preserve your capital--and your sanity. If you follow this approach, you’ll have the resources--both financially and mentally--to start investing again once the market starts trending higher, which it undoubtedly will.

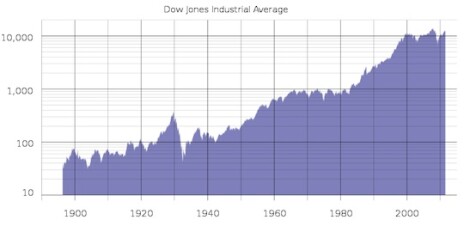

(To those who argue with that point, I invite them to take a look at a chart of the Dow Jones dating from 1890s. It clearly shows a long-term uptrend. We have a similar one hanging in our office to remind us that in the long-term, the trend is always up.)

The message right now: Protect your capital. And your sanity. Your portfolio will thank you.

---

Today I want to discuss a stock that Cabot had great success with back in 2007 and that has recently reappeared on our radar screens: Crocs (CROX). Way back before the big bear market of 2008 (remember that?), Cabot Market Letter nabbed its subscribers 307% profits in CROX. And recently, the stock popped up in Cabot Top Ten Trader.

I remember clearly the first time I saw someone wearing a pair of Crocs shoes. It was the summer of 2004 and they were bright orange. I thought the shoes were the most ridiculous looking things I’d ever seen. Nevertheless, sales have boomed!

Crocs’ success has come from its lines of sandals, sneakers and other types of shoes made from its proprietary closed-cell resin Croslite material. Crocs makes shoes for men, women and kids in almost every color you can imagine. The company also sells shoes in other materials, like leather, and shoe charms that fit onto its classic clog model.

Hospitals and restaurants are big customers, though most of the people I know who own Crocs just love the convenience factor of having a lightweight, slip-on shoe that cleans easily (probably a big reason for their popularity with kids).

After getting hit hard in the bear market and recession, Crocs is doing well again!

Crocs reported just last week that its second quarter revenues jumped 30% to $296 million and earnings soared 65% to $0.61 per share. The company also saw wholesale sales rise 26% to $176 million, retail sales pop 38% to $92 million and online sales jump 30% to $28 million.

Much of Crocs’ growth is due to its overseas and product line expansion. In Q2, sales in the Americas were up 16% to $121 million, sales in Asia increased 38% to $122 million and sales in Europe climbed 50% to $52 million.

The company increased its forward guidance after the glowing quarter and many analysts followed suit. Shares of CROX jumped last Thursday after the news and subscribers to Cabot Top Ten Trader are sitting on 50% gains since they bought the stock in May.

You could buy the stock here and hope for the best, or you could see Mike Cintolo’s latest recommendation in his Cabot Top Ten Trader newsletter. A new issue is out Monday after the market closes ... don’t miss it!

---

Now for this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

Assets Segregate Liabilities Accumulate

Many people learned the second part of this the hard way in 2007 and the years that followed when the over-leveraged U.S. housing market collapsed, dragging the developed world into a global recession. As to the first part, it’s been expressed in more common language as “A fool and his money are soon parted.” (We sometimes wonder how a fool and his money get together in the first place.)

---

In this week’s Stock Market Video, Cabot Market Letter Editor Mike Cintolo says that the stock market has decisively broken down after the Dow’s 500-point drop on Thursday. The broad market is weak and it, along with many sectors and stock, has likely put in an intermediate-term top. Be defensive and protect your capital, so you have cash and confidence when the market gets going again. Stocks discussed: Baidu (BIDU), Apple (AAPL), Chipotle Mexican Grill (CMG) and Lululemon (LULU). Click here to watch!

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 8/1/11 - How to Become an Instant Expert

On Monday, Cabot China & Emerging Markets Report Editor Paul Goodwin discussed the importance of becoming an instant expert on a stock when deciding whether to invest in it and the importance of chart reading once you own it. Paul also suggested the ballot box as a solution to the political infighting that plagues Washington. Paul also recommended a Chinese stock for your watch list. Featured stock: Sina.com (SINA).

---

Cabot Wealth Advisory 8/2/11 - A Top Pick for 2011

On Tuesday, Dick Davis Digest Editor Chloe Lutts wrote about the 30th anniversary of Dick Davis Digest and the publication of its 700th issue this week. She discussed how it not only survived, but thrived, during the 30 years since the first issue was published. Chloe wrote about the recent news that Borders is going out of business and a stock that you can invest in. Featured stock: IAC/Interactive Corp. (IACI).

---

Cabot Wealth Advisory 8/4/11 - Hang Tough!

On Tuesday Cabot Market Letter Editor Mike Cintolo discussed why you shouldn’t fall in love with your stocks, but you should fall in love with your portfolio performance. Mike also talked about why results in a growth stock investing system are almost guaranteed to be skewed and streaky. He also recommended a winning stock in the oil patch. Investments discussed: Cabot Oil & Gas (COG).

Until next time,

Elyse Andrews

Editor of Cabot Wealth Advisory