Choppy market conditions seemed to be fading in late August, when growth stocks and the rest of the market picked up steam together. But so far in September, we’re back to the rotational ways we’ve seen for much of 2021—that’s not necessarily bearish, just a reminder that picking spots and stocks carefully makes sense, as does buying on weakness. And another thing to consider is booking partial profits, which is something I used to write more about.

In fact, I used to dub it the “conservative aggressive” strategy—you’re still buying aggressive growth stocks and aiming for big winners, but you’re handling them in a more conservative fashion, specifically, ringing the register on a portion of your position relatively early in the move, and then riding the rest for what ideally turns into a longer-term gain.

[text_ad]

It sounds simple … and it is. The key, as always, is to follow the plan. It’s easy to say you’ll sell a portion after the stock has a good run, but when you’re watching the name levitate day after day, it’s hard for most to think of paring back.

What I’ve always liked about booking some partial profits on the way up is that it’s a good strategy in any environment. If things are choppy and tedious, as they have been for months, it allows you to scratch out some modest profits when you get them. And while you won’t make as much as super-bulls during a runaway market, you’ll do just fine by riding the shares you still own.

There’s no magic formula, and in fact, I usually use judgment as to when to take some chips off the table. But if you’re looking for a few pointers, here are three:

3 Rules for Booking Partial Profits

First, when selling, I always advise selling between one-quarter and one-half of shares—readers of my Cabot Growth Investor advisory know I usually settle at one-third, though there’s no science to it. The real money is in the longer-term trend, which is why I want to give more than half my position a chance to morph into a huge winner.

Second, when looking at when to sell, you want to do it when your profit is more than your initial risk. Example: You bought a stock at 50, with a loss limit at 44, for a six-point risk. If shares get off to a good start and rally to, say, 59—9 points profit, or 1.5x your initial risk—you can consider peeling off a few shares. The 1.5x amount isn’t set in stone; maybe you shoot for 2x or even more, but the point is you’re not selling for just two or three points of profit—doing that means the math will work against you.

And third, once you do sell some shares, try to raise your stop (or mental stop) to near breakeven (ballpark) on the rest of the position. This will bring you the greatest benefit from booking partial profits: With some money in the bank and little risk on the remaining portion (barring overnight gaps down), you can give the rest of your stake plenty of room to maneuver, increasing your odds of capturing a big move.

Is booking partial profits some sort of magic elixir to making money? Of course not. But it’s a simple, well-rounded approach to many environments, especially when moves prove fleeting like this year.

2 Growth Stocks I Like Right Now

On to the current market, the recent action is somewhat worrisome, and I wanted to relay a few things I’m watching closely right now for clues to the market’s true health.

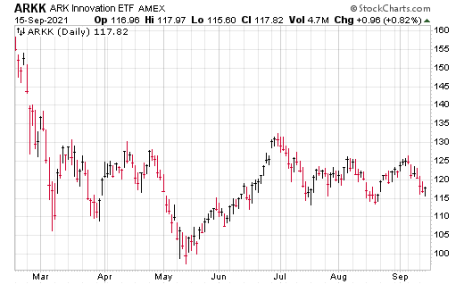

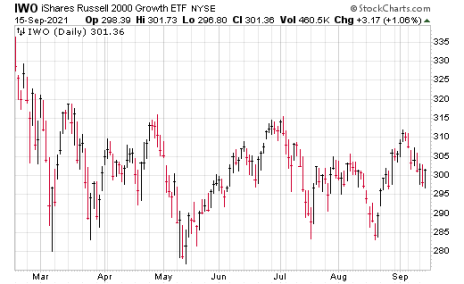

The first are the Russell 2000 Growth Index (IWO) and ARK Innovation ETF (ARKK)—both had good-looking advances in August (relatively persistent for the first time in a long time), but both smacked into resistance and were rejected in September … and now they’re threatening key support.

The idea here is simple: If IWO dives below 285-ish, and ARKK plunges beneath 110 or so, that would tell me growth-oriented stocks are changing character for the worse—and would also almost surely correspond to a general intermediate-term sell signal in the overall market.

Conversely, IWO above the 312-315 area and ARKK north of 130 would be a sign that growth stocks are changing character for the better—something we’ve been waiting on for months.

When it comes to individual stocks, I am seeing more wear and tear. Last week, names like Shopify (SHOP) and Square (SQ) cracked near-term support, and this week some more names are close to doing the same—Snap (SNAP) and Advanced Micro Devices (AMD) are names I’m watching as they test support near their 50-day lines. Obviously, more cracks from these or other growth titles wouldn’t be good.

That said, despite the tedious action—and it is tedious—I’m still not having any trouble finding good-looking stocks that should be good buys if they do rest or pull in some.

One that I’m very high on is Lightspeed Commerce (LSPD), which smells like a follow-on play to Shopify, except that it’s focused mostly on the retail and hospitality industries. Shares broke out of their first base as a public company in July, had some fits and starts, but have accelerated higher of late. If LSPD hits a pothole, odds favor it won’t last long.

Another one to watch is Datadog (DDOG), which gapped to new highs on earnings a few weeks ago, and while it hasn’t set the world on fire, it’s built on those gains as its moving averages catch up. Whether it’s here or on a bit more of a shakeout, DDOG is approaching a very solid risk-reward entry point.

If you want to know what other growth stocks I’m currently recommending – several of which I’ve already booked partial profits on – click here to subscribe to my Cabot Growth Investor advisory, where we’ve consistently beaten the market for the last two decades!

Do you book partial profits on your stocks? Tell us about your strategy in the comments below!

[author_ad]