October (a tricky month for the market, as you’ll see below) is here, and the end of the year is fast approaching.

For that reason, I thought it would be fun to look at some of the seasonal investing ideas that—whether true or not—are believed by many investors.

[text_ad]

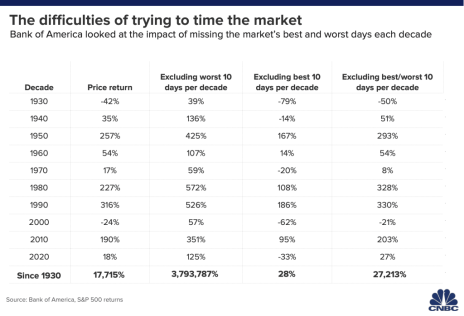

Many investors—erroneously—believe that timing the market is their key to riches. But history has proven, and the chart below shows, that long-term investing is the best strategy for most folks who are interested in socking away serious money in their retirement portfolios. The reason: Inevitably, investors who try to time the market (and I’m not talking about the pros who can do very well with technical analysis) miss out on the best days and end up re-entering on the worst days for gains!

Specifically, this chart from Bank of America shows that if you examine market data back to 1930, the bank says that “if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28%. If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%.”

That’s eye-opening, isn’t it?

Nevertheless, there are enough seasonal events (portfolio reallocation, tax-loss harvesting, elections, etc.) to at least support the idea that they’re going to translate into investing results. So, let’s see where they are right and where they are wrong.

The Myths (and Truths) about Seasonal Investing

For these statistics, I primarily consulted Jeffrey Hirsch, the editor of The Stock Trader’s Almanac, who like his father Yale, who founded his newsletter, is a statistician. He parses market data and is an expert in seasonal trading and investing. In his newsletter, Jeffrey often addresses many of the old stock market adages, and previously had this to say about September:

“September is the worst month over the last 71 years. Start of the business year, end of summer vacations, and back to school once made September a leading barometer month in the first 60 years of the 20th century, now portfolio managers back after Labor Day tend to clean house. Since 1950, September is the worst-performing month of the year for DJIA, S&P 500, NASDAQ (since 1971), Russell 1000 and Russell 2000 (since 1979). After four solid years from 1995-1998 during the dot.com bubble buildup, S&P 500 was down five Septembers straight from 1999-2003.”

In the last 21 years since, the S&P 500 has advanced 12 times in September and declined nine times.

October is a Scary Month: The Bank Panic of 1907, the Stock Market Crash of 1929, and Black Monday 1987 all happened during the month of October.

Jeffrey had this to say about markets in October: “October often evokes fear on Wall Street as memories are stirred of crashes in 1929, 1987, the 554-point drop on October 27, 1997, back-to-back massacres in 1978 and 1979, Friday the 13th in 1989 and the 733-point drop on October 15, 2008. During the week ending October 10, 2008, Dow lost 1,874.19 points (18.2%), the worst weekly decline in our database going back to 1901, in percentage terms. March 2020 now holds the dubious honor of producing the worst, second- and third-worst DJIA weekly point declines. The term ‘Octoberphobia’ has been used to describe the phenomenon of major market drops occurring during the month. Market calamities can become a self-fulfilling prophecy, so stay on the lookout and don’t get whipsawed if it happens.

“But October has become a turnaround month—a ‘bear killer’ if you will.”

All told, thirteen post-WWII bear markets have ended in October: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, 2002, 2011 (S&P 500 declined 19.4%), and 2022.

Last year, stocks had a weak October, with the S&P declining a little over 2%.

Santa Claus Rally: A Santa Claus rally describes a sustained increase in the stock market that occurs in the last week of December through the first two trading days in January. According to The Stock Trader’s Almanac (and coined by Yale Hirsch), the stock market has returned an average of 1.3% and is positive 78% of the time during the seven-day window that starts on Christmas Eve and ends in early January.

January Barometer (Almanac): The term January Barometer refers to the belief held by some traders that the investment performance of the S&P 500 in January can predict its performance for the rest of the year. Based solely on the past performance of the U.S. market, an up January has generally been bullish for stocks. That has particularly been the case when the market has gained more than 5% in January. Since 1945, the January barometer has held true roughly 75% of the time when January experienced market gains. Notable exceptions followed extended periods of market growth.

It’s worth noting that a down January has not been a reliable predictor of an overall weak year. To wit: The down start to 2021 was not indicative of a down year overall, but it did hold true in 2022.

And, of course, last year’s up January did portend gains in 2023, and (although it’s too early to call it) the market’s impressive 2024 is consistent with the up January we had.

Of course, historical trends are not a guarantee of what will happen in the future, and there are a myriad of other, more important fundamental factors to consider, including valuations, earnings strength, and fiscal and monetary policy, among others.

The “Sell in May and Go Away” proverb is said to have originated centuries ago in England when merchants, bankers and other interested parties in London’s financial district noticed that investment returns generally did worse in the summer. According to the Almanac, since 1945, the S&P 500 has gained an average of about 2% from May through October. That compares with a roughly 6% average gain from November through April.

Presidential Market Cycle: In 2016, Charles Schwab analyzed market data going back to 1950 and found that, in general, the third year of the presidency overlapped with the strongest market gains. The S&P 500, a fairly broad index of stocks, exhibited the following average returns in each year of the presidential cycle:

- Year after the election: +6.5%

- Second year: +7.0%

- Third year: +16.4%

- Fourth year: +6.6%

Between 1950 and 2019, the stock market experienced gains in 73% of calendar years. But during year three of the presidential election cycle, the S&P 500 saw an annual increase 88% of the time, demonstrating a notable consistency. By comparison, the market gained 56% of the time and 64% of the time, respectively, during years one and two of the presidency.

As you can see, investors can gain and lose money during certain seasonal investing cycles. But the most famous adages are not always (and are sometimes never) true, so a good investing plan is to be a stock picker. That way, knowing that you’ve chosen the right companies that will weather any temporary market swings will be the catalyst that keeps your portfolio growing for the long term.

[author_ad]

*This post is periodically updated to reflect market conditions.