This year, I’ve made some money shorting stocks, but after careful consideration, I’ve decided that it is too risky a strategy and won’t focus on it going forward.

Let me explain, with an example.

Earlier this spring, when the markets were in free fall as the coronavirus pandemic spread in the U.S., any stocks that were deemed to be beneficiaries of the pandemic went to the moon.

Alpha Pro Tech (APT) was one such company.

The company is United States-based and manufactures disposable protective apparel, building supply, and infection control products.

Over the past 10 years, revenue has grown at a 3.7% CAGR while net income has grown at an 8.8% rate. It’s a solid little company with a $200 million market cap.

[text_ad use_post='206125']

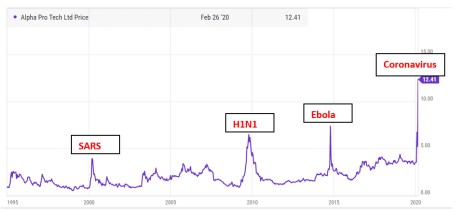

However, occasionally, there is a health scare, be it SARS in 2003, H1N1 in 2009, and Ebola in 2014.

During these periods, APT’s stock goes nuts, as shown below.

As you can see from the chart above, the stock shoots up when a health scare emerges but then always comes back down to earth.

As it became clear that the coronavirus was not going to be contained to China, APT started going crazy.

Over the past 10 years, it has traded at a median EV/EBITDA multiple of 10.8x and an EV/Sales multiple of 0.7x.

When I established my short position, the stock was trading at 34x EBITDA and an EV/Revenue multiple of 5.0x.

Based on its historical price performance through health scares and its elevated valuation, I shorted the stock at 16.

But I watched in horror as APT stock continued to rise.

It eventually peaked at 41.69. At its peak, I had a paper loss of 160%!!

Eventually, as I knew it would, APT’s stock price collapsed. I ultimately covered my short position at 9 and made a significant profit. Nonetheless, the experience was harrowing and reminded me that “the market can stay irrational longer than you can stay solvent,” as John Maynard Keynes so famously said.

APT went to 42, which was an irrational price given the company’s fundamentals. But why couldn’t it have gone to 100?

If it had stayed at an “irrational” price, my broker could have forced me to add collateral or even to sell other high conviction ideas to cover my Alpha Pro Tech short.

When Shorting Stocks, the Math Isn’t In Your Favor

The other problem with shorting stocks is that your downside is unlimited but your upside is capped at 100%.

When I’m looking to invest, I’m looking for asymmetric risk/reward scenarios. My ideal situation is a stock that has 3x more upside than downside. So if a stock could trade down by 50% in a worst-case scenario, I have to believe that the stock has at least 150% upside potential.

When shorting a stock, the upside is capped at 100% (if the stock goes to zero), but your downside is unlimited if the stock goes parabolic. As such, it’s a terrible risk/reward bet.

I recently had a conversation with famed short seller Jon Carnes of EOS funds. Carnes is known for exposing Chinese frauds. Despite an uncanny ability to sniff out corporate fraud, Carnes has recently focused less on shorting stocks, for a couple reasons.

First, you have to pay an exorbitant interest rate (60% to 100%) to short stocks that are rumored to be frauds because they are hard to borrow. This isn’t a big deal if the stock goes to zero quickly, but you can run into trouble when trading in a stock is halted for six months or more as the SEC investigates a fraud. In this scenario, you still have to pay the massive interest rate until the stock begins trading again. These interest payments can eat up all your profit, even if the stock goes to zero.

Second, companies that are subject to short reports can be very litigious and legal fees can eat up a large portion of your profit, even if you are successful.

Carnes told me that, after factoring in interest payments, legal fees and stress, he probably would have been better off investing in an S&P 500 index fund.

How amazing that it’s hard to consistently make money shorting stocks even if they are frauds.

In summary, shorting stocks is not worth the risk.

You are much better off spending your time identifying and investing in great companies.

If you need help doing just that, I’m here to help! Subscribe to my Cabot Micro-Cap Insider advisory, where I recommend the best micro-cap stocks on the market. Since launching the advisory back in April, I have a 40% average gain on my stock recommendations – more than twice the 17% return in the S&P 500 during that time!

To join me, click here.

[author_ad]

*This post has been updated from an original version.