Running ... and Investing

America A Land Of Enormous Impossibilities

Stock Market Analysis Video

In Case You Missed It

---

--- Special Offer ---

Turn Crisis Into Opportunity

Our upcoming webinar, How You Can Reap Huge Profits from the American Energy Boom, will show you how to turn crisis into opportunity with the best stocks in the energy sector. Take advantage of our early bird discount when you sign up by June 18 and save 50%! And hurry, there are only 200 seats available.Secure yours today!

---

I’ve always tried to live a healthy lifestyle, mostly by doing two very simple things: eating right and exercising regularly. Today I want to focus on my favorite form of exercise: running ... and how it relates to investing.

I guess you could say running is in my blood, as both my dad and my grandfather were excellent runners, and so is one of my cousins. I love to run for the physical benefits (staying strong, fit and healthy) and also for the mental benefits (stress release, clearing the mind, daydreaming). I actually came up with most of this column while I was running last week.

Here are seven tips on how to be a better runner ... and investor.

1.) Get the right equipment. One reason why I love running is that you can go right outside your front door. Before you start, you need proper fitting shoes so you don’t get a blister or get injured. Before you start investing, you need to make sure you have the proper equipment, too. That means reading some investing books, learning commonly used investing terms and perhaps subscribing to a newsletter to help guide you. (Cabot has 10 distinct publications that suit nearly every type of investor. Learn more here.)

2.) Carve out time. We’re all busy and constantly barraged by more distractions than ever (email, phone, Twitter, Facbook, the list goes on!). But if you want to run, or invest, seriously, you need to carve out quality time in which to do so. In the summer, I get up earlier than usual almost every day to run before work. I love the early morning solitude (something that’s difficult to find in the city) and getting outside while it’s still relatively cool. It’s the same with investing. Whether you’re a night or morning person (or maybe you prefer to spend your lunch break hunkered down with stock charts), find the time of day that best suits your schedule so you can spend some quality time with your investments.

3.) Find your system. Some people prefer short distance running, while others prefer long. Some prefer running on treadmills, or tracks, or city streets, or trails, or beaches. Some like running in the early morning, afternoon or even at night. It’s generally more enjoyable (and productive) when you can run in your ideal conditions. (I personally love running outside in the morning and I consider myself a medium-distance runner.) The same goes for investing: You need to find your system. Some people are better suited to growth investing, while others prefer value. Some people love the thrill of day trading, while others take the Warren Buffett approach and hang on to their stocks forever. Whatever you ideal system is, find it and stick with it.

4.) Keep track of your results. I used to run at a solid pace for a respectable distance, but lately, I’ve ramped things up and started running noticeably faster and further. I love to keep track of how often I run, how far, how fast and more. It’s the same with investing. Spend some time looking over your results. This will help your performance immensely. You’ll learn what you did wrong so you won’t do it again and conversely, what you did right so you can repeat it.

5.) Practice, practice, practice. As with most things in life, the more you run, the easier it is. You’ll be able to go faster, go farther and enjoy it more if you practice regularly. And if you stick to your investing system and trade when you’re supposed to (and not when you shouldn’t), you’ll find it’s easier too. Experience is often the best teacher and it’s a big part of successful investing.

6.) Make it fun. Running is one of my favorite parts of the day. It’s something I do completely for myself and I always feel better after. If I’m stressed out, running makes my problem seem more manageable. Plus, I’m competitive, so I love the challenge of running faster or farther. Investing can work the same way. For those of you who don’t look at stock charts all day at work, it can be a nice escape from everyday life. It’s a challenge and it makes you think. Plus, it’s fun to see your system working and to make money!

7.) Just do it. To steal a phrase from Nike’s book, my last piece of advice is to just do it. Don’t worry that you won’t be as fast as other runners or get discouraged when you can’t run several miles right away. Likewise, don’t get so worried about the markets that you can’t actually start investing. It’s easy to become paralyzed by the mountains of data available or the minute-by-minute changes in a stock’s chart, but if you find a system that works for you and you stick to it, you’ll eventually overcome any fears about taking the plunge and becoming an active investor.

I’m not likely to win a marathon anytime soon (or even attempt running one!) and you’re not likely to become the next Warren Buffett. But when you arm yourself with the right tools (a system that works, a newsletter to guide you, time to spend investing and keeping track of your performance), you’ll be ready to start investing, and if you stick with it, you’ll find success.

--- Advertisement ---

Diversify for Less Than 13 Cents Per Day ...

That’s how little it costs to get the best stock across all sectors. If you want to diversify your portfolio and profit from using several different investing philosophies to pick winning stocks, Cabot Stock of the Month is right for you. And the price is so low, you’ll recover it from your very first profitable investment. Get started today!

---

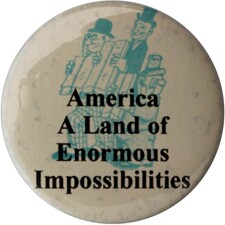

Now for this week’s button. Don’t forget, you can view them all here

.

America: A Land Of Enormous Impossibilities

It means the opposite, of course. It underscores the fact that that every enormous success came about because someone--a risk-taking, highly motivated person or company--worked hard to find a solution when everyone else had seen only impossibilities. For centuries, America has been the most entrepreneurial culture in the world, and our main hope for continued success is that we continue to nourish and motivate our creative, entrepreneurial culture.

---

Before I move on to today’s video, I want to share a nice note we received from W. Packard of Oldsmar, Florida: “I wanted to thank you all for the weekly analysis videos. They are fantastic insights as we can see and hear your thought nuances regarding the topics you discuss. Love them and would like to see you all increase your video chart analysis.”

Thanks Mr. Packard!

In today’s Stock Market Analysis Video, Cabot China & Emerging Markets Report Editor Paul Goodwin says it’s been an interesting week in the stock market, though not in a good way. Wednesday’s decline was both steep and on high volume, so Paul recommends not investing heavily right now. Stocks discussed: TIM Participacoes (TSU) and Polypore International (PPO). Click here to watch the video!

--- Advertisement ---

Why this is THE Year for Our Favorite Chinese Stocks

Think it’s too late to make astounding profits in China? Think again! Take advantage of this once-in-a-lifetime opportunity to build your portfolio, your standard of living and your retirement by profiting from the world’s hottest stocks. Click here to learn more.

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 5/30/11 - The Key to Investment Success

On Monday, Cabot Benjamin Graham Value Letter Editor Roy Ward discussed why having a plan and staying disciplined are so important to investment success. Roy also discussed his biggest losing stock and his biggest winner as well as a stock he thinks could be the next big winner. Featured stock: BlackRock (BLK).

---

Cabot Wealth Advisory 6/1/11 - Social Networking Grows Up

On Tuesday, Dick Davis Investment of the Week Editor Chloe Lutts discussed why you shouldn’t fall prey to the End-is Nigh news, financial or otherwise. Chloe also wrote about the recent LinkedIn IPO and recommended a stock in the rapidly growing mobile advertising segment. Featured stock: Global Traffic Network (GNET).

---

Cabot Wealth Advisory 6/2/11 - Investing Infrequently Asked Questions

On Thursday, Cabot China & Emerging Markets Editor Paul Goodwin discussed some investing Infrequently Asked Questions (IAQs) and why he doesn’t agree with the legendary investor John Bogle’s advice to buy a sector rather than the best stock in the sector. Paul also discussed a solar stock for your watch list. Featured stock: LDK Solar (LDK).

Until next time,

Elyse Andrews

Editor of Cabot Wealth Advisory

P.S. Have you visited our new Facebook page? Click here to “like” us and see what fellow Cabot readers are saying!