By Chloe Lutts

---

Unemployment

And the Market

A Stock for a Slow Economy

---

--- Advertisement ---

Get One FREE Investment Pick Every Week

Each week, Dick Davis Digest Editor Chloe Lutts selects one top investment pick to send you FREE in Dick Davis Investment of the Week, a brand-new e-letter! In her job as editor of the Digests, Chloe reads hundreds of top investment picks from the best minds on Wall Street. Now, she brings you one of her favorites every Tuesday with the compelling reasons why she picked it.

And the best part is, it’s absolutely free. Don’t miss another selection ... subscribe today!

---

As an investor, it’s important to remember that the economy is not the same thing as the stock market, and vice versa. The market can roar ahead even while the economy is struggling, and stocks can falter despite economic growth.

But that’s not to say you should ignore news about the economy. For one thing, investors’ expectations are what do drive the market, and those expectations are certainly influenced by the economy--and by how investors feel about the economy.

Plus, on days like last Friday, faced with headlines like “Dow slides for seventh week out of eight,” it’s hard not to wonder: Is this a symptom of a sick economy, or a harbinger of more economic pain to come? In particular, we’ve been getting a lot of commentary in the Dick Davis Digest inbox lately about employment--and unemployment.

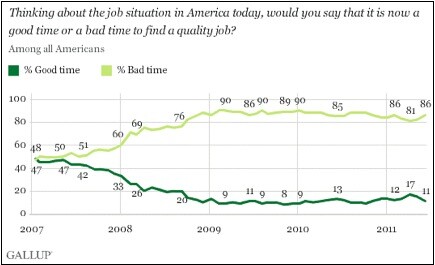

Most of our Digest contributors seem to feel the same way about the employment picture as the rest of the country: pessimistic. Gallup recently asked 1,020 adults living in the U.S. whether they thought it was a good or bad time to find a quality job. Overall, 86% now say it is a bad time to find a job, up from 81% in early April. A chart of responses to the same question over the last few years is below; you can see that this month’s reading is the same as February’s, the worst in 2011 (but not quite as bad as most of 2009). April’s reading was the most optimistic since 2008.

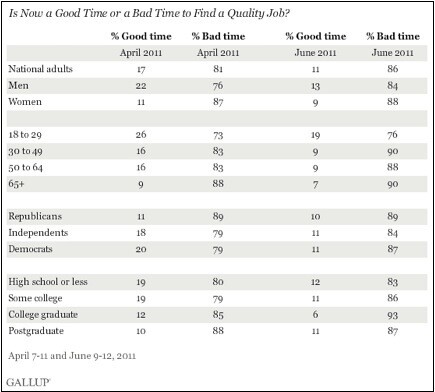

Interestingly, the largest increases in pessimism were among men and Democrats. Men and Democrats were both among the most optimistic groups in April, but now appear to have sobered. Democrats, in particular, went from being way more optimistic than Republicans (with Democrats putting 20% in the good time column and only 79% in the bad time column, compared to Republicans’ 11% and 89%) to being almost as pessimistic as Republicans this month. The full breakdown by group is in the table below.

Of course, this poll only measures how people feel about employment prospects. How about some hard numbers?

Gallup, ADP and the government’s Bureau of Labor Statistics all agree that unemployment stayed almost the same from April to May, hovering around 9.1% or 9.2%. Only a handful of jobs were added in May, less than a quarter the number that were added in April, according to ADP’s seasonally-adjusted data. According to the Bureau of Labor Statistics, most of these gains were in health care, mining and professional and business services. Most other industries were flat for the month.

Our Digest contributors have largely internalized these numbers, it seems. Typical is the viewpoint espoused by Steve Christ, Editor of a newsletter called The Wealth Advisory:

“Unemployment is stubbornly high, housing has stalled and economic growth is currently trending in the low 2.0% range. ... That’s because this time our problems are structural--not monetary in nature. ... So what’s the cure we have all been looking for? It’s simple really. We need to put people back to work. Unfortunately, after three decades of selling our souls to the multinationals that is easier said than done. As Bill Gross noted in his latest monthly missive, the old model has been worn out to the point that just doesn’t work anymore. The result is persistent unemployment that is structural in nature. ... As Gross writes: ‘Those who advocate that job creation rests on corporate tax reform (lower taxes) or a return to deregulation of the private economy always fail to address dominant structural headwinds which cannot be dismissed: 1) Labor is much more attractively priced over there than here, and 2) U.S. employment based on asset price appreciation/finance as opposed to manufacturing can no longer be sustained.’”

J. Royden Ward, editor of Cabot Benjamin Graham Value Letter, is almost as gloomy as Christ on the employment picture and economic outlook. However, Ward does have some optimistic words for investors:

“The economy has officially slowed in the U.S., Japan, the U.K. and elsewhere. The U.S. economy, as measured by the Gross Domestic Product (GDP), rose 1.8% during the first quarter of 2011, its seventh quarterly increase in a row. The growth of the economy is slow by most standards, and I believe unemployment won’t fall until GDP increases by 3.5% or more. We expect the U.S. economy to remain sluggish for an extended period of time, probably two years or more. We are not bearish on the stock market, though. Stocks could perform very well while the economy dawdles along. Most big companies derive a lot of their sales from foreign countries. Many countries around the globe reported rapid GDP growth for the first quarter of 2011. China grew at a 9.7% pace during the first quarter, India 7.8%, Indonesia 6.5%, and Mexico 4.8%. Companies with large overseas operations, such as Apple (AAPL), Caterpillar (CAT), Google (GOOG), Microsoft (MSFT) and PepsiCo (PEP), will continue to provide solid growth in 2011 and 2012. Another area of the market providing opportunities while the U.S. economy is suffering are discount retailers such as Ross Stores (ROST) and Wal-Mart (WMT); pawn shops such as EZCORP (EZPW); and do it yourself stores such as AutoZone (AZO) and Advance Auto Parts (AAP).”

Ross Stores was featured in Investment of the Week two weeks ago, when I discussed coiled spring stocks. Ward’s other picks for a slow economy also have great potential right now, and I’ve seen them all recommended multiple times by other newsletters--both growth and value. Most recently, AutoZone was profiled in the April 1 Investment Digest by both Richard J. Moroney, editor of Dow Theory Forecasts, and Louis Navellier, editor of Blue Chip Growth. Moroney praised the company’s “nine straight quarters of at least 20% growth in per-share earnings and 18 consecutive quarters of double-digit growth,” as well as its “higher operating cash flow in five of the last six quarters.” Navellier pointed out the same track record, as well as the stock’s recent streak of new 52-week highs.

In the two months since their recommendations, AutoZone has actually managed to make another new high ($299.60) and is now building what could be a strong launching pad once the market’s dead weight lifts. With the recommendations of three proven experts behind it, I’d keep a close eye on this stock.

Wishing you success in your investing and beyond,

Chloe Lutts

Editor of Investment of the Week

P.S. Chloe Lutts is the editor of Dick Davis Investment Digest where AutoZone and other stocks for a slow economy recently appeared. To learn about them, as well as dozens of other high-potential stocks featured in the Investment Digest, click here.

P.P.S. Click here to read Chloe’s issue about coiled spring stocks.