To Love, or Not to Love

Hang Tough

A Winner in the Oil Patch

---

Imagine yourself in the following position: You buy a stock you’ve researched and feel excited about. The company has a new product or service, and as soon as you buy the stock, the price heads higher ... and higher ... and higher! There might be a shakeout or two that you’re able to sit through, but after a few months, you’re sitting on huge gains.

At this point, it’s only natural to feel affection toward the stock. After all, it’s done everything you’ve asked it to do, and all the news is good, pointing to even higher gains. It seems as if the romance is only just beginning.

But, of course, nothing is forever--sooner or later, your stock begins to run into trouble. It stalls out for a while, or begins to underperform the market. Then a good earnings report is released ... but the stock sells off anyway. Over time, there’s some back and forth, but eventually, shares begin to break down decisively.

The proper thing to do is to sell the stock, take the profits and move on. After all, every stock eventually tops out and heads south (for an average decline of 72%, by the way--that is a historical fact). But the investor’s affection gets in the way! Falling in love with a stock is one of the oldest downfalls of investors; it affects novices mostly, but even professionals aren’t immune to the occasional siren song.

Really, nothing good comes from falling in love with a stock. Sure, it might keep you in through a stock’s advance, but I can’t tell you how many investors I’ve talked to during the past 10 years that have literally round-tripped a big winning stock--riding it up 100% or 150%, only to lose all of their gains after the top in the stock and the market.

My simple message here, especially with the market acting funky right now, is to focus your love on important things like your family, your favorite sports team or ice cream. Don’t fall in love with any stock!

Now, because we are human, our emotions will still come into play with our investments in one form or the other. So success is not just about saying “don’t be emotional; don’t fall in love” but also figuring out where to target those emotions.

The answer is obvious but most fail to see it: You should fall in love with your portfolio performance. If you want to get joy from the market, do it by loving what counts ... actually making money! That means monitoring your performance like a hawk, setting total performance goals (by month, quarter, year, whatever) and striving to meet them.

I know that, personally, riding a big winning stock is fun and even thrilling. However, what really gives me joy is recording my portfolio’s solid bottom line performance every month. That’s what this is all about--big winners are nice, but if they’re offset by a bunch of small losses, where’s the benefit? The goal is to make money, not score a splashy hit that’s a Pyrrhic victory in the end. So keep in mind why you’re investing in the first place--to make money, hopefully big money, not to crow about a winner or two.

Switching gears, I wanted to expound about something I wrote in last week’s Cabot Market Letter; I got a good response to it, and I feel it teaches us a couple of lessons about the current market environment.

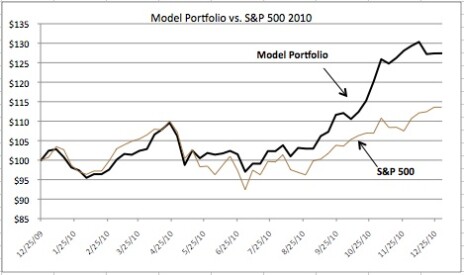

What I wrote was that, in a growth stock investing system, your results are almost guaranteed to be both skewed (meaning a few stocks will account for the majority of your gains) and streaky (you’ll make big money for a few weeks, but then stagnate for months). I also included a chart of the Market Letter’s Model Portfolio from last year, which is republished here:

The equity curve above has a few lessons. First, notice how the Model Portfolio (and the market) really didn’t make much progress for the first eight months of the year--they were down 5% for the year in early February, rallied to a plus-10% in late April, fell back into the red during the spring and remained within spitting distance of the zero line through August.

That means that we endured eight months of research and tracking, buying, selling and sitting, all for naught. Eight months of choppy action. But in the end, it was worth it!

The market took off in early September, and having stuck with some resilient stocks through the choppy summer, and then adding a few more that took off in the fall, the Model Portfolio kicked into high gear, rallying to a 30% gain in early December before pulling back a notch by year-end.

The point here is two-fold. First, when the environment is choppy or clearly trending down, like it was last summer and like it is today, less is more--we intentionally scaled back during that time, doing far less trading and holding some cash. It helped us avoid being ground up in the market’s ups and downs. That’s why our portfolio was actually a few percent ahead of the market at the end of August.

Second, and most important, because we hadn’t thrown in the towel and succumbed to all the negativity (double-dip recession talk was everywhere), and because we remained current on our research, we were able to take advantage of the sudden market thrust. Hanging in there, in other words, was the key attribute between making a lot and making nearly nothing!

Fast-forward to today, and we see a similar environment. The major indexes haven’t done squat since mid-February. The economy is clearly slowing down. And the headlines are not encouraging. It’s not so much that prices have had a huge downturn, but that the combination of sloppy action and nearly six months of zero progress is sure to discourage a lot of people.

My advice: Hang in there! I’m not saying the market is set to turn higher immediately--in fact, I would guess we have some time before a bottom is reached--but I am saying that it will eventually turn higher. And the investors who are paying attention, have an updated watch list and hopefully have held some resilient stocks through the morass will be all the better for it.

---

As for the market, my view is that it’s clearly not healthy here. It’s not a disaster, but during the latest downleg, one of our key market timing indicators, which measures the number of stocks hitting new 52-week lows, has been flashing yellow. That is a warning sign that the broad market is weaker than the major indexes are letting on.

On the other hand, many leading stocks are still holding their own. Not a lot of money is being made, of course, but institutions aren’t completely bailing out on every stock and sector. I wouldn’t say that’s encouraging, per se, but it’s a sign that the bears aren’t fully taking control.

At this point, it’s usually good to get back to basics--look for stocks that have resilient charts, great growth stories and numbers (no pipe dreams!) and plenty of liquidity. Of all the groups, we’re seeing some of the best action in the energy patch.

One idea on this front is Cabot Oil & Gas (COG), no relation to our company. Here’s what I wrote about the company in Cabot Top Ten Trader back in early July:

“The Marcellus Shale formation in Pennsylvania has become the nation’s largest natural gas reservoir (and, by some estimates, the second largest in the world), and Cabot Oil & Gas is hitting gushers in some of its 200,000 acres. Thanks to better results per well from improved drilling techniques, as well as improved infrastructure, Cabot has seen its Marcellus production nearly double in recent months. Management has said it expects production to jump more than 33% this year, but that is almost surely conservative; one analyst is looking for a 49% jump as more wells come online. Of course, natural gas prices are in the dumps, but even if they can stabilize at these levels, Cabot could make a killing in the quarters ahead as it boosts production. Analysts see earnings up 26% this year and a monster 77% in 2012, but those figures could get a boost when the company reports second quarter results the morning of July 28.”

Well, those results were released, and were fantastic--sales rose 23% and earnings crushed expectations, rising 116%. Far more important, though, is that production spiked nearly 48% and analysts have rushed to boost their expectations for this year and next. All told, earnings are estimated to rise 43% this year to $1.40 per share, and that growth should accelerate in 2012, rising a huge 95% to $2.73.

Moreover, the stock is acting very well, refusing to buckle much despite the market and, frankly, some softness in the oil patch. COG has been trading above its shorter-term 25-day moving average for much of the past six weeks (!), and is holding up in the lower 70s. It’s a bit extended to the upside, but a small position on a dip toward 70 could be interesting, as long as you are willing to bail if the stock drops through 63.

All the best,

Mike Cintolo

Editor of Cabot Market Letter

Editor’s Note: Mike Cintolo is VP of Investments for Cabot, as well as editor of Cabot Market Letter, a Model Portfolio-based newsletter of the best leading growth stocks in the market. It’s been four and a half years since Mike took over the Market Letter, and during that period he has beaten the S&P 500 by 14.1% annually thanks to top-notch stock picking and market timing. If you want to own the top leaders in every market cycle, be sure to give Cabot Market Letter a try by clicking HERE.