The markets have been in turmoil since February, with the Dow Jones Industrial Average racking up losses of more than 3,000 points. And declines have been widespread across sectors and market caps. Rising inflation (more than 8% now) and interest rates (mortgage rates more than 5%), as well as the Russia-Ukraine war, are weighing heavily on investors’ minds. Usually, in periods like this, even the insiders—the execs and board members—tend to cash in their shares. However, that’s not exactly the case right now. Sure, there is plenty of insider selling, but there’s also quite a bit of insider buying.

Maybe those insiders’ “insider knowledge” is giving them optimism that the near-term future is brighter than most folks think.

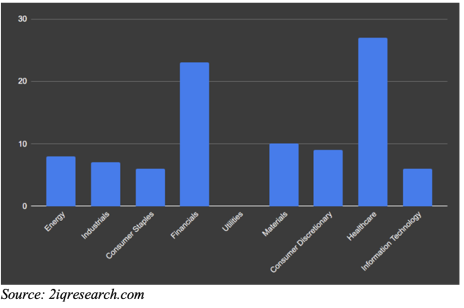

The following graph shows where most of the insider buying occurred during the first quarter of 2022.

[text_ad]

Here’s a list of the Top 10 companies with the most multiple insider buys on May 26:

| Symbol | Company | Qty. | Price | Size ($) | Filing Date | Own | Insiders | Trade Dates | |

| 1 | CVNA | Carvana Co. | 7.18M | $79.75 | $572.42M | 26-May-22 | 12.39M | 6 | Mar 4 - May 24 |

| 2 | PRPL | Purple Innovation, Inc. | 17.11M | $5.53 | $94.53M | 26-May-22 | 207.85M | 10 | Mar 3 - May 25 |

| 3 | JYNT | Joint Corp | 258.22K | $16.07 | $4.15M | 26-May-22 | 4.28M | 5 | Mar 16 - May 25 |

| 4 | NMFC | New Mountain Finance Corp | 224.86K | $12.76 | $2.87M | 26-May-22 | 1.75M | 5 | May 12 - May 24 |

| 5 | CROX | Crocs, Inc. | 40.34K | $66.20 | $2.67M | 26-May-22 | 735.19K | 8 | Mar 3 - May 25 |

| 6 | DTC | Solo Brands, Inc. | 97.82K | $7.77 | $759.77K | 26-May-22 | 111.95K | 3 | Nov 1 - May 25 |

| 7 | RPID | Rapid Micro Biosystems, Inc. | 166.4K | $4.39 | $730.12K | 26-May-22 | 5.83M | 12 | Mar 10 - May 26 |

| 8 | FSK | FS Kkr Capital Corp | 26.02K | $21.96 | $571.32K | 26-May-22 | 129.53K | 6 | Mar 2 - May 24 |

| 9 | DDD | 3d Systems Corp | 35.16K | $10.61 | $212.98K | 26-May-22 | 981.83K | 2 | May 19 - May 26 |

| 10 | TSLX | Sixth Street Specialty Lending, Inc. | 4.5K | $21.20 | $95.42K | 26-May-22 | 26.5K | 2 | Mar 7 - May 24 |

| Source: Benzinga.com | |||||||||

In this market, I’m extremely interested in what the insiders are doing. But that doesn’t mean that investors should jump on the bandwagon just because we have insider buying. This is definitely a stock picker’s market, so it’s imperative that we do a bit of analysis before diving into the shares. Today, I took a look at about 100 recent insider buys and found them spread through a variety of sectors, with the majority showing up in the biotech, financial, technology, energy, REITs, and transportation sectors.

How to Know When Insider Buying is Important

There are a variety of catalysts that prompt insider buying—actions that might spell opportunities for investors to also load up on shares of some of these companies. They include:

- A direct correlation between increased insider trading—the legal kind—and directional market shifts. Research has shown that when lots of folks who are “in the know” start stockpiling their company shares, there’s a good chance that they have reason to believe that the broad markets are gaining ground. They are in position to see positive signals such as growing backlogs, declining inventories, supply shortages, etc. And vice-versa. When these people start fire-selling their shares, you may want to rethink your overall market strategies to prepare for a possible market drop.

- Conditions of employment. When they are hired, CEOs, CFOs, and other top insiders often are required to buy shares. What’s important to note is when they make big and unusual purchases, adding significant holdings of their company stock—especially when they are market, and not option transactions.

- Buying by non-execs. What may also be valuable to you is watching what other company insiders—such as line supervisors or employees with direct product production responsibilities—are buying. These folks generally have the pulse of the company’s fortunes; they see demand and supply up close. So, if they start buying big chunks of stock, it may be important.

Not All Insider Buying is a Big Deal

Option exercising is always interesting. I marvel at just how generous some of these programs are. A lot of them are fabulous perks for the executives—giving them the ability to buy shares at rock-bottom prices, and then when the shares rise, these insiders can really clean up. But that kind of insider buying is generally business as usual, and doesn’t tell us much about a company’s prospects.

Some Extra Tips

Here are a few more ideas on following insider buying:

- Identify the purchaser. Certainly, the C-suite officers should be cognizant of what’s going on with their company. Not so much the directors. Consequently, I don’t pay a lot of attention to what the directors are buying and selling.

- Watch for good-sized buys from several insiders—not just one or two. The more, the better.

- Insider buying in smaller companies is usually more telling. Generally, insiders will own a pretty good portion of company stock at small- and mid-sized businesses. For instance, utility companies and conglomerates often have less than 5% insider ownership. So any exec making purchases would have to buy a whole lot of stock for the market to notice it. However, if a small regional bank suddenly has several insiders buying big blocks of shares, that may be very meaningful. Perhaps a sale of the company is in the offing, or grand expansion plans are around the corner. But please know that because of strict SEC rules regarding insider trading, you most likely won’t see immediate action following large purchases. It may take a while for any upcoming event to occur that would make the stock price rise.

Sources for Investigating Insider Buying

The SEC requires several forms from insiders, including Forms 3, 4, 5, and 144. You can access the information from these filings at any number of websites, but my favorite is:

financeyahoo.com – Just type in your stock symbol, look across the top menu, and you can click on Holders to find out which insiders are buying or selling, the size of the transactions, and how many shares each one currently holds.

You can also find insider trades at nasdaq.com. On the left side menu, you can click on Insider Activity.

From those 100 companies I reviewed, I narrowed my favorites down to three companies.

| Company/Symbol | Industry | Price | Analyst Ranking | Current Growth Rate |

Carlyle Secured Lending, Inc. (CGBD)

| Financials | $14.27 | Buy | 30.1% |

Rivian Automotive, Inc. (RIVN) | Automotive | $31.11 | Buy | 57.5% |

| Transocean Ltd. (RIG) | Oil & Gas Drilling | $4.17 | Buy | 16.2% |

These companies are just a starting point for your research. One statistic alone does not make a winning stock. But seeing big purchases by the “folks in the know” is a great beginning.

Do you pay attention to insider buying in your investing? Has it led you into any winning stocks before? If so, tell us about them in the comments below.

[author_ad]