Tactical allocation is a relatively straightforward practice in which you make small changes to your portfolio composition to take advantage of shifts in the broader stock market.

If you look at analyst ratings at all, you’ve likely seen firms offering “Overweight” or “Underweight” ratings on individual equities or sectors. For instance, Morgan Stanley raised their price target for Microsoft (MSFT) to 520 and maintained an “Overweight” rating on April 11 of this year.

These overweight or underweight ratings indicate that the analyst expects an individual stock to outperform its sector or a sector to outperform its asset class (e.g., an overweight rating on financial stocks would indicate that the analyst expects financials to outperform U.S. equities).

[text_ad]

When you make changes using tactical allocation, you don’t sell an asset class or a sector wholesale, you simply reduce your exposure to it and reallocate what you’ve sold to other areas of the market.

The reason this is relevant now is that we’re seeing signs of rebalancing by large institutional investors in the market this summer but without either widespread selling or significant buying.

A major thesis for the ongoing bull market has been that once the Fed begins cutting rates, institutional investors will need to deploy some of the record amount of cash that’s been sitting on the sidelines. The rationale behind that is cash rates of 5%+ offer enough of a return to avoid taking on equity risk, and so large pensions, hedge funds, etc. can accept those returns for a larger share of their investible assets.

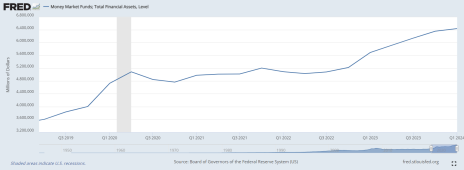

The chart below shows the total balance in money market funds dating back to Q2 of 2019 (five years ago).

Board of Governors of the Federal Reserve System (US), Money Market Funds; Total Financial Assets, Level [MMMFFAQ027S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MMMFFAQ027S, June 17, 2024.

As you can see, despite repeated calls for cuts to the Fed Funds rate, cash balances (now at $6.4 trillion) have only been rising for the last few years. Could that trend reverse in the face of actual cuts? Yes, certainly. However, the market is forward-looking, and a weakening labor market and declining inflation both make a case that cuts are likely on the table this year, although the timing and scale of those cuts are obviously unknown.

In that same time, the Invesco Nasdaq ETF (QQQ), a good proxy for mega-cap tech stocks, has risen 155%, or more than 30% each year.

This leads me to two conclusions: 1) Large investors are not inclined to chase this rally indefinitely (we would expect cash balances to decline if they were committing more capital to equities). 2) Large investors are not rushing to the exits (which would suppress the returns of the market’s leading stocks and sectors).

Another consideration would be that large investors are of the opinion that rate cuts simply are not coming in the foreseeable future or will be small and infrequent, which is certainly a possibility, but which does not invalidate the second point.

So, we’re left with a scenario in which big money is not eager to fuel the rally, nor is it inclined to stop the rally in its tracks.

Which brings me back to tactical allocation. With the incredible returns from mega-cap tech stocks, it’s worth considering trimming your exposure there. In other words, taking profits while those market leaders are still high, but not cutting your exposure to them entirely should they move higher from here.

How to Implement Tactical Allocation

One way to do that is to reduce your holdings in tech-focused ETFs and individual positions (especially in the Magnificent Seven or AI-related names) and use the proceeds to invest in underperforming assets.

Small caps are an obvious candidate (as measured by IWM, small caps are up less than 30% in the last five years), as is something as simple as the Dow Jones ETF (DIA), which is up 48% in the last five years and has been outperforming in the last week as the market rotates.

Bonds are another potential option. The Vanguard Total Bond Market ETF (BND) is down almost 13% in the last five years and should outperform once the Fed commences cutting.

The biggest risk to reallocating into these underperformers is that both bonds and small caps are likely to suffer should the Fed ultimately be forced to raise rates. While that would hit equities across the board, bonds and small caps are some of the more rate-sensitive asset classes out there.

In the event that the Fed ultimately holds rates steady beyond 2024 (or if the AI rally picks up steam), by tactically reallocating, you’re not eliminating your exposure to the outperformers, you’re just paring it back.

On a final note, tactical allocation is not a permanent change to your portfolio composition, it’s something to use when you have a clear thesis on relative sector performance (both which sectors may outperform in the short and intermediate term and why those sectors may outperform). In the event that your thesis doesn’t play out, you can simply reallocate back to your preferred asset blend during your next periodic rebalancing.

[author_ad]