Tesla – The Car

Tesla – The Company

TSLA – The Stock

---

--- Advertisement ---

10 Year-End Trades Every Investor Should Make Now

All of which are riding the trends in their own sectors higher, set to break out on earnings, and match trading signals that led us to 386% gains in Tesla, 191% gains Qihoo, 93% gains in Green Mountain Coffee Roasters, and 93% gains in First Solar.

Now is the perfect time to test-drive our market-beating service before the end of the year.

For more details, click here now.

---

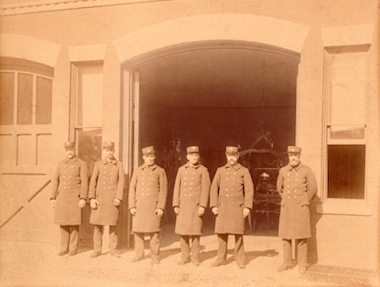

Today we start with an old photograph taken here in Salem about 1890.

That’s the crew of the old Church Street Fire Station. In the background, you can see the fire apparatus, which was pulled to the scene of a conflagration by horses. And on the far left you see my great-grandfather, Albert C. Smith, who was the driver of the horses.

Years later, he became associated with a firm that provided horses to municipalities, and by 1920, he was head of his own business, supplying horses and carriages to customers large and small. He was a successful businessman.

So when the automobile came along, he was one of the first men in Salem to buy one. But when offered the chance to become a dealer, he declined, arguing that he was in the horse business.

But the horse business didn’t grow from there, and the automobile industry boomed!

In fact, over the past century, the internal combustion engine has revolutionized life in the U.S., becoming a major—some would argue indispensable—part of the economy. But along the way, the automobile industry has grown very mature. Sales peaked in 2006, and in the economic collapse of 2008-2009 both Chrysler and General Motors were on the brink of death when rescued by loans from more solvent entities.

In the meantime, a new revolution has begun. Hybrid cars like the Toyota Prius have been gaining market share all over the world. And this year, the top-performing automotive stock has been Tesla Motors (TSLA), a California company whose battery-powered cars have won awards from a wide range of industry observers.

But some insiders are still skeptical about Tesla, particularly since the news about three Model S fires has been getting heavy media attention.

Which brings me to a letter I received last week from a subscriber to Cabot Stock of the Month.

Tesla – The Car

Mr. Lutts:

Good evening/morning:

I have been a subscriber to your financial newsletter for some time (ten years? more??). I find it very solid and worthwhile.

The reason for my writing to you is based upon two things:

[I have] continuous experience in automotive electronics since 1971 having worked for an OEM, various suppliers and now for thirteen years as an independent consultant offering technical advice & business strategy to Tier One and Tier Two automotive suppliers as they do business in North America. A majority of our clients are headquartered outside of the USA and most of them are cutting edge in terms of the value they provide in components, systems, technology, and services. This work for various companies over four decades has spanned Corporate Research Labs, product development and production designs in operating divisions, and the running of high tech product lines and businesses.

•Your comments in your most recent Stock update regarding Tesla Motors … where you commented that “the important thing to realize is that these fires are superficial bad news; Tesla’s cars are safer than the vast majority cars on the road today. Because they are different, people don’t trust them yet.” Further in your paragraph you allude to the fact that the company’s stock run up makes it “… an obvious target of bad news …”

I would recommend that you consider refraining from comments such as “… safer than the vast majority cars on the road today”… and also that the vehicles themselves really only are victims of getting lots of bad press because they are so cutting edge (implied not stated of course.)

Without knowing what the facts are (whether it be how safe the vehicles really are compared to their peers or how vulnerable they might or might not be during normal road use), whether found out by the NHTSA or another independent agency, it might behoove you to refrain from making comments that imply that safety concerns are overblown.

I will not comment further … but that is what I would do if I were in your position with the visibility that you have and the wide scope of a learned audience that you address on a frequent basis.

I hope you can take these comments in the constructive manner that they are intended.

I wish you best of luck in your business moving forward.

Best regards,

R.W.

Carmel, Indiana

I responded to R.W., first by thanking him for being a long-term subscriber, and second, by thanking him for taking the time to write a civilized letter of constructive criticism.

But—I pointed out that Tesla’s Model S had been rated safer than all other cars by the National Highway Traffic Safety Administration back in August, so there was a reason for calling it the safest car.

And I discussed the concept of “superficial bad news,” which is a phrase my father coined that suggests that while all eyes are focused on the current news, business is progressing as usual behind the scenes. At Tesla Motors, I firmly I believe it is.

Yes, the story of the fires has gained traction in the media today, but there are 150,000 car fires in the U.S. every year, which kill roughly 200 people, and they seldom make national headlines. The main reason for the intense media focus on the Tesla fires (in which nobody was injured) is that Tesla had become high-profile!

---

Tesla – The Company

Tesla had become high profile because its Model S was named Automobile of the Year by Automobile Magazine.

It had become high profile because the Model S was named Car of the Year by Car and Driver.

It had become high profile because the Model S earned the highest score ever from the sober analysts at Consumer Reports.

And it had become high profile because its stock went to the moon over the summer and early fall.

Also, it stayed high profile because the Model S just received the highest owner satisfaction score from Consumer Reports.

But most people don’t trust the cars today, because they use an unfamiliar (unproven) technology—and that’s a typical human reaction to anything new.

And that explains the attitude of my correspondent, an industry expert who has no confidence in electric cars—especially by this new manufacturer—and wants me to be very careful about waiting until all the evidence is in before making judgments.

In that way, I believe he’s a bit like my great-grandfather, who thought of himself as a horse man, rather than as a transportation man.

Well, the trouble is, waiting until all the evidence is in is smart in his business, but it doesn’t work in mine!

---

TSLA – The Stock

When I recommended TSLA stock to the readers of Cabot Stock of the Month back in December 2011, the only Tesla cars on the street were the two-seat Roadsters; the company had sold about 2,000 of the little sports cars worldwide. But it was developing the Model S, promising to begin deliveries in mid-2012. It had about 6,000 deposits for the big car. And beyond that was the promise of an all-electric mass-market car—that’s still a very attractive part of the story that many people don’t even know about.

In short, many people knew nothing about the company, and among those that did, there was substantial uncertainty about Tesla’s ability to survive; any operating profits looked at least a year away

But the stock was acting well! Here’s the chart I published at the time.

And here’s what I wrote:

“Tesla came public in June 2010 at 17, and peaked at 36 that November, before retreating to a low of 21 in February of this year. The big market selloff this August pulled it down to 21 again, establishing a double bottom. It pushed up to 35 in November and December, but selling pressures (sparked by a negative Morgan Stanley opinion on electric cars in general) pushed it down to touch 26 last week … and that leaves it sitting right on its 200-day moving average, which we view as a buying opportunity.”

What Tesla had, therefore, were the three main attributes of a great growth investment.

1.The company had a revolutionary product that could eventually serve a mass market and thus it had enormous growth potential

2.The company was not well-loved; it was not even well-known.

3.And the stock was in an uptrend, revealing that investors as a whole were accumulating the stock because they were developing more positive perceptions of the company.

Combined, these factors meant the stock had terrific upside potential, and would likely climb higher as more and more people learned about the company and more and more investors developed positive opinions about the company’s future.

Throughout 2012, the news about Tesla slowly got better, and the stock brought a little profit to my readers.

The Model S was introduced, and received the rave reviews mentioned above. But that didn’t do a lot for the stock.

But it wasn’t until April 1, 2013, when Tesla announced that it expected to announce a first-quarter profit, that the stock really got going.

And it wasn’t until a month later, when the actual results came out, that buyers began to stampede into the stock on big volume and gapped the stock up from 56 to 70.

Now, some people would see that burst and take profits, figuring the stock was due for a retreat. But at Cabot, we’re big fans of high-volume buying that follows great earnings reports, so I kept the stock rated buy.

And the news kept getting better, and people kept buying the stock all summer and into the fall.

In less than two years, the stock had grown from a wallflower into the top glamour stock of the year. By the start of September, the stock was up more than 400% for the year. But the higher the stock got, the more danger signs I saw in its popularity. So I increasingly warned my readers that the higher the stock, the greater the downside potential. And on September 24, a week before the stock peaked, I wrote, “I continue to advise that you take a partial profit if the idea of a major correction is painful.”

A week later, my readers were looking at profits of 559%

And then the stock began losing momentum, as all great glamour stocks do. And, today, two months later, Tesla is down 38%.

Now, the easiest thing in the world to do today is to blame the fires for this decline.

But the reality is that TSLA—the stock—was ripe for a fall, just as every top glamour stock is at its moment of peak perception. It’s a natural evolution.

Remember Apple?

In September 2012, just over a year ago, Apple was the most popular company in the world, and the most highly valued too, trading at $700 a share. Everyone loved it.

Yet seven months later, Apple had lost 46% of its value—and there was no one reason for the decline.

But the students of market psychology, the reason was obvious. At the top, the world had been singing the praises of the company. Everyone who could own Apple owned it, especially institutional investors.

But when the tide turned the momentum shifted, and with no more buyers left, the power shifted to the sellers. Furthermore, as with Tesla, the lower the stock fell, the worse the news got. The Apple Magic was gone.

So what comes next for TSLA?

Well, at Cabot we have a model for the behavior of hot young stocks, with phases labeled Romance, Transition and Reality. TSLA is now in the Transition Phase, where making money is very difficult for investors.

Eventually, I expect it to enter the Reality Phase, where making money is easier, though the stock isn’t quite the skyrocket it was in Romance Phase. When that time comes, I expect to be telling my Cabot Stock of the Month readers to buy again.

If you’d like to join them, click here.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Chief Analyst, Cabot Stock of the Month

Publisher, Cabot Wealth Advisory