Learning to Love the Fat Tail

Streaky and Skewed

The YouTube of China

---

I’ve written a lot about the importance of keeping track of your past trades and calculating key metrics such as batting average and slugging percentage. I won’t rehash all that here, but I do want to touch on something that occurred to me when reviewing a few of my trades this week.

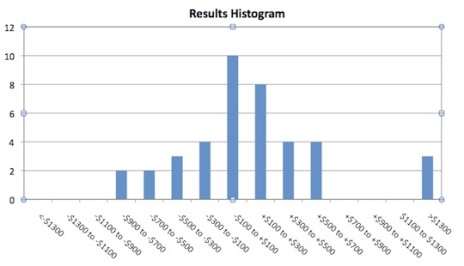

Aside from all the customary statistical analysis, I also plot a histogram of my trade results. I create a dozen or so columns on the chart, each one measuring the number of trades that resulted in X amount of profit (or loss).

One column in the middle might be any trade that lost less than, say, $100, or made less than $300 (i.e., nearly breakeven). The column to the right might convey how many trades made more than $100, but less than $300; the next one on the right, from $300 to $500. Accordingly, the left side of the chart would categorize losing trades. An example below depicts 40 fictitious trades.

Glancing at this chart, you can see 10 trades in this batch were closed out right around breakeven. Another eight were closed out with small profits ($100 to $300). And from there it spread out roughly evenly--a lessening amount of losers and winners as the numbers got larger, though there was a minor skew toward the right hand (profitable) side.

So far, the results resemble a standard bell curve--that is, most results are around the middle, and the farther you get from the middle in each direction, the fewer results you see.

But wait! There happens to be an out-of-sorts column way out to the right hand side--there were three trades that garnered more than $1,300 in profit. This is what’s known as a “fat tail” to the bell curve, and it’s what I want to focus on. Simply put, this fat tail is how a winning investor beats the market.

---

Any investing system that generally follows the mantra “cut losses short, let winners run” probably will feature a distribution curve similar to the chart above. While most people picture a winning trader as constantly and consistently churning out winners, the reality is that most successful systems endure long periods of treading water, with just a few trades responsible for most of the gains.

In this example, just three out of 40 trades resulted in big money. (Note that the dollar amounts in the chart are just examples; “big” is a relative term.) The other trades basically canceled each other out!

What can we learn from this?

First and foremost, you shouldn’t get discouraged if you have a streak where you win one, then lose one, then win, then lose, etc. Such action can be super frustrating, and it’s probably a good idea to back off when you see this. But be sure not to get discouraged--realize that even the best traders have these back-and-forth periods; they’re perfectly normal.

Second, it re-emphasizes the value in cutting losses. Why? Because if you let a few small losses (in this example, say, $400) morph into bigger losers ($1,000 or more), they’ll eat into the benefit you get from those big winners. In other words, you have to make sure your big winners really count.

Third, you should be hesitant to tell a stock when it’s gone “too far.” As you probably know, I think booking some partial profits on the way up is a good idea, and there are times when a profitable stock just doesn’t have the get-up-and-go you’re looking for, so you can sell it on the way up, too. But if you’re booking small profits left and right for no reason, you’ll never be able to develop a bigger winner ... and consequently, you’ll have a hard time making money.

Lastly ... and something that few investors really think about ... is that having a system that is so skewed can actually be very liberating. The reason is because you know that you’re only one good trade away from putting a boost in your results ... or, if you’re already doing well, from kicking things into overdrive. Contrast that to systems that make very small amounts of money frequently--but then lose a bunch all at once. It can be depressing in that situation, knowing that a huge grind is needed just to get back to where you started.

Anyway, the major point is really to know the ins-and-outs of the methodology you’re employing. That way, you’ll know what is “normal” for your system, giving you confidence to ride out some tedious, back-and-forth periods and to shoot for those valuable big winners.

--- Advertisement ---

Turn Market Volatility Into Huge Gains

Leverage your investments to make money in all markets! Cabot Options Trader Editor Rick Pendergraft uses the market’s volatility to bring his subscribers huge profit-making opportunities. Just check out these gains from the last three months:

A 70% gain on a Call on Linear Technology (LLTC) in only 11 days!

An 128% gain on a Call on Maxim Integrated Products (MXIM) in 15 days!

A 164% gain on a Put on Cisco (CSCO) in ONE day!

---

For my stock idea today, I’m going with a small company with a big story that’s just had its first major pullback since blasting off in February. I’m talking about Youku.com (YOKU), which has been called the YouTube of China, but in reality, it’s more like a combination of a Netflix or Hulu (because it offers generally professionally-made movies and shows) and YouTube (because advertising is the main source of revenue).

The company just reported first-quarter earnings last Thursday evening, and while the loss per share of six cents was a bit better than expected, the real upside showed up in revenue, which totaled $19.5 million, up 174% from the year before and well above expectations. Triple-digit revenue growth has always been one of my favorite fundamental criteria, and Youku.com had 140%-plus year-on-year growth in nine of the past 10 quarters.

The stock actually blasted off just as the market was topping in mid-February--it rose nine out of 10 weeks, advancing from 30 to 70 during that time. Powerful! Then came the correction, and it brought shares down to 54 last week, where they found support at the 10-week moving average.

So YOKU is a great buy right here, correct? Not so fast. Leading stocks are still generally under pressure, as are many Chinese Internet-related stocks. I’m not advising people to buy many things hand over fist. But YOKU is young (it went public only last December), likely still under-owned (just 128 mutual funds own a stake) and has a ton of growth ahead of it.

It’s small and speculative, but a small position around here, with a stop around 52, could work out. At the very least, we’d keep the stock on your watch list.

All the best,

Mike Cintolo

Editor of Cabot Market Letter

Editor’s Note: Mike Cintolo is VP of Investments for Cabot, as well as editor of Cabot Market Letter, a Model Portfolio-based newsletter of the best leading growth stocks in the market. It’s been over four years since Mike took over the Market Letter, and during that time he’s beaten the market by 13% annually (up a total of 65% since then, compared to a loss of 6% for the S&P 500) thanks to top-notch stock picking and market timing. If you want to own the top leaders in every market cycle, be sure to give Cabot Market Letter a try by clicking HERE.