What are the stocks that will benefit most from tax cuts? You might not like this answer, but it’s the reality.

We get this question every year around budget time. We get it even more when there is a major shift in the U.S. Congress or the White House. Which stocks will benefit most from tax cuts? Or which will suffer most from tax increases? But stocks don’t exist in a vacuum. And taxes are anything but a simple factor that moves company ledgers up and down.

If you’ve done anything even remotely involved in taxes recently, you know this. Whether you do them yourself or hand off all your financial records to an accountant, there’s a lot that goes into determining tax liability. Personal taxes cover things like income, assets, depreciation, education expenses, and home offices. Then there are entire worksheets that cover lesser-known items like household employment taxes, donated property, loss from theft or disaster, and royalty income. In all, the IRS has more than 2,400 forms and instruction sheets. Yes, some of them are duplicates in different languages. Still, there are a LOT of things that impact taxes. And we haven’t even gotten into business and corporate taxes.

Even with this information, we also know that the stock market moves on news and events, both good and bad. Then within that, any individual stock or industry can be more or less impacted than others. An easy example is the way 2020 hit the airline and travel industry hard, but it was barely a blip for many tech companies.

Still, there is a popularly held belief that taxes do impact stocks. So let’s take a look and find out what’s true and what’s not.

[text_ad]

Taxes, stocks, and the cold, hard reality of charts

Let’s start with some history. ProCon.org, a subsidiary of Encyclopedia Britannica, reports that the corporate tax rate in the U.S. between 1971 and 1978 was 48%. It changed to 46% in 1979 and remained there until it dropped to 34% in 1987. From 1994 until 2017, the top corporate tax rate was a similar 35%. That changed to 21% in 2018, and it appears that the rate could move to 28% in the near future.

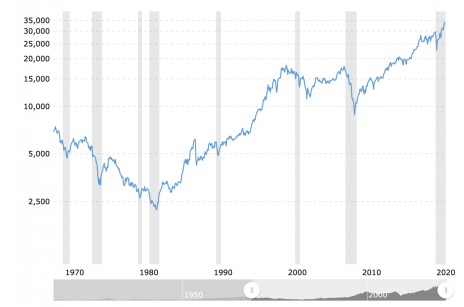

Meanwhile, the Dow Jones Industrial Average has steadily increased in that same span of time. There are, of course, some apparent dips and recessions, but overall, the chart is up, as you can see from this graph, courtesy of macrotrends.

Here’s something interesting, however. The corporate tax rate was 46% in 1986 and went down to 34% the following year. The DJIA, however, was at 4,620 in August of 1986. Following the tax cut, the market spiked, but then dipped back to 4,559 in August 1988. In other words, a 12% tax cut didn’t seem to impact the market outside of a possible short-term blip.

You can also see that the market declined throughout the 1970s, even with a steady corporate tax rate. And that 35% rate that we had for over 20 years starting in 1994 didn’t seem to impact the market at all; it went up approximately 20,000 points in that time, even with the 2008/2009 financial crisis.

The reality of stocks that will benefit most from tax cuts: A case study

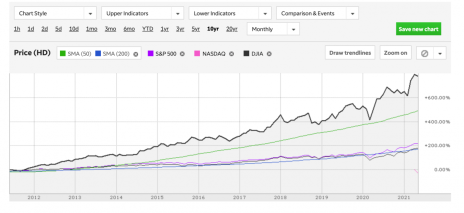

Let’s put the general information aside for now and look at a specific case study. In 2017, Kiplinger reported that Home Depot (HD) could see some distinct benefits from lower corporate tax rates. In theory, that made a lot of sense. They wrote that “Home Depot doesn’t have the same opportunities to avoid taxes that a more internationally diversified company might, so it ends up paying a much higher rate.” Therefore, lower tax rates should benefit the company.

In truth, it’s hard to say how much difference that made in their stock price. Their 10-year chart shows steady increases.

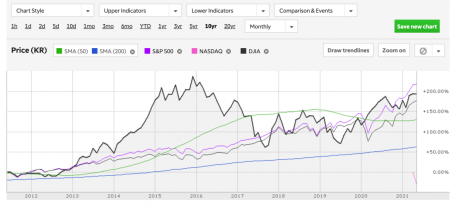

For comparison, here’s another U.S. company, Kroger (KR). Kroger operates over 2,700 supermarkets across the U.S. Their 10-year chart makes it clear that there is little correlation between tax rates and share price.

But where does that leave us? This is truly a complicated matter. And tax rates are so entangled in other economic issues that’s it’s hard to tease apart. Taxes pay for infrastructure, public education, and the military. They subsidize research and distribution of things like thecoronavirus vaccine. There are arguments that these suffer because corporate taxes are too low. Others argue that lower taxes lead to more jobs and a growing economy.

The truth is that the stocks that will benefit most from tax cuts are most likely the same stocks that will do well regardless of that tax rate. Perhaps even more important, however, is your approach to investing.

One way to inform your approach is to follow us here at Cabot Wealth Network. There is a lot of free advice on our website and several free reports you can download and read. And when you’re ready, we also offer a wide range of award-winning investment advisories where we share the latest investing information and tips.

What is your opinion on tax rates and stock prices? Have you noticed any correlation?