Dan Loeb is an American billionaire and founder as well as CEO of Third Point. Loeb is one of the greatest investors in the world. Since inception, his strategy has generated 18% annual returns, far outpacing the general market. He currently manages $18 billion in investor assets.

Loeb generates strong returns by focusing on several different buckets.

4 Ways Dan Loeb Makes His Money

Activist Investing

An activist investor buys a significant stake in a company and then tries to influence management’s decisions. Dan Loeb is famous for these types of investments. He has written many iconic letters in which he has harshly criticized managements and CEOs.

[text_ad]

Example: Yahoo In 2011; Loeb bought a 5% stake in Yahoo. Loeb was convinced that Yahoo needed both a new CEO and board. He also wanted Yahoo to raise money by selling its Asian assets, Yahoo Japan and Alibaba.

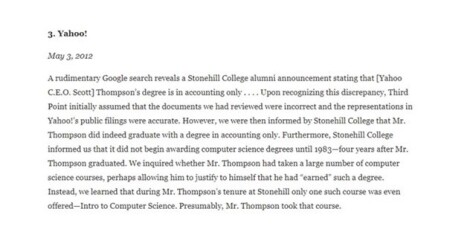

At first, he had no success with his demands. That changed when Loeb found out that the then-CEO, Scott Thompson, lied on his resume. Instead of two degrees in accounting and computer science, he in fact only had the accounting one. He never studied computer science.

Ultimately, Thompson was replaced as CEO due to this scandal. And ultimately Dan Loeb did quite well on his investment in Yahoo (which was bought out by Verizon (VZ) in 2017), making more than a billion dollars.

Distressed Debt Investing

Distressed debt investing describes the purchase of bonds from companies that filed for bankruptcy or are likely to do so. It’s an inherently risky investment that can go in both directions. Hedge funds that invest this way must do excellent research work.

The potential profit of these investments lies in the extremely low price of the bonds. They often sell for fractions of par value (nominal value of the bond). If a company can survive or be restructured, the price of the bonds surge, and investors make a quick profit.

Example: In 2012, Loeb invested in long Greek sovereign bonds. This was during the height of the sovereign debt financial crisis in Greece. Research by his team suggested that the bonds offer a great risk-reward opportunity.

And they were proven right. The investment turned out very profitable and contributed a considerable part of Third Point’s 21% return that year.

Spin-Offs

Dan Loeb is also interested in spin-offs. A spin-off is an independent company that used to be part of a bigger business (the parent company). Spin-offs happen for many reasons, but mostly it’s to shine light on a neglected and/or undervalued part of a business.

Example: Three years ago, Loeb bought into Sony and suggested spinning off the semiconductor unit. This spin-off, however, never took place since Sony’s management eventually didn’t follow Loeb’s suggestions.

His most recent attempt to provoke a spin-off was in the oil company, Shell. But for now, Shell’s management doesn’t seem to agree with Loeb either.

As you can see, Loeb focuses on creating a stock spin-off instead of analyzing certain ones that have already been announced. This has the advantage of even less competition since the spin-off was never on anyone’s radar.

Value Compounder

With the growing size of the assets Loeb and Third Point manage, he also participates in “value compounders.” This term describes investing in Warren Buffett-like companies that have sustainable competitive advantages.

Third Point’s recent investment in Amazon is a perfect example of a “value compounder.” Here’s an excerpt of why Loeb thinks Amazon (AMZN) is attractive.

The more time I spend in the market, the more I understand that there is no “right way” to make money investing.

There are many ways. The key is to find a strategy that works for you.

My preferred way to make money is through micro-caps, but I’m not naïve enough to believe it’s the right strategy for everyone!

Does your investment approach overlap with Dan Loeb’s?

[author_ad]