Diversifying your portfolio is important. But you can over-diversify. At a certain point, concentrated investing makes more sense. Let me explain.

When I started my career in the equity research department of a mutual fund company in Boston, I couldn’t understand why the portfolio managers owned 70 to 100 different stocks.

By owning so many stocks, the funds became closet index funds. Layer on the fees (1% on average), and it became incredibly difficult to outperform the index.

And none did consistently over time.

Owning so many stocks minimizes volatility and career risk because it reduces the chance that you as a portfolio manager will significantly underperform in any given year.

But it also virtually guarantees mediocre results.

[text_ad]

To me, concentrated investing – that is, focusing your investments on your best ideas – makes infinitely more sense.

The Upside of Diversifying

My favorite professional investor is Joel Greenblatt. He managed Gotham Capital for 10 years and generated 50% annual returns for a decade. If you haven’t read his book, You Can Be a Stock Market Genius, definitely check it out.

Anyway, Greenblatt quantified the benefits of diversification. In his book, he summarizes as follows.

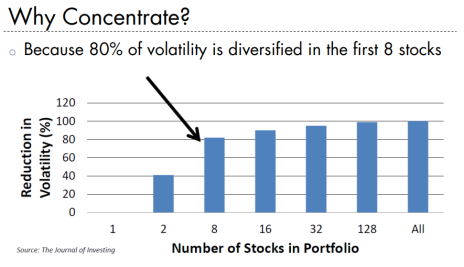

“Statistics say that owning just two stocks eliminates 46% of the nonmarket risk of owning just one stock. This type of risk is supposedly reduced by 72% with a four-stock portfolio, by 81% with eight stocks, 93% with 16 stocks, 96% with 32 stocks, and 99% with 500 stocks.”

This chart sums up the benefits of diversification nicely.

The marginal benefit of diversification quickly falls as you add incremental stocks to your portfolio.

When Concentrated Investing Makes Sense

On the other hand, actually knowing the stocks that you own inside and out is incredibly valuable.

Why put money into your 30th-best idea?

Joel Greenblatt summed it up when he wrote, “Don’t screw up a perfectly good stock-market strategy by diversifying your way into mediocre returns.”

Many of the best investors of all time, including Greenblatt, Charlie Munger and Warren Buffett, used a concentrated investing style to become billionaires.

As Warren Buffett said, “Diversification may preserve wealth, but concentration builds wealth.”

There is an important caveat though.

If you do not know what you are doing or have no interest in the market, it’s best to diversify.

My two older sisters have absolutely no interest in the market and my advice to them is to dollar cost average every year into an inexpensive Vanguard index fund.

This strategy works for them.

But if you like investing and you know what you are doing, it probably doesn’t make sense for you to own more than 30 stocks.

I will leave you with one final caveat.

While a concentrated investing approach works best for me, you need to find what works best for you.

Venture capitalists are famous for making small bets in hundreds of companies in anticipation that one Uber or Facebook will make the fund.

Famous portfolio manager Peter Lynch generated 30% returns for the Magellan fund by owning thousands of stocks.

There is no one-size-fits-all approach that is right for everyone.

Ultimately, you need to find an approach that works for your personality and risk tolerance.

Because that will give you the best chance at investing success over the long run.

[author_ad]