Stock Market Video

Stock Market Video

Why Tactical Investing Makes Sense

Pride of opinion … Precedes a fall

In Case You Missed It

---

In this week’s Stock Market Video I counsel caution for growth investors. Markets have been jumpy and the intermediate trend has turned down. The right thing to do now is to keep your stocks on very short leashes, do very little buying and take special care around the quarterly reports of any of your holdings. I showed some brutal responses to earnings misses, as well as a few positive stories. Stocks discussed include: McDonalds (MCD), Google (GOOG), DaVita (DVA), Royal Caribbean (RCL) and Whirlpool (WHP). Click below to watch the video!

$insert("/sitecore/content/ads/CTT/2011-04-Our-Scientific-System”,"wt21")

Why Tactical Investing Makes Sense

I read with interest a little piece in a recent Wall Street Journal about a move among financial advisors toward what is called “tactical investing.”

There’s no standard definition of tactical investing, and part of the apparent surge in interest in the topic may just mean that it’s the buzzword of the moment. Wall Street loves to have a hot piece of jargon to throw around; it’s the investing equivalent of the purple ties and shirts that are currently sweeping the men’s fashion world. But when investment advisors and asset managers make any move away from their “buy-and-hold” mantra, it’s always worth looking at why.

Fortunately, the “why” of tactical investing is as plain as a chart can make it. Here’s a chart of the S&P 500 since its peak at 1,527, just as the Tech Bubble burst. (As you look at this chart, you may be remembering the feeling in the pit of your stomach during 2000 and 2001 as you watched the value of your retirement account plummet. You should remember; it’s a useful exercise. And you should remember the feeling during the explosive deflation of the Housing Bubble in 2008, too.)

(Needless to say, if I’d shown the chart of the Nasdaq for the same period, the movement in the year 2000 would have been way more dramatic, but I don’t want to open old wounds.)

In the WSJ article, one investment executive, clearly quite pleased with his bold thinking, said that he was “nearly doubling the cash allocation in his model portfolio, to 9%.” Given that the Cabot Market Letter had its Model Portfolio 35% in cash two weeks ago, I just had to laugh.

I suppose it’s a good thing that money managers are embracing the idea that jumping out of an asset class in free fall is beneficial. After all, Cabot growth investing letters have been doing it for over 40 years. And Cabot China & Emerging Markets Report, which I write, has been 100% in cash at least twice since I took it over. (It’s only 15% in cash now, but we have a lot of stocks that are trying to figure out which way to move.)

This kind of defensive move out of stocks and into cash is what Cabot means by “market timing.” We don’t try to predict where markets will be in a year, or even tomorrow. We just figure out which way markets are trending and manage our portfolios accordingly.

Cabot Market Letter and Cabot Top Ten Trader even found sectors and industry groups that were actually rising while the markets were diving, including housing way back in 2001–2002 and commodities in early 2008. And being able to put money into counter-trend stocks during a bear market is the ultimate in tactical investing.

Markets have been up and down a lot, but haven’t made a nickel of net progress since 2000. That’s the big message from the S&P chart above. (From its high of 1527 in 2000, the Index closed Thursday at 1413). So if your strategy is buy and hold, you might want to take the hint the market is giving you and get a little more tactical.

---

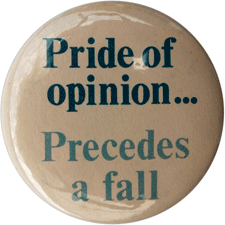

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

Pride of opinion … Precedes a fall

Tim’s Comment: Proverbs 13:10 says, “Pride goeth before destruction and an haughty spirit before a fall.” The ancients were concerned that such overreaching insulted a higher power, but we know today that the main danger is psychological. Hubris can lead to errors of judgment, and your best defense against your own human fallibility is a humble spirit and an investing discipline that controls your risk. Just as speed kills, overconfidence can bankrupt.

Paul’s Comment: If you subscribe to my theory that markets are always actively engaged in trying to take away your money, then this button is just pointing out one way markets go about it. A bull market will make you think you’re smarter than you really are, and a bear market will force to you conclude that you have the brains of a newt. It’s okay to be proud of a good investment decision, but if you start thinking you’ve got it figured out, the market will slap you back to reality.

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 10/22/12--How to Use Stop-Losses on Small-Cap Stocks

Monday’s issue was written by Thomas Garrity of Cabot Small-Cap Confidential. Tom writes about the special handling needs of small-caps and how to use stops that will help you avoid getting stopped out of stocks that recover quickly.

Cabot Wealth Advisory 10/23/12--Adding the How and Why to the What

In this issue, growth investing expert Mike Cintolo, editor of Cabot Market Letter, looks at the logic behind long-honored investing wisdom like “cutting losses short,” and sees a secular bull market ahead … sometime. Stock discussed: eBay (EBAY).

Cabot Wealth Advisory 10/25/12--The Warren Buffett Approach

Roy Ward, the editor of Cabot Benjamin Graham Value Letter, uses this issue to express his admiration for Warren Buffett, the modern hero of value investing. Roy also recommends two stocks that he believes should tempt even growth investors. Stocks discussed: American Express (AXP) and UnitedHealth Group (UNH).

Have a great weekend,

Paul Goodwin

Editor of Cabot Wealth Advisory

and Cabot China & Emerging Markets Report

P.S. An ETF is an investment fund traded on public stock exchanges, much like stocks. But unlike individual stocks, which sometimes deliver nasty “surprises,” ETFs hold dozens and even hundreds of stocks, commodities or bonds, so you get the safety of diversification. In that way, they’re much like mutual funds.

Because ETFs are “unmanaged,” however—you might say they run on autopilot—ETFs entail far lower annual fees than comparable index-based mutual funds, and far lower fees than actively managed mutual funds. And instead of pricing once a day after the market closes, like mutual funds, ETFs are traded throughout the day as if they are regular stocks, so you can buy any time you want and when you buy, you get exactly the price quoted when you buy.

For all these reasons, ETFs are hot right now.

In fact, The Wall Street Journal estimates the total value of all ETFs exceeds 600 billion dollars! That’s a lot of money for something created less than 20 years ago. Sadly, a lot of that money is stuck in broad market index funds … because most investors don’t know any better. They’re content to be average.

But why settle for average when you can do three times better?

The secret is in what I call the perfect investment vehicle … sector ETFs that allow you to invest precisely in the economic sectors most likely to bring the biggest gains.